In this fifth installment of Alston & Bird’s dive into environmental, social, and governance (ESG) finance, we consider green and sustainability-linked bonds (SLBs) in the European high yield market. More specifically, we take a look at some recent high yield bond issuances in Europe that carry the “green” or “sustainability-linked” label to see what green or sustainability-linked high yield bonds look like in the European market; what investors are seeing in the presentation, monitoring, and enforcement of ESG metrics; and what the future may hold in this burgeoning segment of the market.1

What Are Green Bonds?

Green bonds are bond issuances in which the proceeds must be exclusively applied to finance or refinance, in part or in full, new and/or existing eligible “green” projects that promote progress on environmentally sustainable activities.

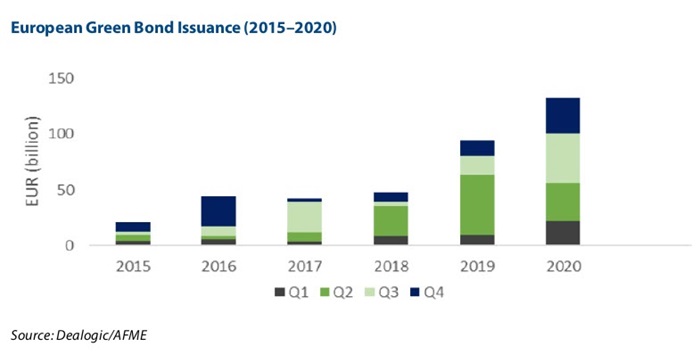

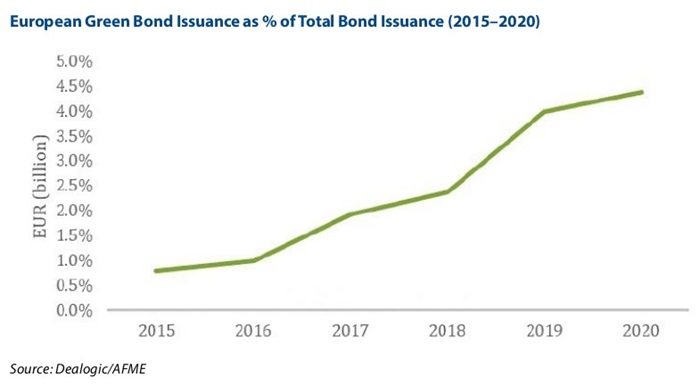

Originally issued by multilateral and supranational lenders such as the World Bank, corporates have over the last few years begun to issue green or sustainability-linked bonds to appeal to ever-more environmentally aware investors and stakeholders. While European green-bond issuance saw a 41% increase in volumes in 2020 (from €94.0 billion in 2019 to €132.5 billion in 2020), there is a long way to go before green bonds can be compared favorably to traditional bonds where, according to Moody’s, issuance volumes by European investment-grade companies topped $893 billion in 2020. Nevertheless, the exponential growth of green bonds is very telling and 2021 is broadly expected to be a bumper year for green and ESG bond issuance.

Currently, four types of “green bonds” are contemplated under the Green Bond Principles (GBP), a set of voluntary process guidelines for issuing green bonds set out by the International Capital Markets Association (ICMA), first introduced in June 2018:

- Standard Green Use of Proceeds Bond: A standard recourse-to-the-issuer debt obligation aligned with the GBP.

- Green Revenue Bond: A non-recourse-to-the-issuer debt obligation aligned with the GBP in which the credit exposure in the bond is to the pledged cash flows of the revenue streams, fees, taxes, etc., and whose use of proceeds go to related or unrelated green projects.

- Green Project Bond: A project bond for a single or multiple green projects for which the investor has direct exposure to the risk of the projects with or without potential recourse to the issuer and that is aligned with the GBP.

- Green Securitized Bond: A bond collateralized by one or more specific green projects, including covered bonds, asset-backed securities, mortgage-backed securities, and other structures; and aligned with the GBP. The first source of repayment is generally the cash flows of the assets.

What Are Sustainability-Linked Bonds?

