Recent changes to biosimilar policy will have an impact on reimbursement, competition, and innovation of these drugs. Since March 6, 2015, the U.S. Food and Drug Administration (FDA) has approved nine biosimilars, with five approvals issued in 2017 alone and many more in development. But only two are available on the market. Biosimilars have the potential to save between $25 billion to $150 billion over 10 years, but regulatory guidance and reimbursement policy will largely shape the extent to which biosimilars will produce such savings.

Although pharmaceutical manufacturers have successfully navigated the FDA’s regulatory pathway for biosimilars development and approval, reimbursement policy lagged behind until recently when the Centers for Medicare & Medicaid Services (CMS) released two final rules and one proposed rule. These rules establish new payment policies for biosimilars and provide insight into the agency’s direction for biosimilar reimbursement in the future. These rules also contain polices that may affect reimbursement for biosimilars under Medicare Parts B and D. However, questions remain about how these new Medicare Part B policies will be implemented and whether CMS will finalize polices related to Medicare Part D.

Medicare Part B

Separate coding for biosimilars

In the Calendar Year (CY) 2016 Physician Fee Schedule final rule, CMS determined that the payment amount for a biosimilar biological product would be based on the average sales price (ASP) of all National Drug Codes assigned to the biosimilar biological products included within the same billing and payment code. In effect, products relying on a common reference product’s biologics license application are grouped into the same payment calculation for determining a single ASP payment limit, and a single Healthcare Common Procedure Coding System (HCPCS) code is used for such biosimilars.

On November 2, 2017, CMS released the CY 2018 Medicare Physician Fee Schedule final rule, in which CMS revised the Part B biosimilar payment policy. Rather than grouping all biosimilars with a common reference product into the same billing code, the revised payment policy provides for the separate coding and payment for products approved under each individual abbreviated application. CMS finalized this policy in response to concerns related to patient and provider choice and to increase competition in the marketplace. As a result, effective January 1, 2018, newly approved biosimilar biological products with a common reference product will no longer be grouped into the same HCPCS code. However, CMS noted that changes to the coding are not likely to be completed until mid-2018.

CMS was not able to quantify the new payment policy’s impact on the potential savings or costs to Medicare Part B, physician offices, or beneficiaries. However, CMS believes this change could lead to additional savings for Medicare and its beneficiaries over the long term by increasing the utilization of products that are less expensive than reference biologicals.

Key outstanding issues

CMS plans to issue detailed guidance on coding, including instructions for new codes for biosimilars that are currently grouped into a common payment code and the potential use of modifiers or unique codes to track the use of biosimilars. CMS noted that it will continue to monitor Part B biosimilar payment and utilization and may use the following questions for further analysis in this area, as the market develops:

- Could small-molecule pharmaceutical pricing, utilization, and models apply to the biosimilar product context?

- Although the literature on biosimilars is currently much less extensive than the literature on small-molecule drugs, are there studies that are relevant to the policy question of Medicare’s biosimilars pricing?

- To what extent can Medicare learn from and use the experience of other countries with nationwide reference pricing policies?

- What are the key parameters for determining the optimal tradeoff between short-run price savings and long-run incentives to innovate?

- What insights can be gleaned from the optimal patent exclusivity literature or other strains of research?

Biosimilars to be subject to changes to 340B drug pricing

On November 1, 2017, CMS released the CY 2018 Hospital Outpatient Prospective Payment System final rule, which adjusted the applicable payment rate for separately payable drugs and biologicals (other than drugs on pass-through status and vaccines) acquired under the 340B Drug Pricing Program from average sales price plus 6 percent to ASP minus 22.5 percent.[1] This change is effective January 1, 2018. Rural sole community hospitals, prospective payment system-exempt cancer hospitals, and children’s hospitals are excluded from this policy for CY 2018. CMS believes using this average discount to set payment rates will: (1) adjust payments to better reflect resources expended to acquire such drugs; (2) protect the confidential nature of discounts applied to a specific drug; and (3) tie the beneficiary copayment to an amount that is more connected to the actual cost of the drug.

CMS determined that biosimilars will be included in the alternative 340B payment policy. However, the two currently available biosimilar products have pass-through status and will not be affected by this alternative 340B payment methodology. In the future, biosimilars that are not on pass-through payment status will be paid ASP minus 22.5 percent of the reference product. CMS believes this payment is appropriate and consistent with the amount paid for non-340B-acquired biosimilars (ASP plus 6 percent).

