On January 30, 2020, the Board of Governors of the Federal Reserve System adopted a final rule that revises the “controlling influence” framework for determinations of “control” as set forth in the Board’s Regulation Y (Bank Holding Companies and Change in Bank Control) and Regulation LL (Savings and Loan Holding Companies). The new rule becomes effective on April 1, 2020, without any grandfathering or phased implementation.

As we have previously noted, this is a significant development for banking organizations, their investors, and those that seek equity investments from banking firms. We see numerous benefits from the Board’s final rule, including:

- Providing private equity and other investors in banks and bank holding companies1 with significantly greater deal certainty about when an investment is noncontrolling, avoiding or mitigating regulatory burdens.

- Easing friction in capital-raising transactions.

- Reducing “gray areas” when banking institutions wish to make noncontrolling equity investments in nonbanking companies, particularly those they have business relationships with.

- Mitigating the “Hotel California” problem for investors that desire to exit a regulated control relationship.

Importantly, we note that over the years many investors, including banking organizations themselves, have taken a position on their investments without obtaining nonobjection from the Federal Reserve. Or investors have agreed to passivity commitments to avoid a determination of control, which may no longer be necessary in light of the new rule. In either situation, we suggest that a fresh review of existing investments may be warranted.

Background on the Control Framework

A control determination by the Board effectively determines whether a company that invests directly or indirectly in a depository institution is a bank holding company under the Bank Holding Company Act of 1956 (BHC Act) or a savings and loan holding company under the Home Owners’ Loan Act of 1933 (HOLA), subjecting that company (and its affiliates) to activity restrictions, source of strength requirements, capital and liquidity requirements, regulatory reporting, transactions with affiliates rules, and ongoing supervision by the Board. A control determination also affects the regulatory framework for a banking organization investing in a nonbank firm and can affect the ability of a company to unwind an existing control relationship. While control determinations made under the controlling-influence standard are subject to notice and an opportunity for a hearing, these rights are rarely, if ever, used.

Under the BHC Act, a company has control over a second company if:

(A) the [first] company directly or indirectly or acting through one or more other persons owns, controls, or has power to vote 25 per centum or more of any class of voting securities of the [second] company;

(B) the [first] company controls in any manner the election of a majority of the directors or trustees of the [second] company; or

(C) the Board determines, after notice and opportunity for hearing, that the [first] company directly or indirectly exercises a controlling influence over the management or policies of the [second] company.

While the first two tests are generally bright-line rules, the controlling-influence test in particular has been left to interpretation by the Board, considering a range of factors of control, and has been subject to sometimes changing and unpublished guidelines, often assessed case by case. The final rule is meant to increase the transparency and consistency of the Board’s determinations in particular under this controlling-influence test.

Controlling-Influence Presumptions

On May 14, 2019, the Board published a proposed controlling-influence framework rule and solicited public comment. In the final rule, the Board determined to reject or to postpone consideration of many of the comments requesting changes to the rule and adopted a final rule that was largely unchanged. For additional discussion of the proposed rule, please refer to our earlier advisory.

The final rule adopts the proposed rule’s tiered framework of presumptions of control based on the percentage of voting shares in a company and other indicia of control, including: (1) a company’s voting and nonvoting equity investment in a second company; (2) a company’s rights to director and committee representation in a second company; (3) a company’s use of proxy solicitations to shareholders of a second company; (4) management, employee, or director interlocks between the companies; (5) covenants or other agreements that allow a company to influence or restrict management or operational decisions of a second company; and (6) the scope of the business relationships between the companies.

In line with current Board practice, the thresholds set forth under the final rule create presumptions only and will not determine whether control exists; however, the Board reiterated in the final rule that it would not expect to find a controlling influence unless a presumption was triggered. While the Board still retains its discretion to determine control, this is a notable change from current practice. Also, in the final rule, the Board notes that while certain relationships may not trigger a control presumption, the Board may otherwise limit relationships for safety and soundness reasons.

