On November 19, 2020, the Securities and Exchange Commission (SEC) adopted amendments to Regulation S-K in an effort to modernize, simplify, and enhance certain financial disclosure requirements. The amendments are intended to enhance the focus of financial disclosures on material information for the benefit of investors, while simplifying compliance efforts for registrants.

Modernizing Regulation S-K

Eliminating selected and supplementary financial data (Items 301 and 302)

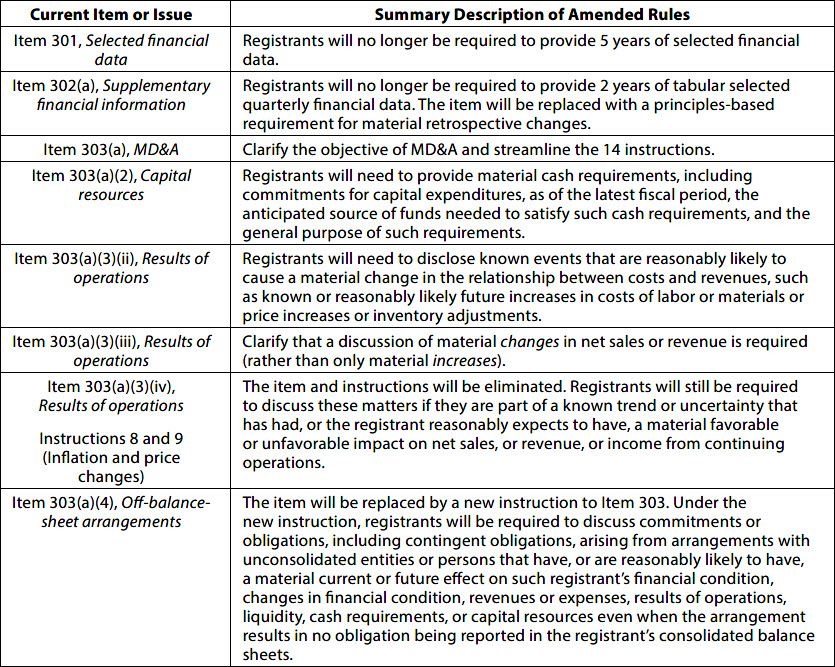

The adopted amendments eliminate the requirements under Item 301 (Selected Financial Data), meaning registrants will no longer be required to provide five years of selected financial data. Similarly, the amended rules eliminate the requirements under Item 302 (Supplementary Financial Information), meaning registrants will no longer be required to provide two years of tabular selected quarterly financial data. The staff found both items to be duplicative and tailored the amendments to focus on information that is material to investors and registrants.

Modifications of MD&A (Item 303)