Key outstanding issues

CMS. In the CY 2018 final rule, CMS noted concerns about paying different rates for similar drugs and biologicals and stated that it will continue to assess the feasibility and practicality of an alternative 340B payment adjustment for biosimilars in the future.

Congress. Following CMS’s proposal to reduce reimbursement for drugs acquired through the 340B Program, members of both the House and Senate sent letters to CMS opposing the policy. In September 2017, 228 bipartisan members of the House submitted a letter to CMS urging the agency to not move forward with the reimbursement reduction. On October 6, 2017, 57 bipartisan Senators sent a letter to CMS opposing the reimbursement reduction. Consequently, Congress may take legislative action to undo or pause CMS’s 340B payment revision. On November 14, 2017, Representative David McKinley (R-WV) introduced H.R. 4392, which would essentially undo CMS’s payment adjustment for 340B drugs. While many Members of Congress have expressed opposition to CMS’s policy, Senator Bill Cassidy (R-LA) and Representative Larry Bucshon (R-IN) each introduced legislation (S. 2312 and H.R. 4710, respectively) that would put a two-year moratorium on the registration of new 340B hospitals and associated sites and would also require increased data sharing and transparency.

Hospitals & providers. The American Hospital Association, Association of American Medical Colleges, and America’s Essential Hospitals filed a lawsuit against the U.S. Department of Health and Human Services (HHS) to prevent the payment cuts for hospitals that participate in the 340B Program. The plaintiffs believe that the final rule would reduce Medicare reimbursements to certain public and not-for-profit hospitals and clinics by nearly 30 percent for prescription drugs purchased through the 340B Program. On December 29, 2017, U.S. District Judge Rudolph Contreras rejected the plaintiffs’ injunction request and granted HHS’s motion to dismiss. Judge Contreras concluded that the plaintiffs’ claim is substantively based on the Medicare-related provisions of the Social Security Act, and therefore the plaintiffs are required to satisfy the conditions regarding judicial review. According to Title 42 of the U.S. Code, Section 405(g), judicial review is permitted only after a final decision of the HHS Secretary. Because the plaintiffs did not present a specific claim for reimbursement to the HHS Secretary to make a final decision, Judge Contreras concluded that the court lacks subject-matter jurisdiction under Rule 12(b)(1) of the Federal Rules of Civil Procedure and dismissed the case. The American Hospital Association notified the court of its appeal and has asked the federal appeals court to expedite the appeals process.

Medicare Part D

Contract Year 2019 Medicare Advantage (MA)/Part D proposed rule

On November 16, 2017, CMS released its Contract Year 2019 Medicare Advantage (MA) and Medicare Part D proposed rule (MA/Part D proposed rule). This proposed rule includes the following proposals that may affect reimbursement of biosimilars. The final rule is expected to be released in February or March 2018.

Treatment of follow-on biologicals products as generics for non-low-income subsidy (LIS) catastrophic and LIS cost sharing. CMS proposes to classify follow-on biological products (i.e., biosimilars) as generics for the purposes of cost sharing for Part D enrollees who do not receive the LIS and are in the catastrophic portion of the benefit, and for LIS Part D enrollees throughout all phases of the benefit. CMS believes lower cost sharing for lower-cost alternatives will improve enrollee incentives to choose follow-on biological products over more expensive reference biological products and will reduce costs to both Part D enrollees and the Part D program.

Part D tiering exceptions. Currently, Part D plan sponsors are required to establish and maintain reasonable and complete tiering exceptions procedures. In cases where a plan sponsor determines that a nonpreferred drug is medically necessary, based on the prescriber’s supporting statement, the exceptions process allows an enrollee to obtain a drug in a higher cost-sharing tier but pay the lower cost-sharing that would apply to the preferred drug.

CMS proposes to revise existing policies related to tiering exceptions, including the permissible limitations Part D plan sponsors may apply to tiering exception requests. Specifically, CMS proposes to eliminate the provision allowing plans to exclude a dedicated generic tier from the tiering exceptions process and instead establish a framework based on the type of drug (brand, generic, biological product) requested and the cost-sharing of applicable alternative drugs. This proposal would not apply to plans’ specialty tiers. CMS believes the proposed changes will make the tiering exceptions process more accessible and transparent for enrollees and less cumbersome for plan sponsors to administer.

