Effective December 24, 2015, all securitizations of residential mortgage loans (RMBS), both public and private, will be subject to the Credit Risk Retention Rule (the “Rule”).[1] The Rule was promulgated on December 24, 2014, by the Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of the Currency (OCC), Securities and Exchange Commission (SEC), Department of Housing and Urban Development (HUD) and Federal Housing Finance Agency (FHFA) (collectively, the “agencies”) to implement the credit risk retention requirements of Section 15G of the Securities Exchange Act of 1934, as amended by Section 941 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (together, the “Exchange Act”). As required by the Exchange Act, the Rule generally requires, for nonexempt assets, that sponsors[2] retain at least 5 percent of the credit risk of any securitization and prohibits them from directly or indirectly hedging or transferring such retained credit risk. The Rule is meant to ensure that sponsors have “skin in the game” for nonexempt assets.

Exemption for Securitizations of Qualified Residential Mortgages

Securitizations of residential mortgage loans are exempt from the risk retention requirements if (1) they are backed solely by qualified residential mortgages (QRMs) that are not currently 30 days or more delinquent on the closing date; (2) they are not backed by pre-existing RMBS; and (3) the sponsor provides a certification from the depositor. Additionally, securitizations are also exempt if they are backed solely by QRMs or three-to-four unit residential mortgage loans that are owner-occupied, that are deemed to be for business purposes and that otherwise satisfy the QRM requirements.

Under the Rule, a QRM is defined as a qualified mortgage (QM), as defined in Section 129C of the Truth in Lending Act (TILA).[3] Generally, a QRM or a QM is a loan that:

- Has a term shorter than 30 years;

- Has total points and fees that are not excessive;

- Has no risky features, such as negative amortization, interest-only or balloon payment features;

- Has adequate documentation of the borrower’s income and assets;

- Has an annual percentage rate above a certain threshold; and

- Meets one of the following three characteristics: (1) the monthly loan payment, plus the borrower’s other debt payments, does not exceed 43 percent of the borrower’s monthly income; (2) the loan qualifies for purchase by a government-sponsored enterprise or is insured by the Federal Housing Administration; or (3) the loan is made by a small lender that keeps the loan in portfolio.

Neither the QRM definition nor the QM definition incorporates a loan-to-value (LTV) ratio requirement or standards related to the borrower’s credit history. When the Rule was passed, the agencies noted that they were aligning the QRM definition with the QM definition to minimize additional regulatory burdens and compliance costs and facilitate the return of private capital to the mortgage market.

The QRM exemption also requires that the depositor provide a certification stating that it has evaluated the effectiveness of its internal supervisory controls and determined that those controls are sufficient to ensure that all assets collateralizing the RMBS are QRMs. The evaluation and determination must be done, for each issuance of RMBS that relies on the QRM exemption, within 60 days of the cutoff date for the relevant securitization. The sponsor must then present a copy of the certification to potential investors prior to the sale of the RMBS. The certification must also be presented upon request to the Board of Governors of the Federal Reserve System, FDIC, OCC or SEC.

If it is determined after closing that one or more of the loans in a securitization that relied on the QRM exemption do not meet the QRM standard, the entire securitization shall not lose its exemption if three conditions are met. First, the depositor must have complied with the certification requirement described above. Second, the sponsor must repurchase the defective loans within 90 days after the determination that the loans do not satisfy the requirements at a price equal to or greater than the unpaid principal balance of the loan. And third, the sponsor must promptly notify the holders of the RMBS for that securitization that certain loans are being repurchased, the amount of the repurchase price and the cause for the repurchase. It is not clear how this requirement will work with the role of the asset representation reviewer typically found in recent jumbo prime RMBS.

Risk Retention Methods: Vertical, Horizontal or a Combination

If no exemption is available, the Rule requires that an eligible entity retain not less than 5 percent of the credit risk of any asset that the securitizer, through the issuance of a security, transfers, sells or conveys to a third party. “Credit risk” is (1) the risk of loss that could result from the failure of the borrower to make required payments on a timely basis or from the borrower’s bankruptcy, insolvency or similar proceeding; or (2) the effect that significant changes in the underlying credit quality of the asset or RMBS interest may have on the market value of the asset or the RMBS interest.

Credit risk can be held either through an eligible vertical interest, an eligible horizontal residual interest or a combination of vertical and horizontal interests.[4] The percentage of any such interests must be determined as of the closing date of the securitization.

An “eligible vertical interest” is defined as either (1) a single vertical security entitling the holder to the same percentage of amounts paid on each class; or (2) an interest in each class of RMBS interests constituting the same proportion of each class.

An “eligible horizontal residual interest” is an interest in a single class or multiple classes that represents the most subordinate claim to payments of both principal and interest by the issuing entity (with the exception of any non-economic REMIC residual interest). Such horizontal interest must absorb any shortfalls in interest or principal before those shortfalls are allocated to any other classes. As opposed to vertical interests, where the 5 percent slice must be 5 percent of the aggregate interest of the issuer, the 5 percent for horizontal interests must be 5 percent of the fair value of all RMBS interests issued, as determined in accordance with generally accepted accounting principles (GAAP).