As opposed to green bonds, sustainability-linked bonds (SLBs) are bonds in which the proceeds of the bonds are not ring-fenced to be applied towards green or sustainable purposes. Instead, SLBs have financial or structural characteristics that vary depending on whether the issuer meets certain predefined key performance indicators (KPIs) that are assessed against certain sustainability performance targets (SPTs).

SLBs may be applied in a general corporate setting or for other purposes; therefore, the use of proceeds is not a determinant in its categorization as an SLB. If an SLB is issued, the issuer will be committing to improvements in the sustainability outcomes of its business within a pre-agreed timeline. SLBs are forward-looking, performance-based instruments. SLBs appeal to companies that want to offer ESG bonds with fewer financial restrictions. Companies issuing SLBs tend to experience lower staffing and administrative costs compared with green bonds. Similarly, companies have more control over the financial benefits of SLBs because the financial benefits of SLBs are in the hands of the issuer.

The growth of SLBs throughout the course of 2020 is enabling more issuers to access the sustainable finance market. Whereas green bonds tend to be issued by issuers with heavy expenditure in the green area (i.e., renewable energy, utilities providers, sustainable construction), corporate issuers that do not rely on green expenditure use the proceeds of an SLB without using such proceeds to fund a green project. Investors are able to get more clarity on their ESG commitments through such an SLB sale, and extra resources will not need to be expended to isolate ESG projects. What will be important to investors is the SLB issuer’s sustainability/ESG strategy and whether or not pre-agreed targets are met through the term of the SLB. This could explain why SLB issuance has grown so sharply during the COVID-19 pandemic, which seems to have heightened awareness of social and sustainability issues.

In a significant developent for the growth of SLBs, in September 2020, the European Central Bank (ECB) announced it would start to accept SLBs as collateral beginning January 1, 2021 and that it could start buying them under its asset purchase programs provided they comply with program-specific eligibility criteria. Although green bonds have featured in the ECB’s asset purchase programs for years, SLBs had not been eligible for them because the central bank considered coupon increases or decreases triggered by an issuer’s sustainability performance as a margin. This has now changed, and the ECB has said the coupons on SLBs must be linked to a performance target referring to one or more of the environmental objectives set out in the EU Taxonomy Regulation and/or one or more of the United Nations’ Sustainable Development Goals relating to climate change or environmental degradation.

The European High Yield Green and Sustainability-Linked Bond Market

Green bonds and SLBs are much more commonly seen in the investment-grade space than in the sub-investment-grade (high yield) space, with issuance volumes of investment-grade green bonds dwarfing sub-investment-grade (high yield) green bonds by a ratio of about 10:1 in the last year alone.

