The Securities and Exchange Commission (SEC) recently adopted final rules that will require most public companies to calculate and disclose a ratio that compares the annual total compensation of their “median employee” to that of their CEO. These rules, which are commonly referred to as the “Pay Ratio Rules,” have drawn strong support from investor groups concerned with income inequality in the U.S.[1] and considerable opposition from business groups that believe that the cost of compliance outweighs the usefulness of the information to investors.[2] Although adoption of the rules was required under Section 953(b) of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, the SEC recognized the controversy surrounding this provision and noted that Congress did not describe its specific objectives or intended benefits. In adopting the final rules, the SEC provided some additional flexibility on how companies may determine their median employee. These alternatives are intended to reduce the compliance burden and the attendant costs.

Commissioners Luis Aguilar, Kara Stein and Chair Mary Jo White voted in favor of the rules, with Commissioners Daniel Gallagher and Michael Piwowar dissenting.

The Pay Ratio Disclosure

The core part of the Pay Ratio Rules is simple, requiring the disclosure of three specific amounts:

- The median of the annual total compensation of all employees of the registrant (other than the CEO);

- The annual total compensation of the CEO;[3] and

- The ratio of the first amount to the second amount.

Total compensation is calculated in the same manner as in the Summary Compensation Table under Regulation S-K, Item 402(c), as if the median employee were a named executive officer. Accordingly, it will include such items as salary, cash incentives, grant date value of equity awards, annual change in pension value, perquisites and benefits, and other compensation. If the median employee is an hourly employee, “salary” for such calculations will be equal to the employee’s wages plus overtime. The CEO’s total annual compensation typically will be the same as the amount disclosed in the Summary Compensation Table.[4]

The ratio must be expressed with the median employee’s compensation having a value of one (e.g., “300:1”), or the CEO’s pay may be described as a multiple of the median employee’s pay (e.g., “the CEO’s annual total compensation is 300 times the annual total compensation of the median employee”). The actual median employee should not be identified, although the registrant may choose to describe the employee’s job title or position. The registrant may provide additional information to put the pay ratio disclosure in context, including other ratios, as long as the extra information is clearly identified and not made more prominent than the required disclosure. The final rules also require disclosure of various items relating to the identification of the median employee.

The Pay Ratio Rules were adopted as a new Item 402(u) to Regulation S-K. Accordingly, for most companies, the required disclosure will most commonly appear in proxy statements or annual reports on Form 10-K. The information must be filed no later than 120 days after the end of the previous fiscal year.

The Included (and Excluded) Employees

The most complicated portions of the Pay Ratio Rules involve the determination and identification of the median employee. The first step of identification is determining the applicable employee population. For purposes of the final rules, employees generally include all employees of the registrant and its consolidated subsidiaries, including full-time, part-time, seasonal and temporary workers, with several important exceptions.

- The rules only cover employees who are employed as of a date within the last three months of the registrant’s fiscal year. Each registrant is allowed to choose a determination date that occurs in the last quarter of its fiscal year. While many companies will choose to evaluate the employees as of the last day of their fiscal year, companies with significant changes in their employee base in the final weeks of the year, such as retail companies that hire seasonal employees for the holidays, may decide to pick an earlier date. The registrant must disclose the date it used to identify the median employee, and if the date changed from the prior year, it must describe the change and provide a brief explanation of the reasons for the change.

- The rules exclude workers who provide services to the registrant or its consolidated subsidiaries as independent contractors or leased workers if the workers are employed by an unaffiliated third party and their pay is determined by that unaffiliated party. The narrowness of this exception raises potential issues regarding contractors, freelancers and professionals who provide services to registrants independently and who are not employed by another company.

- The rules allow registrants to exclude individuals who became employees of the registrant as a result of a merger or acquisition that occurred during the fiscal year. The registrant must disclose the acquired business and the approximate number of employees it is omitting under this exception. Those employees may not be excluded in the registrant’s next fiscal year.

- The rules allow registrants to exclude individuals employed in foreign jurisdictions (1) to the extent they comprise 5 percent or less of the registrant’s total employees (the de minimis exemption) or (2) if the data privacy laws in those foreign jurisdictions would prohibit compliance with the rules (the data privacy exemption).

- How does the 5 percent de minimis exemption work?

- If the registrant’s foreign employees account for 5 percent or less of its total employees, it may exclude all (and not less than all) of its foreign employees from the calculations.

- If the registrant’s foreign employees account for more than 5 percent of its total employees, it may still exclude up to 5 percent of its employees who are foreign employees. However, if the registrant excludes any employees in a particular jurisdiction, it must exclude all employees in that jurisdiction. Accordingly, if more than 5 percent of the registrant’s employees are in one foreign jurisdiction, it cannot exclude any such employees. For example, assume a registrant has employees in Mexico (10 percent), Brazil (6 percent), Ireland (3 percent), China (2 percent) and Singapore (2 percent). None of the employees in Mexico or Brazil could be excluded, but all of the employees in two of the remaining three countries could be excluded.

- Foreign employees excluded under the data privacy exemption count against the 5 percent de minimis limit (although more than 5 percent can be excluded under the data privacy limit itself, which does not contain a numerical cap).

- What are the requirements for the data privacy exemption?

- The employee must be employed in a foreign jurisdiction in which the laws or regulations governing data privacy are such that, despite its reasonable efforts to obtain or process the information necessary for compliance with the Pay Ratio Rules (including seeking an exemption or other relief in the foreign jurisdiction), the registrant is unable to do so without violating such data privacy laws.

- The registrant must obtain a legal opinion from counsel that addresses the registrant’s inability to obtain or process the information necessary to comply with the Pay Ratio Rules without violating data privacy laws and the registrant’s inability to obtain exemption or relief under those laws. The legal opinion must be filed as an exhibit to the filing in which the pay ratio disclosure appears.