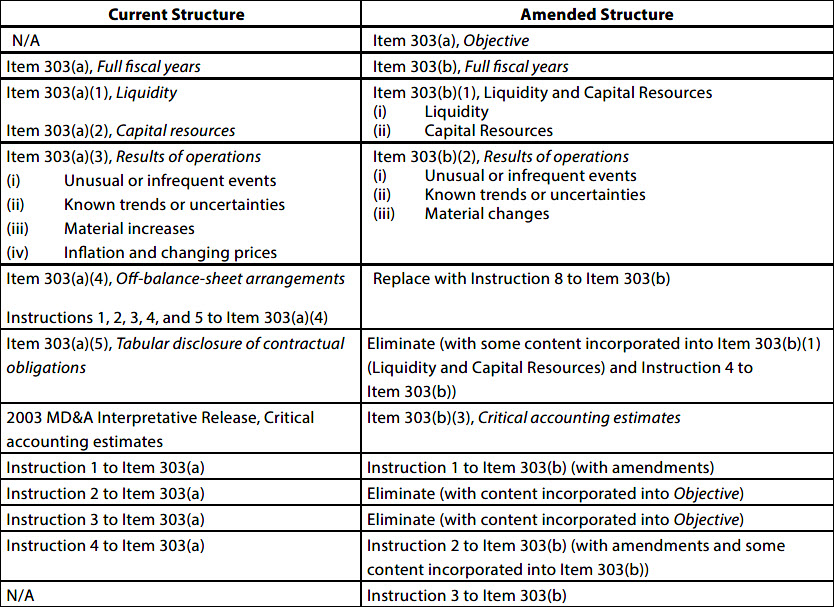

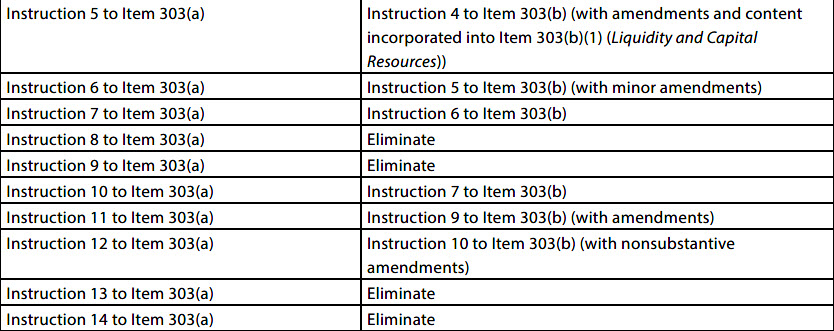

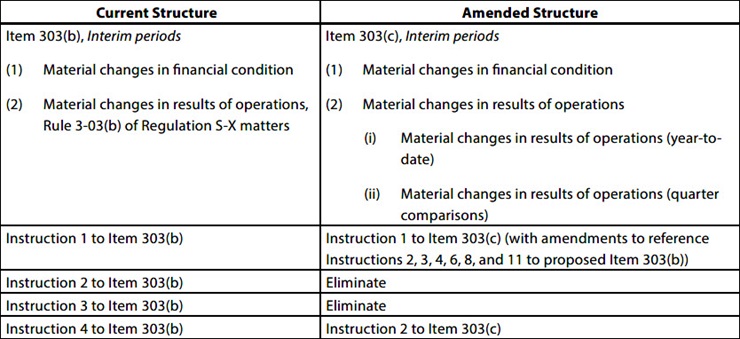

Additionally, the amendments modify the Management’s Discussion and Analysis (MD&A) requirements in Item 303 as follows:

- Item 303(a) includes a new disclosure item, Objective, which requires a registrant to state the principal objectives of its MD&A.

- Item 303(a)(2), Capital resources, requires registrants to provide material cash requirements, including commitments for capital expenditures, as of the latest fiscal period, the anticipated source of funds needed to satisfy such cash requirements, and the general purpose of such requirements.

- Item 303(a)(3)(ii), Results of operations, requires registrants to disclose known events that are reasonably likely to cause a material change in the relationship between costs and revenues, such as known or reasonably likely future increases in costs of labor or materials or price increases or inventory adjustments.

- Item 303(a)(3)(iii), Results of operations, clarifies that a discussion of material changes in net sales or revenue is required (rather than only material increases).

- Item 303(a)(3)(iv), Results of operations, Instructions 8 and 9 regarding inflation and price changes, has been eliminated. Registrants are still required to discuss these matters if they are part of a known trend or uncertainty that has had, or the registrant reasonably expects to have, a material favorable or unfavorable impact on net sales, revenue, or income from continuing operations.

- Item 303(a)(4), Off-balance-sheet arrangements, replaces disclosures with a principles-based instruction to prompt registrants to discuss off-balance-sheet arrangements in the broader context of MD&A. Under the new instruction, registrants will be required to discuss commitments or obligations, including contingent obligations, arising from arrangements with unconsolidated entities or persons that have, or are reasonably likely to have, a material current or future effect on such registrant’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, cash requirements, or capital resources even when the arrangement results in no obligation being reported in the registrant’s consolidated balance sheets.