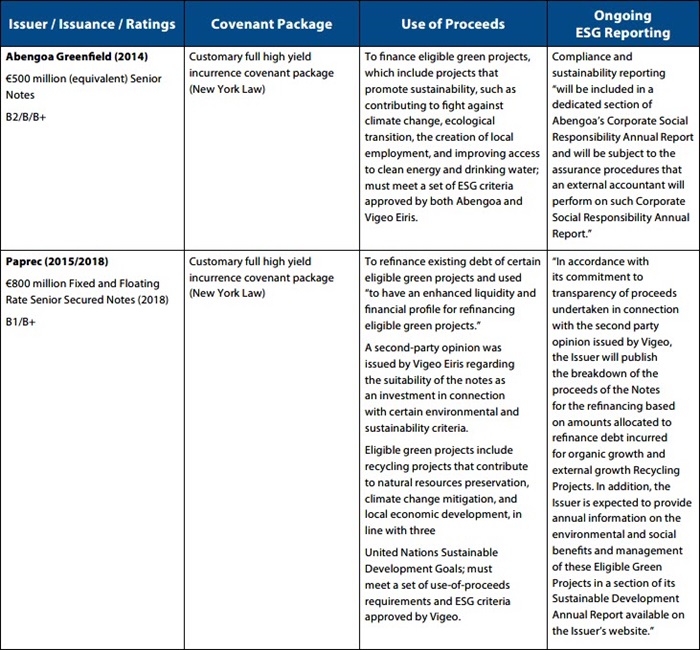

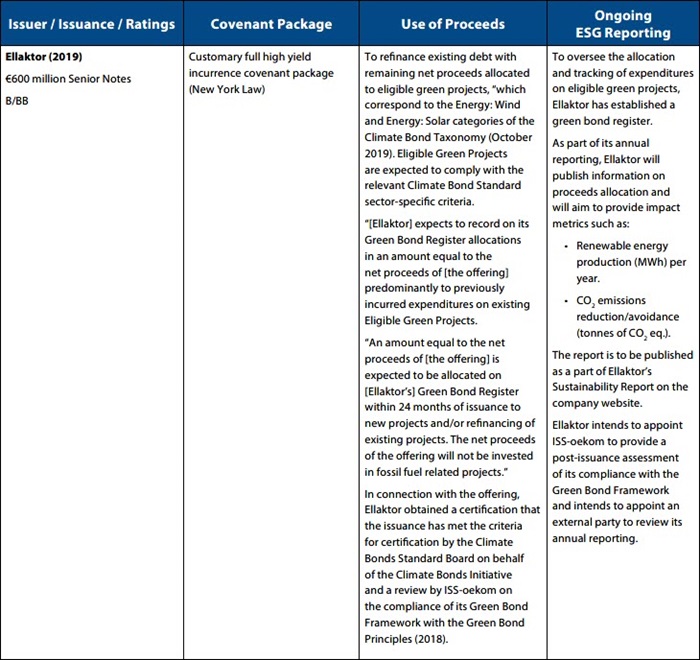

However, since Abengoa Greenfield (a Spanish engineering and clean technology company) issued what is commonly considered to be the first high yield green bond in Europe in 2014, there has been a clearly discernible (albeit relatively modest) growth trend of green or ESG-linked bond issuances in the sub-investment-grade market in Europe. Notable examples of other European high yield green bonds include Paprec (a French waste management services company) in 2018, Ellaktor (a Greek diversified infrastructure group) in 2019, and in 2021, Getlink SE (the Franco-British operator of the Eurotunnel) and Ardagh Metal Packaging (a pan-European packaging materials manufacturer).

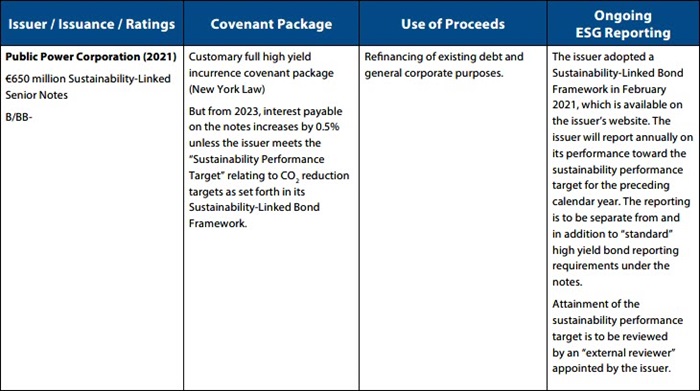

Until recently, only the “standard green use of proceeds bond” has been adopted in the European high yield bond market. This changed with the issuance in March 2021 of Europe’s first sustainability-linked high yield bond by Public Power Corporation (PPC, a Greek electricity supplier) and the proposed sustainability-linked bond offering by Hapag-Lloyd AG (a German shipping company).

This can be contrasted with the remarkable growth of green bonds and SLBs in the wider sustainable debt market, particularly over the last 18 months or so, including during the COVID-19 pandemic. According to Moody’s, the heavy issuance of bonds aimed at tackling the effect of the COVID-19 pandemic pushed the size of the sustainable debt market to a new record through 2020 when companies took advantage of historically low interest rates to shore up cash, and took advantage of new types of debt to demonstrate their social-conscious credentials, as they weathered the pandemic. For 2021, the rating agency forecast that the volume of green bonds will hit $375 billion, jumping by 39% compared with 2020. Indeed, by some estimates, green high yield issuance volume thus far in 2021 has already tripled that of the entire 2020.

