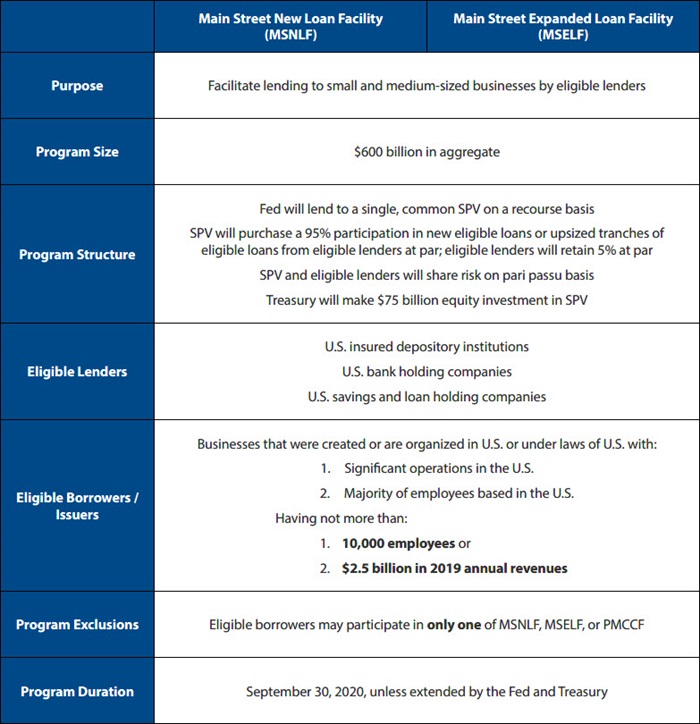

On April 9, 2020, the Federal Reserve announced it is taking additional actions to provide up to $2.3 trillion in loans to support the economy as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. These actions include providing credit to small and mid-size businesses with up to 10,000 employees or $2.5 billion in annual revenues through the purchase of up to $600 billion in loans through the Main Street Lending Program.