Medicare Payment Advisory Commission

The Medicare Payment Advisory Commission (MedPAC) convened a session in January 2018 on biosimilars and Medicare Part D. During the session, staff members proposed a policy to apply the Part D manufacturer coverage gap discount to biosimilars.

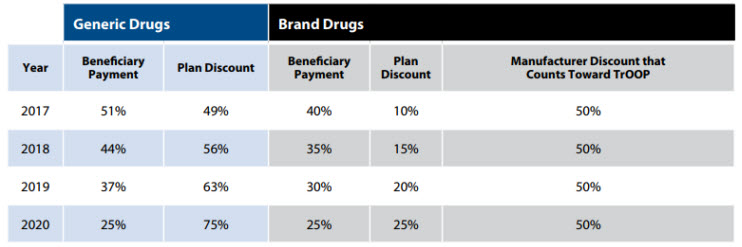

Once a Medicare Part D beneficiary’s plan has spent a certain amount on the beneficiary’s covered drugs, a coverage gap, commonly referred to as the “donut hole,” begins. During the coverage gap, beneficiaries pay a higher proportion of the plan’s cost for covered prescription drugs until they hit their true out-of-pocket (TrOOP) threshold. During the coverage gap, manufacturers provide a 50 percent discount for brand and biologic drugs, which is counted toward the beneficiary’s TrOOP. However, biosimilar manufacturers are not allowed to provide the 50 percent discount, and in turn, the price of biologics compared with that of biosimilars is lowered. Therefore, beneficiaries are not incentivized to use the normally cheaper biosimilar.

The following table outlines beneficiary payment, including how payment counts toward TrOOP, for both generic and brand drugs during the coverage gap.

MedPAC considered the following draft recommendation and implications:

The Congress should change Part D’s coverage gap discount program to: require manufacturers of biosimilar products to pay the coverage gap discount by including biosimilars in the definition of applicable drugs; and exclude biosimilar manufacturers’ discounts in the coverage gap from enrollees’ true out-of-pocket spending.

In terms of program spending, this recommendation is expected to decrease Medicare spending by up to $2 billion in the first year and up to $10 billion over five years. The proposal is also expected to result in small near-term savings, potentially larger over the long-term. Further, MedPAC staff estimated that this proposal would, among other things, result in plans being more likely to place biosimilars on formularies and manufacturers paying larger discount amounts.

MedPAC unanimously approved the recommendation and is expected to include the finalized recommendation in its forthcoming March 2018 Report to Congress.

Food and Drug Administration

On January 11, 2018, the FDA released its 2018 Strategic Policy Roadmap, which provides an overview of four key priorities, including initiatives and action items, the agency plans to pursue in 2018. Of these, the FDA has the Drug Competition Action Plan and Biosimilar Innovation Plan. This initiative aims to increase competition from generic drugs and biosimilars and ensure the benefits of competition are realized by consumers. Specifically, the FDA plans to launch a comprehensive program to promote the development and adoption of safe, high-quality biosimilar drugs as part of a new Biosimilar Innovation Plan. The FDA’s role in pursuing this parallel effort complements CMS’s work to address and resolve outstanding issues regarding payment of biosimilars. Combined, these efforts indicate the desire to increase the number of biosimilars available on the market.

Outlook

Since 2015, the potential for biosimilars to increase choice and competition and, in turn, lower drug prices has been widely anticipated. While the market has evolved in response to patient, provider, and manufacturer concerns, the regulatory pathway has become better defined by the FDA, and more companies are seizing the product development opportunity that the biosimilars pathway offers. These and other issues will continue to impact how CMS reimburses biosimilars and how they are accepted by providers and patients. While biosimilars are generally viewed as a tool to drive down overall health care spending, there are several outstanding issues that must be addressed, including implementing new coding for payment of biosimilars under Medicare Part B, potentially applying the 340B payment change to forthcoming biosimilars, and the effect of payment policies that will be finalized in the MA/Part D proposed rule on biosimilar reimbursement. We continue to closely monitor issues related to biosimilars, and in 2018 we expect additional legal challenges to the revised 340B payment methodology, agency regulations on biosimilars, and potential legislation.