In lieu of retaining any or all of the eligible horizontal residual interest, the sponsor may also establish and fund an “eligible horizontal cash reserve account” (“reserve account”) in an amount equal to the fair value of the eligible horizontal residual interest. Amounts in the reserve account, which are to be held in cash or cash equivalents, are to be used only to satisfy payments on RMBS interests on any payment date when the issuing entity has insufficient funds or to pay critical expenses of the trust on any payment date when the issuing entity has insufficient funds. The amounts in the reserve account must be held until all interests of the issuer are paid in full or until the issuer is dissolved.

Finally, in addition to the vertical and horizontal risk retention options, a sponsor may retain both an eligible vertical interest and an eligible horizontal residual interest. When combined, the percentage of the fair value of the eligible horizontal residual interest and the percentage of the eligible vertical interest must equal at least 5 percent.

Disclosure Regarding Risk Retention Method

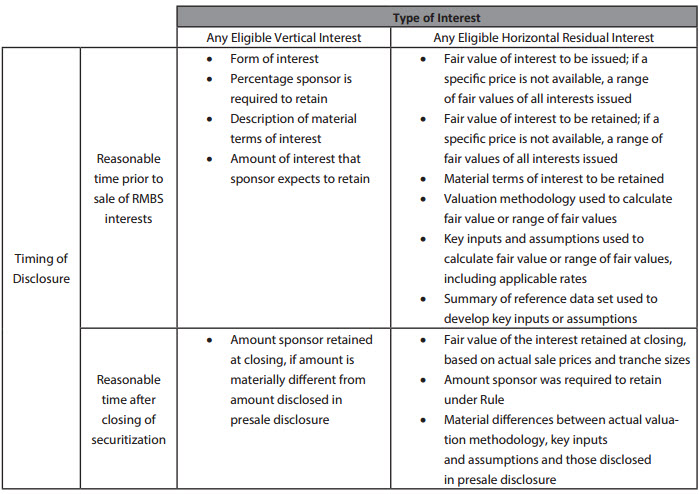

Whether a sponsor chooses to retain the risk vertically or horizontally, it is required to disclose certain information prior to the sale of RMBS. Such disclosure requirements are more onerous for the retention of any eligible horizontal residual interest and require the disclosure of a sponsor’s valuation methodology and key assumptions, which may make the horizontal risk retention option less desirable than the vertical risk retention option. A summary of the disclosure requirements are as follows:

Parties Eligible to Hold Credit Risk

The retained credit risk may be wholly retained by a sponsor or one of a sponsor’s majority-owned or wholly-owned affiliates, and it may be partially retained by an originator. A “sponsor” is defined as “a person who organizes and initiates a securitization transaction by selling or transferring assets, either directly or indirectly, including through an affiliate, to the issuing entity.” If there is more than one sponsor, it is the responsibility of each sponsor to a securitization to ensure that at least one of the sponsors or their affiliates retains the required credit risk.

Any risk retention allocated to a majority-owned or wholly-owned affiliate of a sponsor or to an originator reduces the sponsor’s risk retention requirement proportionally. A “majority-owned affiliate” is an entity, other than the issuing entity, in which the sponsor owns 50 percent or more of the equity. There is no limit to the amount of credit risk that a sponsor’s affiliate may hold.

An “originator” is any person or entity that created the asset through the original extension of credit, excluding any subsequent transferee or purchaser. The amount of credit risk an originator can hold is subject to a floor (at least 20 percent of the total risk required to be retained) and ceiling (the proportion of risk held by an originator, when divided by the amount of risk required to be retained by the sponsor, must not exceed the proportion of the originator’s assets in the securitization divided by all assets in the securitization). Further, the originator must acquire the eligible interest from the sponsor at the closing and must retain the interest in the same manner and proportion as the sponsor. The originator must also comply with the same transfer and hedging restrictions as the sponsor.

If an originator retains risk, the sponsor has certain disclosure and monitoring responsibilities. A reasonable time prior to the sale of RMBS, the sponsor must disclose the originator holding the risk, the form, amount and nature of the risk held by such originator and the method of payment for the risk. Further, the sponsor is responsible for monitoring the originator and ensuring that it continues to hold the credit risk and comply with all transfer and hedging restrictions.

While it is appealing that the Rule allows multiple parties to hold credit risk, ultimately it seems unlikely that originators will play a significant role in such retention on RMBS transactions, given the additional burdens (regulatory, valuation or otherwise), the general ease of selling the loan in its entirety and other reasons.

Hedging, Transfer and Financing Prohibitions

The Rule generally prohibits a retaining sponsor, sponsor’s affiliate or originator from selling or otherwise transferring any retained risk to any person other than a majority-owned or wholly-owned affiliate of the sponsor. Further, the sponsor, its affiliates and the originator are prohibited from directly or indirectly hedging the retained credit risk, subject to certain limited exceptions. The hedging activities that are permitted include hedging the interest rate risk or foreign exchange risk associated with the retained credit risk, entering into a hedge based on an index that contains RMBS interests of the issuing entity and entering into full-recourse financings.

