On Friday, July 7, 2017, the Consumer Financial Protection Bureau (CFPB) finalized most proposed revisions to the Truth in Lending Act (TILA) and Real Estate Settlement Procedures Act (RESPA) Integrated Disclosure Rule (the “TRID Rule”) that the CFPB proposed on July 29, 2016. In the adopting release, the CFPB stated that the final rule “memorializes the Bureau’s informal guidance on various issues and makes additional clarifications and technical amendments.” At the same time, the CFPB issued a proposed rule addressing the “black hole” issue.

Overall, the final TRID Rule clarifies a large number of ambiguities in the original TRID Rule, which should significantly reduce potential lender and assignee liability due to varying interpretations currently in the marketplace. These interpretations often differed from lender to lender and carried the prospect of a court later determining that only one or a handful of them were actually permissible. For example, the Rule clarifies calculations and provides tolerances for the total of payments (TOP) disclosure. Errors involving this material disclosure pose TILA statutory damages and rescission risk. These types of risks should be substantially curtailed going forward once clarifications in this Rule are properly implemented.

There are still a handful of larger issues that remain. Most notably, the CFPB did not resolve the “black hole” revised closing disclosure (CD) timing issue. On the other hand, the CFPB also did not finalize a proposal that would have increased costs on industry by imposing a 0% tolerance requirement on fees for services the borrower was permitted to shop for when the settlement service provider list (SSPL) was not provided. The text in the original version of the Rule is clear enough to indicate that the 10% tolerance should be imposed (whether or not the CFPB originally intended this result). Reducing the tolerance to 0% would arguably have constituted a new rulemaking that did not properly track the administrative process for increasing economic burdens on industry.

The Rule also introduces new interpretations that run counter to long-standing policies. For example, the Rule permits comparing the final CD to the first loan estimate (LE) for tolerance comparison purposes instead of to intervening LEs or CDs. In other words, the final Rule would permit originators to potentially engage in bait and switch activities. In practice, this could look like a $1,000 origination fee disclosed on the initial LE. When the consumer comes back with a better offer from a competitor, the lender could counter with a $0 origination fee on a revised LE. At closing, the lender could then switch back to a $1,000 origination fee all the while remaining in compliance with TRID. (We strongly recommend against lenders engaging in this practice given that federal and state unfair, deceptive, or abusive acts or practices (UDAAP/UDAP) laws would still very much be in play).

We expect there may be additional clarifications and cleanup when the black hole proposed rule is finalized.

Effective Date

Mandatory compliance with the requirements of the Rule is October 1, 2018. However, compliance is optional within 60 days of the Rule being published in the Federal Register. Given that the CFPB characterized many provisions of the Rule as clarifying existing text of Regulation Z, it seems that continuing with noncompliant practices until October 1, 2018, could create uncertainty around whether the Rule was actually violated. In practice, the October 1, 2018, mandatory compliance date may be somewhat illusory. Presumably, the CFPB would be loath to bring enforcement actions against lenders acting in good faith when engaging in disclosure practices that weren’t clearly a violation under the original TRID Rule until the October 1, 2018, mandatory compliance date when they clearly become a violation.

Final Clarifications and Highlighted Variations from the Proposal

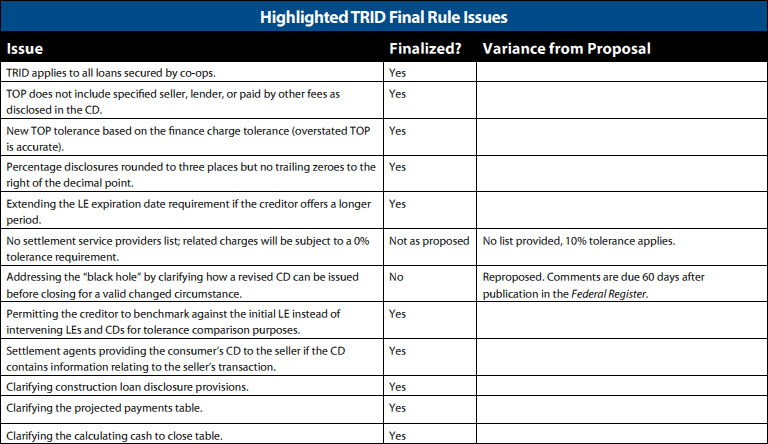

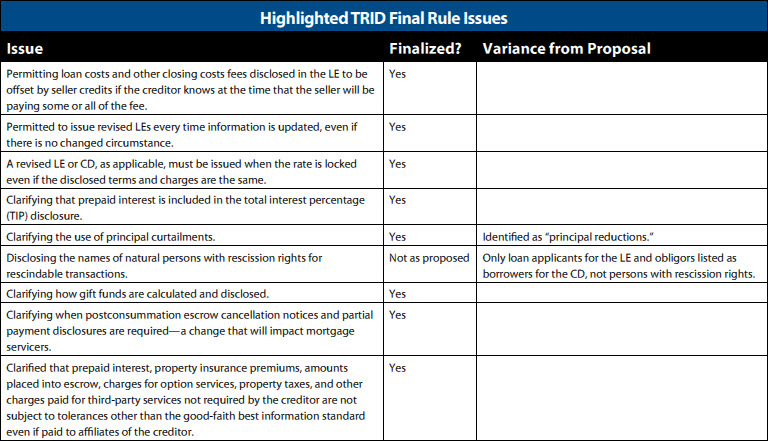

The CFPB finalized a substantial number of clarifications that were proposed. The following chart illustrates select issues finalized by the CFPB and a few notable final rule variations from the proposed rule.