The Board provided the chart below to further detail the tiered framework of presumptions of control:

The Board changed the tiered framework chart only slightly from that in the proposed rule.

Business relationships

The proposed rule considered the percentage of revenue or expenses of both the second company and the first company. The final rule only includes thresholds based on revenues and expenses of the second company. This change was made based on the Board’s determination that “the significance of business relationships from the perspective of a first company is not necessarily indicative of the first company’s ability to control a second company.” The Board also noted that companies should utilize generally accepted accounting principles (GAAP) financials for the previous year when analyzing business relationships. The final rule provides more freedom of operation for business relationships between an investor and the second company.

Total equity

The proposed rule also created a presumption of control under the BHC Act when a company owned 15 percent to 24.99 percent of a class of the second company’s voting stock and held 25 percent or more of the second company’s total equity. In the final rule, the Board simplified its total equity presumption under the BHC Act so that a company will be presumed to control a second company when the first controls one-third or more of the total equity in the second company. This adjustment reflects the Board’s determination that nonvoting equity should not be capped at the same 25 percent voting securities level that the BHC Act identifies as control.2

Other Notable Aspects of the Final Controlling-Influence Rule

Passivity commitments

Historically, investors taking voting stakes of 10 percent or more (and in some cases 5 percent or more) in a bank or bank holding company could avoid a determination of control if they accepted certain “passivity commitments.” These commitments form a binding, enforceable obligation under law and include certain restrictions on further investment, board representation, management interlocks, proxy solicitations, and business relationships, among other factors. In the final rule, the Board stated that it “does not intend to obtain the standard-form passivity commitments going forward in the ordinary course,” but “will continue to obtain control-related commitments in specific contexts, such as commitments from employee stock ownership plans and mutual fund complexes, and in special situations.” Additionally, the Board indicated that companies subject to the standard form of passivity commitments may now contact the Federal Reserve to seek relief from the commitments and that the Board will be “receptive” to such requests.

Presumption of noncontrol

Reflecting a change from current practice, which sets a 5 percent bar, the final rule expands a presumption of noncontrol if a company controls less than 10 percent of every class of voting securities and does not otherwise exhibit any of the applicable presumptions of control.

Fed math

The final rule codifies the Board’s method for calculating the number of shares held by an investor, which would count all shares that an investor would hold upon the exercise of options and warrants, commonly referred to as “Fed math.” The rule provides an important exception for antidilutive preemptive rights and similarly designed options or warrants that simply allow an investor to acquire additional voting securities to maintain the investor’s percentage share. Additionally, the Board included another exception for preferred securities that are nonvoting unless the issuer fails to pay dividends for six or more quarters. The securities are then only considered voting securities when the holder is entitled to exercise such rights.

Calculating total equity

The final rule sets a standard for determining an investor’s total equity ownership in a stock corporation that prepares financial statements under GAAP by implementing a three-step process: (1) calculate the total percentage of each class of voting and nonvoting common or preferred stock in the second company that the investor owns (generally including options, warrants, and other rights to acquire shares); (2) multiply the amount by the value of shareholders’ equity allocated to the class of stock under GAAP; and (3) divide the amount calculated under the second step by the total shareholders’ equity of the second company under GAAP. The final rule includes a technical correction to the total equity formula in the proposed rule so that classes of preferred securities of the same seniority in liquidation are treated as a single class. Finally, the rule describes instances when debt may be considered functionally equivalent to equity (and in limited cases, the obverse) for purposes of calculating total equity.

Nonvoting limited partnership and LLC member interests

The rule provides clarity that a limited partnership or membership interest may be considered nonvoting even if the interest includes a defensive voting right to remove a general partner or managing member for cause, or to approve a replacement general partner or managing member who has been removed for cause or has become incapacitated, and the right to vote to dissolve the company or to continue operations following the removal of a general partner or managing member.