Recent European High Yield Green and Sustainability-Linked Bonds

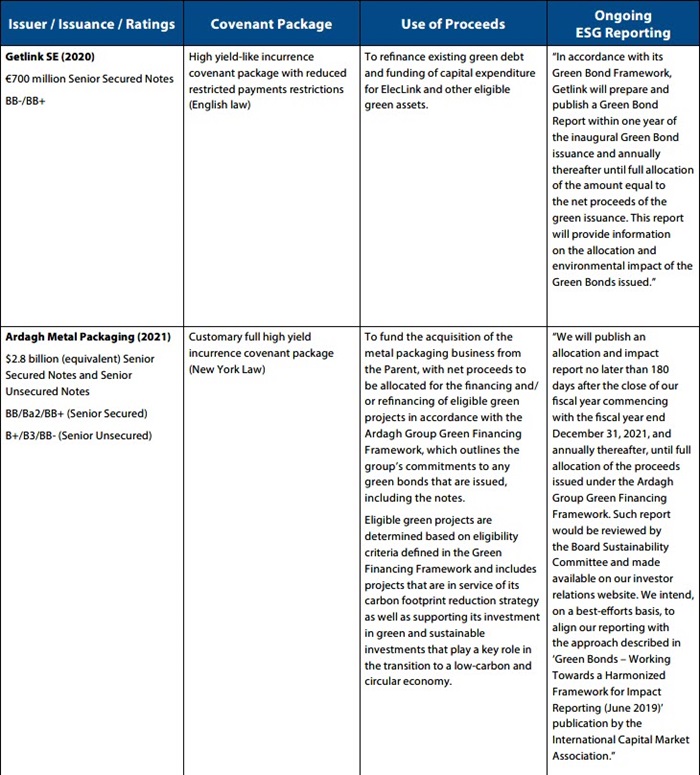

Below is a table highlighting certain key features of recent European high yield green and sustainability-linked bond offerings, as disclosed in the respective bond offering memorandum.

Use of Proceeds and Enforcement

The market has seen “pure” green-bond issuances whose proceeds are earmarked solely for use in funding eligible green projects or refinancing existing green debt (such as in Abengoa, Paprec, and Getlink). There have also been what is sometimes called “striped” green-bond issuances where proceeds are primarily intended for other purposes (such as Ellaktor and Ardagh), with only the remaining proceeds being allocated towards green uses. Even though only a portion of bond proceeds in such deals are linked to green uses, both green and non-green portions trade as a single instrument and the entire bond is considered to be (and supported by second-party opinions as) a green bond.

From a use of proceeds enforcement perspective, what may also be gleaned from the deals discussed here is that there are no clear-cut enforcement mechanisms (short of alleging a misrepresentation in the offering documents) available to investors such as the ability to call a default if the use of proceeds are not as green as had been contemplated by investors at the time of issuance or, worse even, materially deviates from what is described in the offering documents. That being said, both issuers and investors thus far appear to be approaching this developing market in relative good faith, with little evidence of “greenwashing,” where issuers end up deploying capital raised in a green or sustainability-linked bond in non-green or non-ESG-related areas. In fact, most issuers have gone to market with offerings supported by third-party independent opinions (as in the case of Abengoa Greenfield and Paprec), while others have clear disclosure around their self-developed green bond/financing framework within which the bond proceeds are intended to be applied.

While there have been instances of issuances whereby bond proceeds are deposited and held in segregated accounts (which could help facilitate regular independent use of proceeds auditing) or self-monitored and tracked by way of a “green bond register” as in Ellaktor, investors have tended to rely mostly on their own pre-issuance due diligence and post-issuance engagement with issuers to ensure bond proceeds are used as intended and any targeted green KPIs are met. That said, the market is beginning to experiment with more prescriptive structures that tie in more tightly with the green metrics marketed by the issuer, such as that seen in the sustainability-linked bond issued by PPC, whereby investors are entitled to a higher bond coupon if the company fails to meet certain ESG targets.

Presentation of Green Credentials

The table also illustrates some variances in how the “green credentials” of each offering are presented.

