Many types of credit default swaps (CDS) and interest rate swaps (IRS) are currently subject to mandatory clearing and mandatory execution on a swap execution facility (SEF) or a designated contract market (DCM). Execution of package transactions,[1] however, has presented implementation challenges. As a result, the Commodity Futures Trading Commission (CFTC) previously granted no-action relief postponing the date execution of package transactions on SEFs and DCMs would be required.[2]

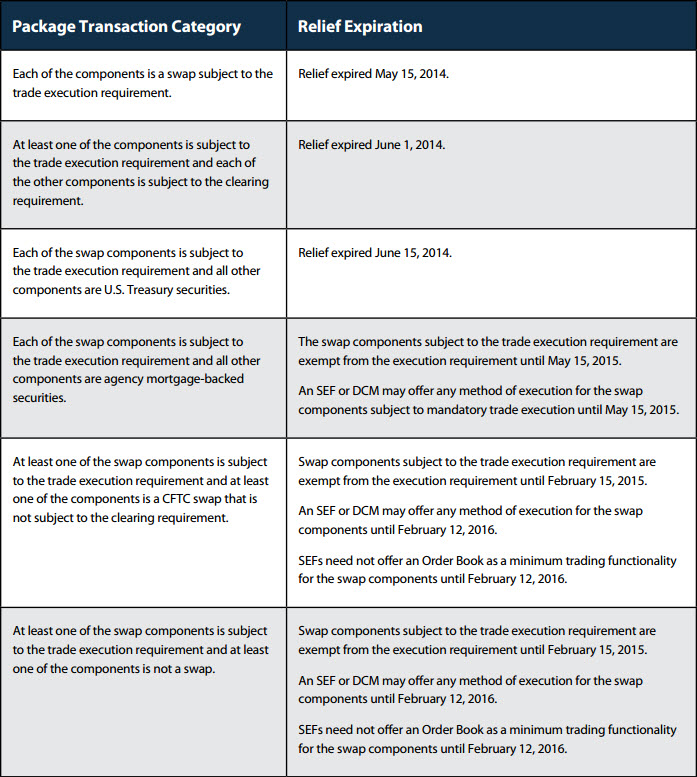

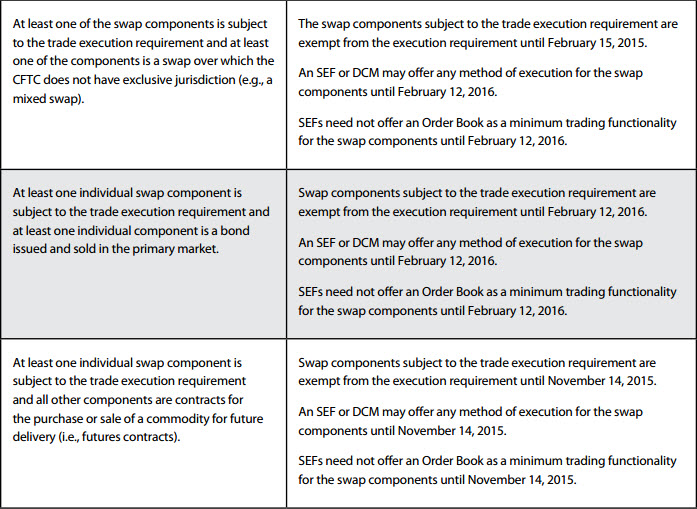

The previous no-action relief has expired for some types of package transactions, and the trade execution mandate must be met for those transactions. For other types of package transactions, the CFTC issued a no-action letter on November 10, 2014, affording market participants additional time to comply with the trade execution mandate, as summarized in the compliance timeline below.[3] For parties to these package transactions, the CFTC is providing additional time to execute package transactions on SEFs or DCMs. For SEFs and DCMs, the CFTC is providing additional time to comply with requirements related to trade execution processes.

[1] A package transaction is “a transaction involving two or more instruments: (1) that is executed between two or more counterparties; (2) that is priced or quoted as one economic transaction with simultaneous or near simultaneous execution of all components; (3) that has at least one component that is a swap that is made available to trade and therefore is subject to the [Commodity Exchange Act] section 2(h)(8) trade execution requirement; and (4) where the execution of each component is contingent upon the execution of all other components.” CFTC No-Action Letter No. 14-62 at 3 (May 1, 2014), available at http://www.cftc.gov/ucm/groups/public/@lrlettergeneral/documents/letter/14-62.pdf.

[2] For a summary of previous no-action relief regarding package transactions, please see http://www.alston.com/advisories/CFTC-package-Transactions/ and http://www.alston.com/advisories/CFTC-involving-swaps/.

[3] To view the CFTC’s press release, please see: http://www.cftc.gov/PressRoom/PressReleases/pr7055-14. To view the CFTC’s no-action letter (Letter No. 14-137), please see: http://www.cftc.gov/ucm/groups/public/@lrlettergeneral/documents/letter/14-137.pdf.

This advisory is published by Alston & Bird LLP’s Financial Services & Products practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.