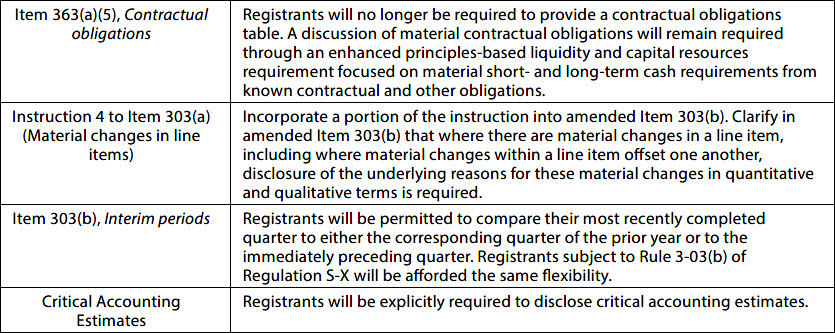

- Item 303(a)(5), Contractual obligations, has been eliminated, including the Tabular disclosure of contractual obligations, which the SEC believes is sufficiently covered in registrants’ financial statements.

- Instruction 4 to Item 303(a) (Material changes in line items), incorporates a portion of the instruction into amended Item 303(b). The instruction clarifies that when there are material changes in a line item, including when material changes within a line item offset one another, disclosure of the underlying reasons for these material changes in quantitative and qualitative terms is required.

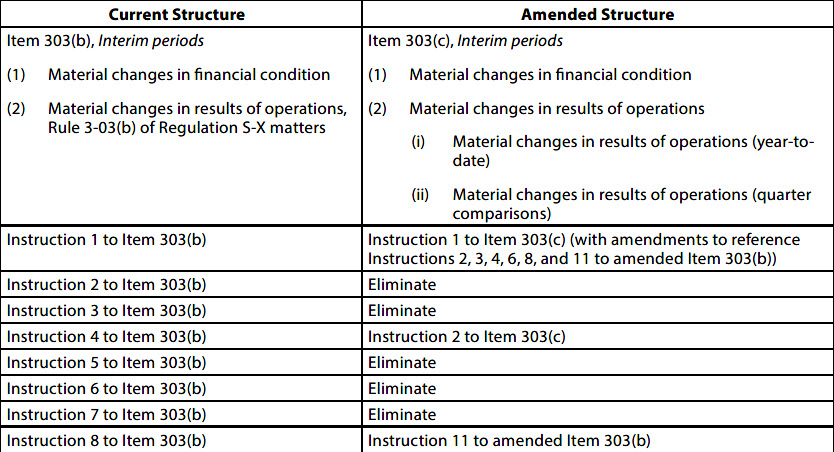

- Item 303(b), Interim periods, permits registrants to compare their most recently completed quarter to either the corresponding quarter of the prior year or to the immediately preceding quarter, rather than just the corresponding quarter of the prior year.

- Item 303(b)(4) includes a new Critical accounting estimate disclosure to help clarify and codify existing SEC guidance in this area.

- Item 303(c), Safe harbor, and Item 303(d), Smaller reporting companies, have been eliminated to be consistent with the elimination of Items 303(a)(3)(iv) and 303(a)(5).

To ensure regulatory consistency, the SEC also adopted certain parallel amendments to the financial disclosure requirements that apply to foreign private issuers, including to Forms 20-F and 40-F. Specifically, Item 3.A of Form 20-F (Selected Financial Data), Item 5 of Form 20-F (Operating and Financial Review and Prospects), General Instruction B.(11) of Form 40-F (Off-Balance-Sheet Arrangements), and General Instruction B.(12) of Form 40-F (Tabular Disclosure of Contractual Arrangements) are being amended to conform to the new requirements of Regulation S-K.

Going Forward

The amendments will become effective 30 days after they are published in the Federal Register. Registrants are required to comply with the rule beginning with the first fiscal year ending on or after the date that is 210 days after publication in the Federal Register. Registrants will be required to apply the amended rules in a registration statement and prospectus that on its initial filing date is required to contain financial statements for a period on or after the mandatory compliance date. Although registrants will not be required to apply the amended rules until their mandatory compliance date, they may comply with the final amendments any time after the effective date, so long as they provide disclosure responsive to an amended item in its entirety.

A discussion of the proposed amendments can be found here.

Summary of the Final Amendments

Overview

Management’s Discussion and Analysis of financial condition and results of operations for Item 303

Final amendments