For Abengoa, the eligible green projects the net proceeds of its offering are to be applied to include “eligible green projects categories which promote sustainability, such as contributing to fight against climate change, ecological transition, the creation of local employment and improving access to clean energy and drinking water,” where each project must meet a set of ESG criteria “approved by both Abengoa and Vigeo.”

Whereas for Paprec, a second-party opinion was procured from Vigeo on the suitability of the notes as an investment in connection with certain environmental and sustainability criteria, with proceeds from the offering to be used “to have an enhanced liquidity and financial profile for refinancing Eligible Green Projects.” And in the case of Paprec, “eligible green projects” means recycling projects “which contribute to natural resources preservation, climate change mitigation and local economic development, in line with three United Nations Sustainable Development Goals” and must meet a set of use-of-proceeds requirements and ESG criteria approved by Vigeo.

With Ellaktor, Getlink, and Ardagh, the use of proceeds was tied to existing green bond/financing frameworks developed in-house, and which in the case of Ellaktor and Ardagh are summarized and disclosed in the offering memorandum. As for PPC, its sustainability-linked bond framework was developed in-house as well, but it is supported by a second-party opinion from Sustainalytics for alignment with the Sustainability-Linked Bond Principles 2020, as administered by ICMA.

ESG Monitoring and Reporting

What is worth noting about ongoing ESG monitoring and reporting is that the “standard” reporting covenant in high yield bonds (which generally requires audited annual reporting as well as quarterly reporting, material change reporting, and sometimes investor conference calls) has not been modified or extended to specifically cover ESG reporting in any of the deals discussed here. For PPC, it was specifically noted that the reporting on its sustainability performance target will be done outside of its high yield bond reporting regime. And while PPC’s ESG reporting will be reviewed by a third-party assurance or attestation service provider (particularly since a failure to meet its ESG targets will result in a bond coupon ratchet), ESG reporting for most issuers often boils down to not much more than the issuer’s own reporting as part of its corporate social responsibility (CSR) reporting regime.

There are also significant differences between external oversight and ESG reporting. For example, while Abengoa’s reporting was subject to “assurance procedures that an external accountant will perform on” its CSR annual report, and Ellaktor has stated its intention to appoint ISS-oekom to provide a post-issuance assessment of its compliance with the Green Bond Framework and to appoint an external party to review its annual reporting, the others (other than PPC) do not appear to be subject to any ongoing regular or robust independent external party assessments beyond voluntary updates around use of proceeds and green KPIs either in periodic CSR reports or on their websites.

ESG disclosure is an area that will surely change as the high yield green-bond market matures and the wider sustainable debt market develops further consensus and standardization on reporting and performance metrics. It is hoped that industry standards around green/ESG reporting and monitoring will be improved with the introduction in Europe of the Sustainable Financial Disclosure Regulation (EU) 2019/2088 (which requires certain financial market participants and advisors to make disclosures around ESG processes and monitoring) and the Taxonomy Regulation (EU) 2018/0178 (which provides an EU-wide framework for classifying economic activities that can be identified as “environmentally sustainable”). Other signs of the market’s focus on the disclosure aspects of green and sustainable financing can be seen from the publication of ESG disclosure guidelines and fact sheets by industry bodies such as the Association for Financial Markets in Europe (AFME), Loan Market Association (LMA) and European Leveraged Finance Association (ELFA).

Green High Yield vs. Traditional High Yield

While there are some key differences between green or sustainability-linked high yield bonds and traditional high yield bonds, one main area that has not shown much difference between green and non-high yield green bonds is pricing.

Generally speaking, high yield green bonds have not been shown to attract better pricing than “vanilla” high yield bonds, and the same is true of the high-grade market. Some of the reasons proffered for this are that from a credit quality assessment standpoint, there is no clear and immediate justification for adjusting the coupon simply because the use of proceeds are for green (as opposed to other) purposes. At the same time, notwithstanding an investor’s desire to promote ESG initiatives and engage in “impact investing,” they may not be ready to sacrifice real money investment returns for those goals. Adding to the fact that green-bond reporting standards from an ESG point of view generally have been variable, it is not surprising that bond pricings at this point remain very much tied to the underlying credit quality of the issuer, with green KPIs merely being the icing on the cake.