For RMBS transactions, these transfer and hedging restrictions expire on the date that is (1) the later of (a) five years after the closing date, or (b) the date on which the total unpaid principal balance of the securitized assets is reduced to 25 percent of the original unpaid principal balance as of the closing date; but (2) in any event no later than seven years after the closing date.

In practice, it may be difficult for entities with limited lifespans, such as hedge funds, to comply with these transfer and hedging restrictions.

Additional Exemptions

In addition to the QRM exemption, certain other types of securitizations are exempted from the risk retention requirement. Exemptions most relevant to RMBS include the exemptions for:

- Securitizations backed solely by seasoned loans;

- U.S. government securitizations;

- Foreign securitizations;

- Securitizations backed solely by community-focused residential mortgages (e.g., loans made through state housing agency programs); and

- Certain “first-pay-class” resecuritizations that are collateralized by servicing assets and ABS where the credit risk was previously retained or that were exempt from the credit risk retention requirements.

Additionally, the Rule gives the agencies the authority to jointly, but not individually, issue additional exemptions on an individual or class basis.

Exemption for securitizations of seasoned loans

Securitizations that are backed solely by seasoned loans are exempted from the risk retention requirements. Under the Rule, a “seasoned loan” includes any residential mortgage loan that (1) has not been modified since origination; (2) has not been delinquent for 30 days or more; and (3) has been outstanding for seven years or has been outstanding for five years or the principal balance of the loan has been reduced to 25 percent of the original principal balance.

This means that most reperforming and nonperforming RMBS currently being done will be subject to the Rule.

Exemption for U.S. government-backed securitizations

Further, the Rule exempts certain securitizations insured or guaranteed by the U.S. government. First, securitizations in which Fannie Mae, Freddie Mac or any successor to such entities acts as a sponsor and fully guarantees the timely payment on all RMBS interests issued are exempt from the risk retention requirement. However, the exemption only applies for so long as Fannie Mae, Freddie Mac and their successor are operating under conservatorship or receivership of the FHFA or with capital support of the U.S. government. Second, securitizations of residential, multifamily or health care facility mortgage loans that are insured or guaranteed, in whole or in part, by the U.S. government are also exempted from the risk retention requirements.

Exemption for foreign securitizations

Finally, the Rule has a limited exemption for certain foreign transactions, which is available if the following conditions are met:

- The securitization is not required to be registered under the Securities Act of 1933;

- No more than 10 percent by dollar value of all securitization interests are transferred to U.S. persons;

- Neither the sponsor nor the issuer is organized under U.S. law, is an unincorporated branch of an entity organized under U.S. law or is a non-U.S. entity located in the U.S.; and

- No more than 25 percent of the assets for the securitization were acquired from an affiliate or branch of the sponsor organized or located in the U.S.

Observations and Conclusions

The risk retention rules add yet another layer of complexity and legal uncertainty to RMBS. It is unclear how risk retention will ultimately affect the existing RMBS market. Due to the correlation of QM and QRM standards, it is likely that a large percentage of newly originated loans will satisfy the QRM standard and that it will be possible to securitize such loans without becoming subject to the risk retention requirement.

Further, for nonexempt transactions, it seems likely that vertical risk retention may be the most popular method. Many transactions currently satisfy the horizontal slice requirements, but sponsors may be unwilling to disclose the valuation information required by the Rule for any horizontal risk retention or be willing to assume the liability. As a result, many securitizations may use only the vertical risk retention option to satisfy the requirement, even if a horizontal slice is also retained.

The attorneys in Alston & Bird’s Finance Group will continue to monitor developments regarding risk retention rules and other matters that affect the RMBS market as they arise. Please reach out to us with any questions.

[1] Credit Risk Retention, 79 Fed. Reg. 77,602 (Dec. 24, 2014). Available at http://www.gpo.gov/fdsys/pkg/FR-2014-12-24/pdf/2014-29256.pdf.

[2] Technically, a portion of risk retention can be retained by the originator; however, we do not currently believe, for a number of reasons, that originators will be asked to or be able to retain risk for purposes of the Rule.

[3] The agencies are required to periodically review the QRM definition. The reviews will take place in December 2019, December 2024, every five years after December 2024 and any time that an agency submits a reasoned request for a review. When a review is commenced, notice of review shall be published in the Federal Register, and when the review is completed, a summary of the review shall be similarly published. If, in the summary, the agencies determine that it is necessary to amend the QRM definition, the agencies shall complete such rulemaking within 12 months of publishing the summary.

[4] The requirements for revolving pool securitizations are different, but it is unlikely that this structure will be used for new RMBS and has not often been used in the past.

This advisory is published by Alston & Bird LLP’s Finance practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.