This advisory answers several important questions about the practical effects of the U.S. Supreme Court’s decision in United States v. Windsor (delivered June 26, 2013, and sometimes called the “DOMA Decision”) for qualified retirement plans. This is a follow-up to our previous advisories, dated April 11, 2014, September 12, 2013, and July 9, 2013.

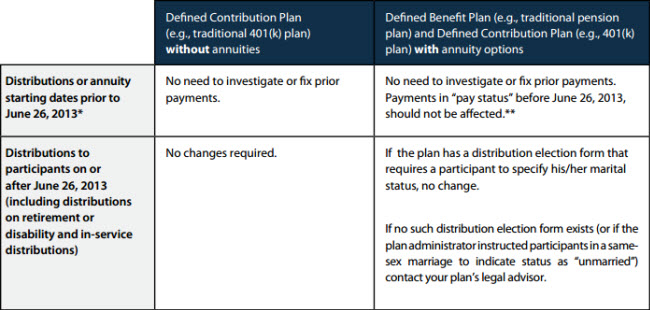

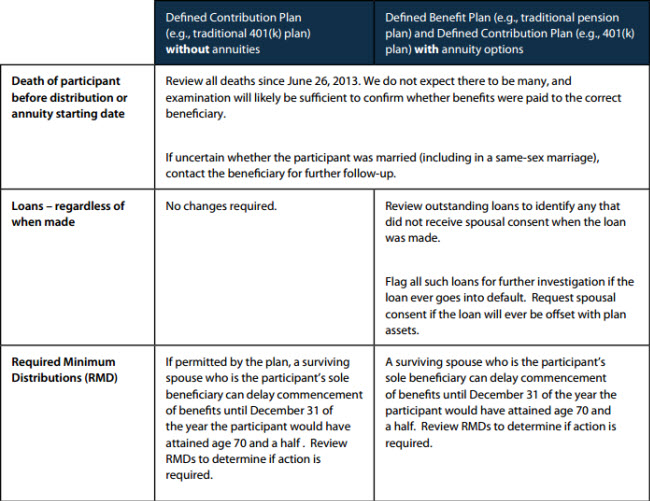

Dealing with the Windsor decision going forward is relatively easy – retirement plan sponsors must consider same-sex spouses as legally married for all plan purposes. On April 4, 2014, the IRS provided guidance on the retroactive impact of the Windsor decision. The chart below addresses the most significant areas of concern with regard to applying the rules under the Windsor decision retroactively to June 26, 2013.

Please note, the suggestions in the table below assume that the plan sponsor and plan administrator can rely on a participant’s statements as to marital status (for example, the plan administrator does not have any independent knowledge that would cause them to question a participant’s statements to the plan).

* We are assuming that no plans will elect to recognize same-sex marriages prior to June 26, 2013. Please call your plan’s legal advisor if this is not the case.

** Plans that offer period-certain annuities may require further investigation of whether spousal consent is necessary for beneficiaries designated prior to June 26, 2013.

For ease of administration, we recommend that most plans adopt a rule recognizing any same-sex marriage that is valid under the laws of the state where it was performed as of June 26, 2013, regardless of where the participants reside. Note, there are special rules that may be in effect from June 26, 2013, to September 16, 2013, for determining the marital status of participants if the affected participant resided in a state where same-sex marriages were not legally recognized during this period. The specific facts and circumstances require special review, so if you have questions about this, contact your plan’s legal advisor.

Immediate Action

We recommend that every plan sponsor set aside some time to review plan documents, benefit forms and benefits administration procedures. We also recommend communicating with participants regarding the effect the change in the law will have. The following are areas where action is required:

1. Plan Amendments During 2014

There are two instances that require plan sponsors to amend their plans to take into account the Windsor decision rules:

i. If the plan desires to recognize same-sex marriages earlier than June 26, 2013.

ii. If the plan language defines “marriage” or defines “spouse” with reference to the Defense of Marriage Act or in a way that otherwise does not recognize same-sex marriages. Note, if your plan simply references “federal law” or uses generic terms that do not exclude same-sex marriages, an amendment will generally not be necessary.

If either (i) or (ii) above is applicable with respect to your plan, your plan will require a plan amendment, generally due by December 31, 2014.

2. Forms and Procedures

All plan sponsors should review all affected forms and procedures. These include the following:

- Distribution election forms

- Beneficiary designation forms

- Loan procedures

- Qualified domestic relation order (QDRO) procedures and model QDRO language

- New hire forms and procedures

- Summary Plan Descriptions (SPDs)

- Required Minimum Distribution procedures

- Benefit summaries

All references to the Defense of Marriage Act should generally be removed, as should any language that prohibits benefits to same-sex spouses.

Beneficiary designation forms and all other affected documents should be amended to state clearly that if an unmarried participant subsequently marries or a marriage becomes recognized under state law on or after June 26, 2013, the beneficiary designation is void and a new designation must be prepared if the participant desires to name someone other than his or her current spouse as beneficiary.

3. Participant Communication

We suggest plan sponsors draft Summaries of Material Modifications (SMMs) to their SPDs. An SMM might use language similar to the sample below, or other language as suggested by your plan’s legal advisor:

Federal tax law has changed under United States v. Windsor (also called the “DOMA Decision”), and your retirement plan now recognizes legally valid same-sex marriages as of June 26, 2013. Because of this, it is possible that beneficiary designations you previously made are now invalid. This is especially applicable if you are currently (or at any time in the future may be) part of a same-sex marriage. For example, if you are married to a person of your same gender but designated someone other than your current same-sex spouse as your beneficiary, your prior beneficiary designation likely became invalid as of June 26, 2013.

We recommend that all participants review their beneficiary designations to ensure that they are current and accurate. Please contact your plan administrator for details.

Please note that United States v. Windsor has no effect on unmarried couples (e.g., individuals in civil unions and domestic partnerships, regardless of whether such couple is registered under state law). Such persons are still considered “unmarried” for plan purposes.

Action Required

Adapting to a major change in law can take time. Therefore, we suggest that plan sponsors act now to ensure they have sufficient time to implement new procedures. Setting aside some time to go through all your company’s benefit communications and procedures with appropriate personnel will be your plan’s best preventative measure to avoid future problems. In addition to updating forms, it will be important that human resources and benefits departments are aware of the Windsor decision so that miscommunications with participants do not result. It may be advisable to document these discussions and updates in your plan’s records.

Important: While every attempt is made to provide accurate suggestions in these matters, please be aware that this advisory does not provide specific legal advice for your individual plan and may not highlight all of the specific issues that are important to you. As such, you should continue to follow your plan’s normal legal review procedures and consult your plan’s legal advisor before making any decisions or changes. Also note that the suggestions we provide are designed to provide protection from legal challenges under the Internal Revenue Code; there is no guarantee that they will provide protection under ERISA. Further guidance from regulatory authorities may be necessary in this regard.

As always, your Alston & Bird attorney is ready to guide you through this transition process. Please give any of us a call if you have questions as you review past distributions, amend forms, communicate with participants and update procedures.

This advisory is published by Alston & Bird LLP’s Employee Benefits & Executive Compensation practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.