That said, the market is beginning to see offerings whose ESG-related metrics are more closely tied to the economics of the bond. For example, in March 2021, PPC issued Europe’s first sustainability-linked high yield bond. Compared to green bonds, the use of proceeds under this bond is not specifically tied to any green projects. However, the company recently adopted a Sustainability-Linked Bond Framework under which it has committed to a 40% reduction in certain CO2 emissions relative to a baseline. In connection with that commitment, the company incorporated a feature into its high yield bond whereby the interest rate on the bond will ratchet up by 0.5% in 2023 if the company fails to meet these CO2 emission reduction targets.

It will be interesting to see whether new offerings along the same lines as PPC’s will hard-wire more robust ESG-related features into the bond covenant package itself, such as restricting new debt incurrence or investment capacity to financing or investing in green projects, restricting dividend capacity if KPI targets are not met, or mandating redemptions if proceeds are not deployed as intended. It is only when green KPIs move beyond being simply the icing on the cake—i.e., that they actually mean something in terms of covenants that need to be complied with (coupled with more comprehensive and stringent reporting standards)—will green bonds begin to deliver pricing benefits to issuers.

In the meantime, investors are beginning to frame issuer/sponsor-friendly covenant packages as a corporate governance issue (the “G” in “ESG”) and may begin looking to push back on aggressive structures as a means of ensuring a more balanced capital structure from a risk allocation perspective.

Closing Remarks

The investment landscape is changing. With Ardagh Metal Packaging’s $2.8 billion high yield green bond issuance representing the largest high yield green bond issuance in Europe to date, and with Getlink’s offering being strongly oversubscribed, there is clear demand for high yield green bonds and the market is poised for further growth. PPC’s first European sustainability-linked bond was also very well received by the market, resulting in a deal upsize from the originally intended €500 million to €650 million.

Whether any of this growth is the result of the COVID-19 pandemic or not is up for debate. Nonetheless, ESG is becoming an increasingly more important investment decision for companies to consider. It is not only investors that companies need to focus on, it is the increasingly vocal and effective stakeholder community that requires companies that want to come to market (in both the investment and sub-investment-grade space) to be focused on ESG credentials now more than ever before; and with continuing fierce competition among what remains a meagre supply of truly high yield green bonds, it stands to reason that issuers that do not present a green angle to their business to investors might actually find themselves paying a premium to pull capital away from an ESG-centric world.

At some point, we expect investments with an ESG component to become mainstream, and it is those businesses and those investments that have strong ESG metrics that would prosper over those that disregard ESG principles. As more and more examples of good and bad social or governance strategies emerge from the COVID-19 pandemic, investors may increasingly demand, and managers to increasingly become mandated to invest in, ESG products such as high yield green bonds and high yield SLBs alongside more traditional green bonds and SLBs. Investor demand for ESG-related investments such as these will increase as demographics, public opinion on social and justice issues, and the aftermath of the COVID-19 pandemic and climate change continue to evolve.

Alston & Bird is one of the first firms to activate a multidisciplinary ESG Advisory Group made up of lawyers across several practice groups to assist boards of directors and managers of public companies in understanding the evolving ESG landscape.

1 In case you missed it, Part 1 in our Alston & Bird ESG series introduces ESG, considers its impact on the structured finance markets, and considers the implications of the COVID-19 pandemic on ESG. Part 2 considers green loans, the “Green Loan Principles,” and the relevance of green loans to businesses. Part 3 considers sustainability-linked loans, the “Sustainability-Linked Loan Principles,” and how businesses could attract and qualify for a sustainability-linked loan. Part 4 considers green bonds, sustainability-linked bonds, the International Capital Market Association’s Green Bond Principles and Sustainability-Linked Bond Principles and how businesses can take advantage of such principles and qualify for green bonds and sustainability-linked bonds, recognizing that issuance of both has grown sharply following the COVID-19 pandemic. We also considered the European sustainability-related disclosure regime.