The 2020 coronavirus pandemic has generated fears of many kinds: fears about the health and well-being of self and loved ones, fears about economic impact and sustenance, fears of short- and long-term disruptions of lifestyle norms. Businesses have experienced particular fears about the threat of legal liability if they become the target of blame for COVID-19 contagion. At the federal and state levels, governments have made efforts to provide protections to businesses that are concerned about COVID-19-related tort liability.

While federal and state protections have been enacted for businesses operating in the epicenter of the pandemic response—for example, health care providers, PPE manufacturers, and biopharmaceutical companies working toward a vaccine or other therapies—what has been done to protect small, medium, and large companies against claims by customers, vendors, contractors, or other non-employees that they contracted COVID-19 in the course of dealing with the business—whether that business is a manufacturing facility, a store, an office, or a warehouse? (Employee claims are generally governed by state workers’ compensation laws and do not fall under the umbrella of general tort claims.)

Federal Business Liability Protections Have Not Passed

Nationwide protections against COVID-19-related liability claims for the general business sector have been the subject of congressional efforts, but have not become law. Congress has previously enacted provisions that affect only the medical industry.

On September 10, 2020, largely along party lines, the U.S. Senate failed to advance a legislative package that included the SAFE TO WORK Act (S.4317). The measure received 52 votes, falling short of the 60 votes needed to advance. Earlier this summer, Senate Republicans put forward the SAFE TO WORK Act, which sponsors believed would promote reopening the economy by providing liability limitations for COVID-19-related exposure injuries. In particular, this legislation would create limitations on personal injury claims against businesses and create limitations on COVID-19-related medical malpractice claims. The bill was designed to apply to small and large businesses; schools, colleges, and universities; religious, philanthropic, and other nonprofit institutions; and local government agencies that have made reasonable efforts to comply with applicable public health guidelines and have not engaged in willful misconduct or grossly negligent behavior. Its features included:

- Creating a federal cause of action for personal injury and medical malpractice laws.

- Establishing exclusive jurisdiction in federal courts and preempting conflicting state laws to promote uniformity across jurisdictions.

- Covering a broad time period by applying to coronavirus-related exposures that take place between December 1, 2019 and October 1, 2024.

- Requiring procedural steps for would-be claimants, including requiring notice of suit and fee arrangement disclosures for class actions.

- Limiting punitive damages to findings of willfulness.

Conventional wisdom is that it is increasingly unlikely that Congress will be able to agree on a legislative package before adjourning for October and most of November. After the election, Congress will return in late November for the start of a lame duck session, which will provide the next opportunity for Congress to agree on federal legislation addressing coronavirus liability.

About Half of U.S. States Have New or Pending Protections

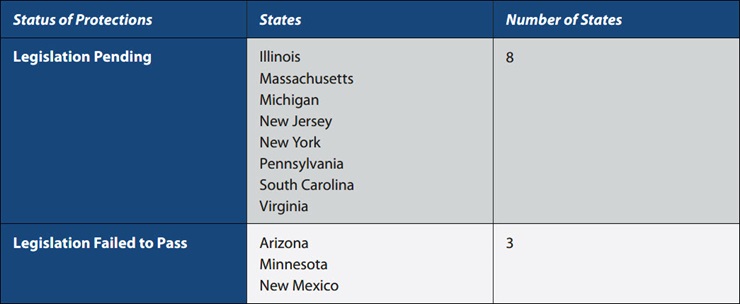

Our ongoing nationwide review reflects that just under half of U.S. states—22 to be exact—have either enacted, or are trying to enact, special measures to protect businesses against COVID-19-related tort claims. Here is a summary of the current status of those efforts:

*Requires affirmative notice or posting by company

While the protective measures vary from state to state, we have observed the following features:

- Many of the protections extend immunity against COVID-19 transmission claims so long as the business is in “substantial compliance” or making a “good-faith” effort to comply with federal, state, and local guidelines for the prevention of coronavirus transmission.

- As would be expected, all states that have passed immunity legislation have explicitly or implicitly carved out an exception for instances of willfulness, recklessness, gross negligence, and other forms of heightened culpability above mere negligence.

- While most states have sought to enact protections through legislation, one state (Alabama) has instead taken executive action via a gubernatorial proclamation.

- Proposed legislation has failed in three states (Arizona, Minnesota, and New Mexico).

Importantly, two states have passed protective measures that require affirmative notice measures by businesses: Georgia and North Carolina.

- Georgia’s unique statute, the Georgia COVID-19 Pandemic Business Safety Act, creates a rebuttable presumption of assumption of risk by any person entering the premises of a business, but only if the business has given a specified warning to visitors via a receipt or ticket or signage. For that reason, uniform warning signs have become ubiquitous at the entrances of Georgia commercial establishments.

- North Carolina’s notice requirement is less defined. Nonessential businesses shall not be liable for a claim related to contraction of COVID-19 so long as the business has provided “reasonable notice of steps taken to reduce the risk of transmission of COVID-19” on the premises. Commentary to the Act provides no clues for the manner or content of such “reasonable notice,” and courts have not yet had opportunity to interpret and apply the clause.

For companies with operations in Georgia and North Carolina, we advise signage and other forms of notice to bolster available statutory protections. But appropriate signage would be advisable in other states too. The common-law defense of assumption of risk is enhanced with evidence that a visitor was put on notice of known risks.

General Takeaways

Nationwide business protections through a federal statute appear unlikely to pass this year. Therefore, statutory protection will vary from state to state, with some states having no statutory protection at all. But common-law defenses of assumption of risk, lack of causation, and lack of fault will come into play wherever tort claims are asserted, whether COVID-19-specific measures are enacted or not. Therefore, businesses should strive for the following general practices:

- Comply with federal (CDC), state, and local guidelines to the maximum extent possible, and keep records of your plan and execution.

- Communicate to your employees, customers, and vendors the expectations for your premises.

- Consider assumption of risk messaging, even where not required by statute.

- Avoid any conduct that could be interpreted as reckless or grossly negligent.

We are continuing to monitor developments nationwide and will be happy to assist with counseling and advocacy to minimize business risks arising from the pandemic.

Alston & Bird has formed a multidisciplinary response and relief team to advise clients on the business and legal implications of the coronavirus (COVID-19). You can view all our work on the coronavirus across industries and subscribe to our future webinars and advisories.