Will This Rule Withstand the Congressional Review Act?

We doubt there would be any serious challenge by Congress to this Rule via the Congressional Review Act. The Rule should reduce overall uncertainty (and potential costs) with regulatory enforcement and private civil liability. Moreover, the CFPB issued a final arbitration rule on July 10, 2017, that will certainly garner more congressional scrutiny than this TRID cleanup rule.

What to Do About the Black Hole[1] for Now?

Before the issuance of the final Rule, creditors could arguably issue CDs more than four days before closing and issue a revised CD within three days of a valid changed circumstance based on several provisions in the Rule, written CFPB implementation guidance, and the text of the proposed cleanup TRID Rule. However, in the final TRID Rule, when the CFPB referenced the black hole proposal, the CFPB also stated:

As noted above and described in the proposal, proposed comment 19(e)(4)(ii)-2 was intended to clarify that the reference to Closing Disclosures required by § 1026.19(f)(1) in existing comment 19(e)(4)(ii)-1 refers to both the initial Closing Disclosure required by § 1026.19(f)(1) and to any corrected Closing Disclosures provided pursuant to § 1026.19(f)(2). Although the Bureau recognizes that the text of proposed comment 19(e)(4)(ii)-2 could plausibly be interpreted as also removing the existing four-business day limit for providing corrected Closing Disclosures to reset tolerances, the preamble to the proposal does not describe that the Bureau intended such a change.

… In particular, the Bureau recognizes that the current rules may lead to circumstances under which creditors might be unable to provide revised estimates for purposes of resetting tolerances where the Closing Disclosure has already been provided and there are four or more days between consummation and the time the revised version of the disclosures is required to be provided pursuant to § 1026.19(e)(4)(i). The Bureau believes, however, that before finalizing a rule that addresses this issue it is advisable to propose more explicit language and to seek comment so that stakeholders who understood the proposal in accordance with the Bureau’s intent will have the opportunity to provide their perspectives on this issue.

This language appears to indicate that the CFPB never expressly and formally intended for creditors to be permitted to issue initial CDs four days or more before closing and issue revised CDs if there is a changed circumstance outside of the three days before the closing window. This casts doubt on some current interpretations based on all written regulation and guidance that creditors are not expressly prohibited from issuing and revising CDs four or more days before closing until the black hole proposed rule is finalized to permit this approach.

On the other hand, this language is also part of a proposed rule and therefore does not carry the same precedential value as a final rule. Issuing initial CDs more than four days before closing and revising them based on changed circumstances outside of the three days before the closing window could still arguably follow the same interpretations based on such written materials until the proposal is finalized. After all, the current text of the Rule and commentary do not explicitly say an initial CD must be provided no more than three days before closing. The commentary is also written in a fashion that illustrates issuing a revised CD as an example to address circumstances when there are less than four days before closing, the creditor has already issued the initial CD, and the creditor therefore has no alternative but to use a revised CD in lieu of an LE. That is, the plain text of the regulation and comment could reasonably be interpreted as not an express prohibition or timing restriction on issuing revised CDs beyond the three-day window if an initial CD has already been provided.

Hurricane season is just around the corner—for a rule to mandate that lenders must choose to either walk away from a loan or bear the cost of all additional inspections and appraisals when closings are delayed by a week or two for circumstances beyond the control of the lender would be unprecedented. Or, consider that consumers may need to delay closing for various reasons; in those cases lenders must also bear the costs or walk away if the economics of the transaction are no longer feasible. It’s also questionable whether the CFPB properly considered all of these potential costs as a basis for the narrow three-day CD revision window interpretation when promulgating the original TRID Rule in the first place.

The concurrent proposal issued with the TRID final Rule states that “under the current proposal, creditors could use either initial or corrected Closing Disclosures to reflect changes in costs for purposes of determining if an estimated closing cost was disclosed in good faith, regardless of when the Closing Disclosure is provided relative to consummation.” If finalized as proposed, this would undoubtedly clarify the issue once and for all and benefit both consumers and industry.

Even with this open issue, the Rule is a welcome outcome that should greatly help to reduce creditor and assignee liability.

[1] The “black hole” issue, as generally described, arises when lenders have issued an initial CD, a changed circumstance occurs but there are more than three days left before closing. Some interpret the TRID Rule to only permit revised CDs, which reset the benchmark for tolerance comparison purposes, to be issued only when the initial CD has been provided within four days of closing.