- If the registrant chooses to exclude any employees using this exemption, it must disclose the excluded jurisdictions, identify the specific data privacy laws that are impacted, explain how complying with the Pay Ratio Rules would violate the data privacy laws, describe the efforts made to obtain an exemption or other relief under those laws and provide the approximate number of employees exempted from each jurisdiction based on this exemption.

- If a registrant excludes any employees in a particular jurisdiction under this exemption, it must exclude all employees in that jurisdiction.

- How does the 5 percent de minimis exemption work?

Identifying the Median Employee

Once the applicable employee population has been determined, the registrant must consider the annual compensation of the included employees to identify the individual whose pay represents the median of the employee group. The final rules allow flexibility in the identification process so that each registrant may select a methodology that is appropriate to the size and structure of its businesses and the way it compensates employees. For example, a registrant with a small number of employees may choose to calculate the median pay by using the compensation data of its full employee population, while a registrant with a large number of employees may choose to base its calculation on a statistical sampling of its employees. In addition, rather than calculating the total compensation for each employee up front, a registrant may choose to use a different compensation measure to identify the median employee, such as information derived from the registrant’s tax or payroll records, as long as the measure is consistently applied to all employees in the calculation.

The registrant must briefly describe the methodology it used to identify the median employee, along with any material assumptions, adjustments or reasonable estimates it used, which must be consistently applied.

- What if the employees are in several different jurisdictions? In the final rules, the SEC recognized that living expenses and pay levels vary in different parts of the world. Accordingly, when a registrant is determining its median employee, it may apply cost-of-living adjustments to the compensation for employees in jurisdictions other than where the CEO resides. If after that adjustment the median employee is determined to be an employee in a jurisdiction for which an adjustment was applied, the same adjustment must be used in determining the median employee’s annual total compensation for the pay ratio disclosure. For example, if the registrant’s CEO resides in the U.S. and the registrant determines that the cost of living in the U.S. is 20 percent higher than the cost of living in India, it may choose to increase the compensation of its Indian employees by 20 percent for the median employee calculation. If the median employee turns out to be an employee in India, then that employee’s annual total compensation for the pay ratio disclosure would be increased by 20 percent as well. In such a case, the registrant must identify the median employee’s jurisdiction, briefly describe the adjustments made in identifying the median employee and calculating the median employee’s annual total compensation, describe the measure used as the basis for the adjustment and disclose the median employee’s unadjusted annual total compensation and the resulting unadjusted pay ratio.

- May compensation be annualized for purposes of these calculations? Yes, a registrant may annualize the compensation for all permanent employees who were employed for less than the full year, but the registrant may not make a full-time equivalent adjustment for any employee. For example, if a part-time employee who works 20 hours per week is hired halfway through the fiscal year, that employee’s compensation may be annualized (as if he or she were employed for the entire year), but the annualized compensation will still be determined at 20 hours per week. The compensation of employees in seasonal or temporary positions may not be annualized.

- May a registrant change its methodology from year to year? Yes, but any change in methodology, material assumptions, adjustments or estimates from the prior year must be disclosed. If the effect of the change is significant, the registrant must describe the change and its reason for making the change. The registrant must also indicate whether it has started or stopped using cost-of-living adjustments.

- How often must a registrant identify its median employee? While the pay ratio disclosure is required every year, the final rules generally allow a registrant to use the same employee as its median employee for a period of three years, as long as there have been no changes in employee population or employee compensation arrangements that would, in the reasonable belief of the registrant, result in a significant change to its pay ratio disclosure. If the registrant decides to use the same median employee as in the prior year, it must disclose that it is doing so and briefly describe the basis for its reasonable belief that no significant changes have occurred. If it is no longer appropriate for the registrant to use the median employee identified in year one as the median employee in years two or three because of a change in the original median employee’s circumstances that the registrant reasonably believes would result in a significant change in its pay ratio disclosure, the registrant may use another comparable employee. For example, assume the median employee for year one is a shop manager making $40,000 per year and that he or she is fired or receives a significant pay raise in year two. Rather than running through the entire process of determining a new median employee, the registrant may be able to select as the new median employee another shop manager who had approximately the same pay as the original median employee.

Effective Date

The new rules will be effective on October 19, 2015, but compliance is not required until the registrant’s first fiscal year beginning on or after January 1, 2017. Accordingly, most registrants will not make pay ratio disclosures until their proxy statement for their 2018 annual meeting. However, due to the complexity of the rules, registrants are encouraged to start evaluating the various methods of identifying their median employee and to run some preliminary calculations in order to determine their pay ratios and to get a feel for what their disclosure will look like.

Status of Other Dodd-Frank Rules

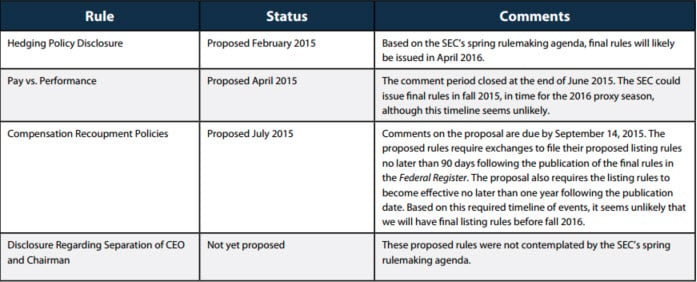

While the SEC has issued final rules implementing many of Dodd-Frank’s compensation-related components, such as say on pay advisory votes and compensation committee adviser independence, many remain outstanding, as highlighted in the chart below.

This advisory is published by Alston & Bird LLP’s Securities practice area and Employee Benefits & Executive Compensation practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.