Reducing the Hotel California problem

The final rule significantly revises the current “tear-down” rule, which historically applied a stricter standard and required a reduction in voting control to 5 percent or less. Under the final rule, assuming the divesting company does not trigger any other presumption of control, a divesting company could choose between: (1) divesting to below 15 percent; or (2) divesting to between 15 percent and less than 25 percent for a period longer than two years (at which time the divesting company will no longer be presumed to control the second company). The Board also clarified that under these divestiture presumptions, the first company will not be presumed to control a second company if 50 percent or more of the outstanding securities of each class of voting securities of the second company is controlled by a person that is not a senior management official or director of the first company or by a company unaffiliated with the first company.

Investment funds

Apparently in response to the many comments and questions the investment company proposal raised, the final rule eliminates the proposed rule’s exception from presumptions of control for registered investment companies. The final rule, however, retains the proposed rule’s presumption of control when a first company serves as an investment adviser to an investment fund and the first company controls 5 percent or more of any class of voting securities of the investment fund or 25 percent or more of the total equity. This control presumption does not apply if the investment adviser organized and sponsored the investment fund within the preceding year. This provision is meant to allow the investment adviser to avoid triggering the presumption of control during the initial seeding period of the fund.

Limiting contractual rights

The final rule includes nonexclusive lists of examples of “limiting contractual rights” as well as structures and terms not considered limiting contractual rights. The rule also retains the exclusion for limiting contractual rights in the context of a pending merger to ensure that the target company operates in the ordinary course while the merger is pending.

Proxy solicitation

The final rule does not include a presumption of control for a company that controls 10 percent or more of a class of voting securities of a second company and solicits “issue proxies” presented to the shareholders of a second company. This is distinct from past practice, when the Board raised controlling-influence concerns if a company with control of over 10 percent of a class of voting securities of a second company solicited proxies from the shareholders of the second company on any issue. However, the final rule retains a presumption of control related to soliciting proxies for the election of directors that makes up at least a quarter of the total directors of the second company.

Revises the “5-25 presumption”

The rule revises the long-standing “5-25 presumption” by including it in the definition of a first company’s control of securities more generally and provides for an exclusion for a first company that controls less than 15 percent of each voting class if its principals and their immediate family members control 50 percent or more of each voting class.

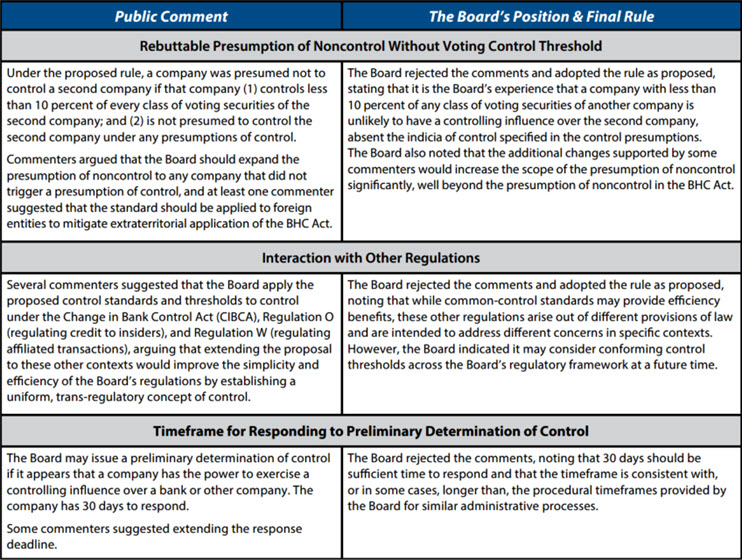

The Board’s Position on Certain Public Comments

We believe that the Board’s determination not to act on certain comments can illustrate the Board’s position on those issues going forward.

Conclusion

We believe that the Board’s final rule should help remove uncertainty in what can be a critical question for those investing in or accepting investments from banking institutions. However, the Board has noted that several aspects of control determinations remain unclear and will require additional attention and revision in the future. We recommend taking these new rules into account when structuring new investments and also reviewing existing noncontrol determinations or positions in light of the new rule and its potential impact.

2 Note that the final rule retains the statutory threshold of control under HOLA when a company contributes 25 percent or more of the capital of a second company.