The Commodity Futures Trading Commission (“CFTC”) recently announced available-to-trade determinations on certain interest rate swaps (“IRS”) and credit default swaps (“CDS”). Unless an exception applies (such as the end-user exception), those IRS and CDS contracts can no longer be executed bilaterally. Instead, they must be executed on a swap execution facility (“SEF”) or a designated contract market (“DCM”). The commencement date for the requirement to execute on a SEF or DCM depends upon the type of swap, with the first date being February 15, 2014.

Background

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, any swap subject to mandatory clearing must be executed on a SEF or a DCM once that type of swap is made available to trade. The “made available to trade” determination is made by means of a CFTC process, which is now complete for the swap products noted in the tables below.

Execution of Swaps on SEFs and DCMs

Once an available-to-trade determination is made for a particular type of swap, all SEFs and DCMs that offer or list that type of swap for trading must do so consistent with the CFTC’s trading requirement. As a result, market participants can execute swaps subject to a mandatory execution requirement on any SEF or DCM that offers or lists that type of swap for trading. Execution of swaps on a SEF or a DCM will require a direct or indirect relationship with the SEF or DCM, which may involve new agreements or other documentation.

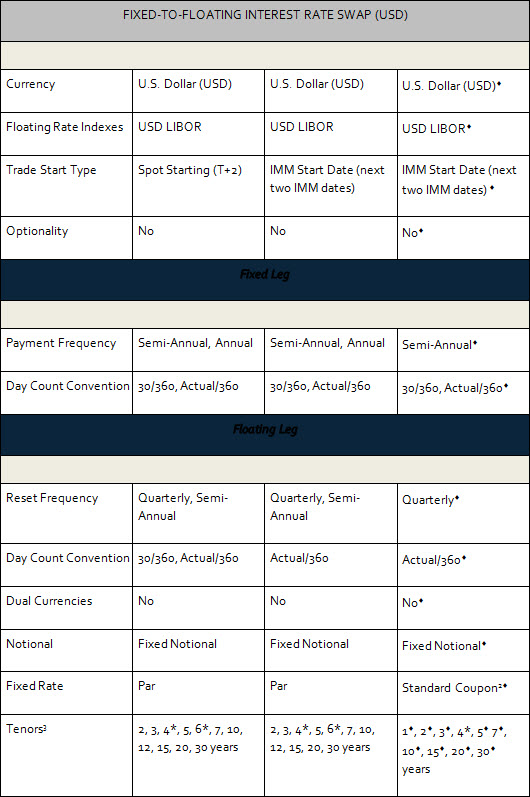

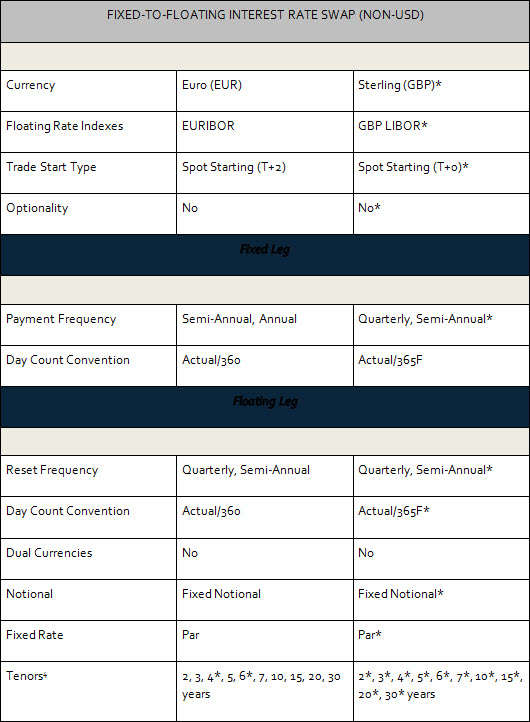

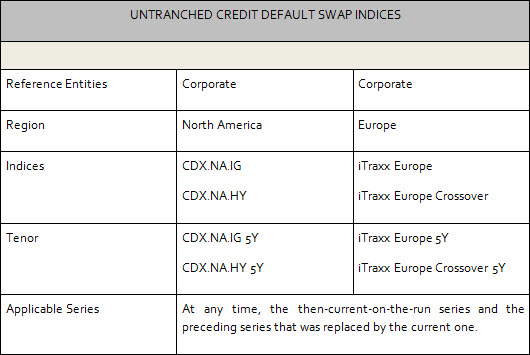

IRS and CDS Contracts Subject to Mandatory Execution on a SEF or DCM

IRS and CDS contracts with the characteristics in the tables below have been determined to be made available to trade.[1] The commencement date for mandatory trade execution will depend upon the characteristics of the swap. In the tables below, IRS contracts with characteristics that have no notation are subject to mandatory trade execution starting February 15, 2014; IRS contracts with at least one characteristic denoted by () but no characteristics denoted by (*) are subject to mandatory trade execution starting February 21, 2014; and IRS contracts with at least one characteristic denoted by (*) are subject to mandatory trade execution starting February 26, 2014. CDS contracts with the characteristics in the table below are subject to mandatory trade execution on February 26, 2014.

Package Transactions

“Package transactions” refer to transactions that include at least one swap that is subject to the mandatory execution requirement and one swap that is not. The CFTC has noted that parties to a package transaction are not necessarily relieved from the mandatory execution requirement for the swap in the package transaction that has been made available-to-trade.5 The CFTC will hold a roundtable on February 12, 2014 to discuss the challenges posed by package transactions.

[1] For further information, please see the following CFTC press releases: http://www.cftc.gov/PressRoom/PressReleases/pr6831-14 (January 16, 2014); http://www.cftc.gov/PressRoom/PressReleases/pr6838-14 (January 23, 2014); http://www.cftc.gov/PressRoom/PressReleases/pr6841-14 (January 28, 2014); and http://www.cftc.gov/PressRoom/PressReleases/pr6843-14 (January 30, 2014).

[2] Standard Coupon refers to the then-current fixed coupon rates for Market Agreed Coupon contracts.

[3] Par coupon swaps with a tenor of 4 or 6 years that are made available-to-trade are limited to the 3M USD LIBOR floating rate index; Quarterly Reset Frequency; and the following fixed leg conventions: (1) Semi-Annual and 30/360; or (2) Annual and Actual/360.

[4] Euro (EUR)-denominated, par coupon swaps with a tenor of 4 or 6 years that are made available-to-trade are limited to the following fixed leg conventions: Annual and 30/360.

This advisory is published by Alston & Bird LLP’s Financial Services & Products practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.