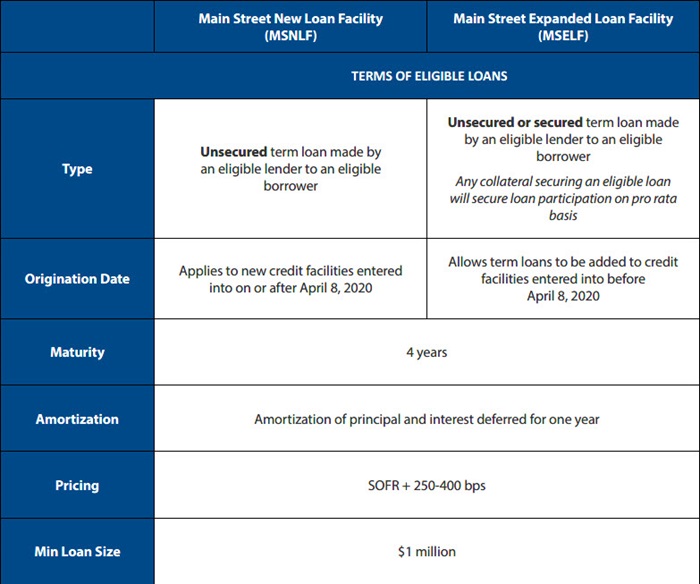

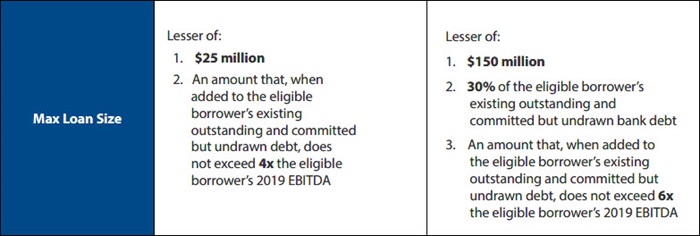

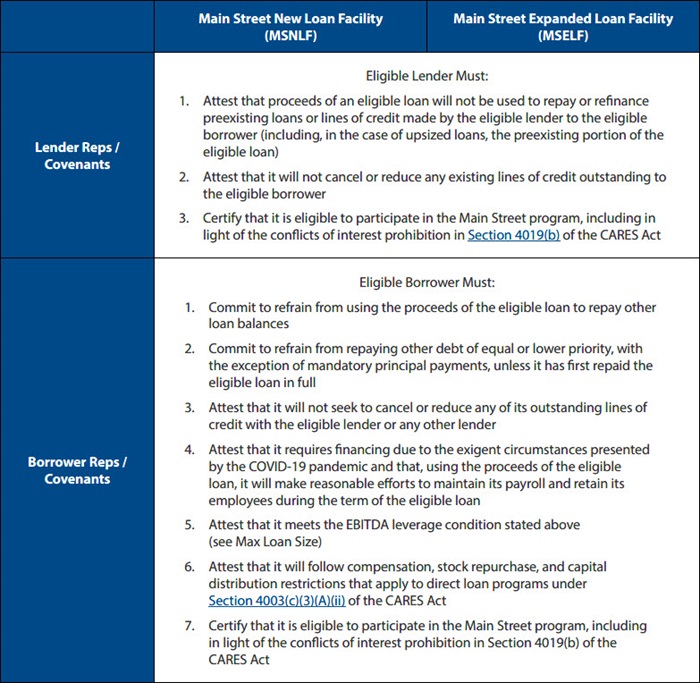

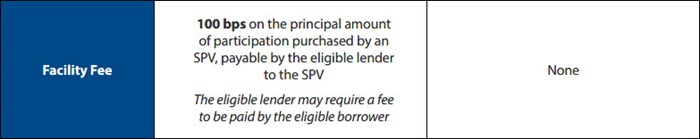

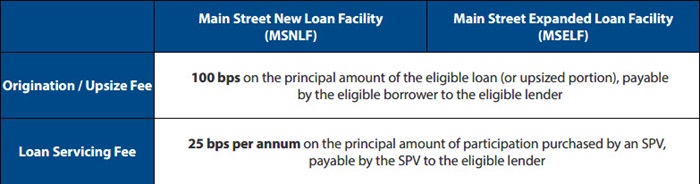

Four-year term loans, with principal and interest payments deferred for the first year of the loan, will be provided by eligible banks (limited to U.S. insured depository institutions, U.S. bank holding companies and U.S. savings and loan holding companies) by either originating new unsecured term loans (the “Main Street New Loan Facility”) or increasing the size of existing facilities with secured or unsecured term loans (the “Main Street Expanded Loan Facility”). Eligible banks will retain a 5% share of the loans and sell a 95% loan participation to a special purpose vehicle (SPV) established by the Federal Reserve. The SPV is authorized to purchase up to $600 billion of these loans. Both the Main Street New Loan Facility and Main Street Expanded Loan Facility require an attestation from borrowers that the borrowers will comply with certain compensation, stock repurchase, and capital distribution restrictions until 12 months after the loans are no longer outstanding. While companies that have availed themselves of the benefits of SBA Payroll Protection Program loans under the CARES Act remain generally eligible to borrow under the Main Street Lending Program, each eligible company will only be permitted to access one of the Main Street New Loan Facility, the Main Street Expanded Loan Facility, or the Primary Market Corporate Credit Facility (a separate, $750 billion facility that will serve as a funding backstop for companies rated BBB-/Baa3 or greater).

A summary and comparison of both Main Street Lending Program facilities can be found below.

We will continue to monitor the many questions that remain to be answered in the coming weeks as additional guidance becomes available and eligible lenders begin underwriting and originating eligible loans. Notable areas that will benefit from further clarification include:

- Whether the leverage limitations will be based solely on generally accepted accounting principles (GAAP) or if earnings before interest, taxes, depreciation, and amortization (EBITDA) will be permitted to be adjusted for any pro forma events or other customary leverage adjustments.

- What exceptions, if any, will be permitted to the required lender representations and covenants regarding cancellation of existing credit facilities (including in circumstances of future events of default).

- What the negative covenants in the definitive loan documentation will include. Will there be a debt negative covenant basket to incur additional secured debt?

- Whether borrowings under the program may be used to temporarily retire revolving debt so long as such revolving facility remains available for future borrowings.

- What constitutes reasonable efforts to maintain the borrower’s payroll and retain employees during the term of the eligible loan.

- What is the term loan amortization schedule after the one-year payment holiday?

- Will companies with asset-based revolving credit facilities calculate their maximum debt limitation using commitments or borrowing base? If commitment, will borrowers reduce excess commitments?

- How will debt be defined for the leverage limitation? Will Paycheck Protection Program loans count as debt for the EBITDA/leverage limiter?

- How existing lenders adapt to accommodate these additional loans in existing capital structures, including:

- The impact of the 4-year maturity on existing credit facilities with greater maturities currently in place.

- How traditional subordination and intercreditor arrangements (including lien priority arrangements and waterfall allocations) will be addressed.

- What lender reaction will be to the 5% risk retention portion of loans under the program and whether that will have any chilling effect on the availability of these loans to smaller or struggling companies.

Since this is not an SBA program, there is no indication that the “affiliation” rules that blocked so many private equity portfolio companies from eligibility for the Paycheck Protection Program will be applicable to Main Street Lending Program eligibility. The more than 4,000 eligible lenders could earn an attractive 100 bps origination/upsizing fee to originate these loans and will hold only a 5% risk retention portion of loans, amounting to essentially a 20% fee. The lenders will also receive a 25 bps per annum servicing fee. All of these features should make the Main Street Lending Program popular with both borrowers and lenders alike.

Overview of CARES Act Main Street Lending Programs

as of April 9, 20201

Alston & Bird has formed a multidisciplinary task force to advise clients on the business and legal implications of the coronavirus (COVID-19). You can view all our work on the coronavirus across industries and subscribe to our future webinars and advisories.

1 Summaries are based on term sheets published by the Fed on April 9, 2020.