On June 27, 2016, the U.S. Securities and Exchange Commission (SEC) issued proposed rules that would significantly increase the current public float and revenue thresholds that registrants must meet in order to qualify as a smaller reporting company (SRC).[1] If adopted, the proposal would increase the number of registrants that qualify as SRCs and thus are eligible to take advantage of certain scaled disclosure requirements for SRCs under Regulation S-K and Regulation S-X of the Securities Exchange Act.

What are the Current Smaller Reporting Company Thresholds?

Currently, SRCs generally are registrants with either:

- Less than $75 million in public float as of the last business day of their most recently completed second fiscal quarter, or

- Zero public float and annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available.

What are the Proposed Smaller Reporting Company Thresholds?

The proposed rules would increase these thresholds to:

- Less than $250 million in public float as of the last business day of their most recently completed second fiscal quarter, or

- Zero public float and annual revenues of less than $100 million during the most recently completed fiscal year for which audited financial statements are available.

As with the current definition, a registrant that is filing its initial registration statement will calculate its public float as of a date within 30 days of filing the registration statement.

How does a Non-Smaller Reporting Company Qualify as a Smaller Reporting Company at a Later Date?

Under the proposed rules, a company that has determined that it does not qualify as an SRC will remain unqualified until its public float is less than $200 million on the last business day of its most recently completed second fiscal quarter. For zero public float companies, under the proposed rules, the company will remain unqualified until its annual revenues are less than $80 million for its most recently completed fiscal year.

How do the Proposed Amendments Affect the Definitions of “Accelerated Filer” and “Large Accelerated Filer?”

The proposed amendments do not change the public float thresholds that determine when a registrant would qualify as an accelerated filer or a large accelerated filer. However, the proposed amendments would eliminate the provision in each definition that specifically excludes registrants that qualify as SRCs. As a result, the proposed amendments would preserve the current thresholds for accelerated filers and large accelerated filers.

Therefore, if a registrant has a public float between $75 million and $250 million, even though it would qualify as an SRC under the proposed rules for purposes of the scaled disclosure requirements, it would still be a large accelerated filer or accelerated filer, as applicable based on the registrant’s public float. These registrants will still have to comply with (i) the accelerated filer deadlines for their periodic reports, and

(ii) the requirement to provide an auditor’s attestation of management’s assessment of internal controls over reporting (as required by Section 404(b) of the Sarbanes-Oxley Act of 2002).

What Scaled Disclosure Accommodations are Available to Smaller Reporting Companies?

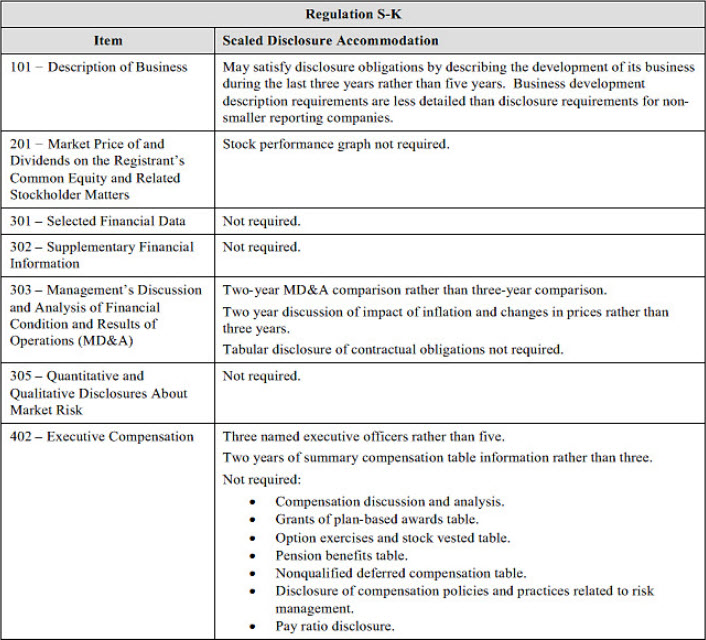

SRCs have the option of providing less disclosure in certain areas than other registrants. Some of the scaled disclosure options provide shorter time periods for certain disclosure items required under Regulation S-K, such as a three-year description of the development of the company’s business instead of five and covering a two-year period in Management’s Discussion and Analysis (MD&A) and the summary compensation table as opposed to three years for non-SRCs.

Additionally, certain items are not required at all for SRCs, including:

- A stock performance graph

- Selected financial data

- Supplementary financial information

- Quantitative and qualitative disclosures about market risk

- Compensation discussion and analysis

- Various tables related to compensation

- Policies and practices related to risk management

- The new pay ratio disclosure

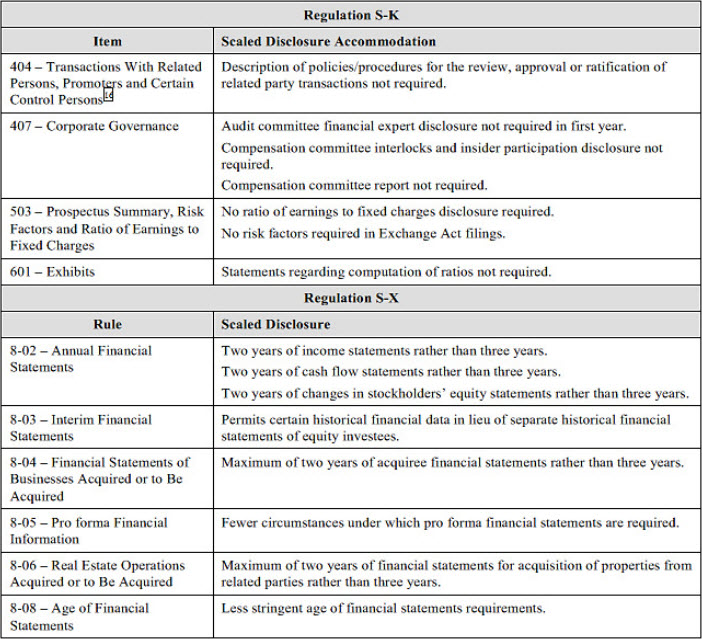

- Policies/procedures regarding related party transactions (although SRCs are still required to disclose related-party transactions that occurred in the past two years in their proxy statement)

- Compensation committee interlocks

- Compensation committee report

- Ratio of earnings to fixed charges

- Risk factors

In addition, under Regulation S-X, financial statements are only required for two years for SRCs rather than three years for non-SRCs. There are also fewer circumstances under which pro forma financial statements are required and less stringent requirements for the age of financial statements. A table summarizing the scaled disclosure under Regulation S-K and Regulation S-X is provided below.

Looking Forward

If adopted, the proposed amendments to the definition of an SRC would increase the number of registrants that are eligible to take advantage of scaled disclosure requirements. Companies should calculate their public float as of the end of their second fiscal quarter, June 30, 2016 for calendar year companies, to determine whether they would qualify as an SRC in the upcoming year if the rules are adopted as proposed. Companies may comply with scaled disclosures on an item-by-item basis, and those who meet the new proposed thresholds may begin analyzing how to best implement the scaled disclosure requirements. These scaled disclosures may reduce compliance costs and generate cost savings for newly eligible SRCs.

Scaled Disclosure Under Regulation S-K and Regulation S-X

[1] The SEC release announcing the proposed amendments is available at https://www.sec.gov/rules/proposed/2016/33-10107.pdf

This advisory is published by Alston & Bird LLP’s Securities practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.