On May 14, 2019, the Board of Governors of the Federal Reserve System published for comment proposed rules that would revise the Board’s Regulation Y (Bank Holding Companies and Change in Bank Control) and Regulation LL (Savings and Loan Holding Companies) to clarify the Board’s “controlling influence” framework. This is a significant development for banking firms, their investors, and those that seek equity investments from banking firms. And it is high time. In the Board’s release, the Board’s vice chair for supervision, Randal K. Quarles, stated that “the Board’s control framework has developed over time through a Delphic and hermetic process that has generally not benefited from public comment.” As a result, the controlling-influence test has often frustrated investors and has sometimes hindered capital-raising transactions by introducing significant regulatory uncertainty.

A control determination by the Board can effectively mean that a company that invests directly or indirectly in a depository institution is a bank holding company under the Bank Holding Company Act of 1956 (BHC Act) or a savings and loan holding company under the Home Owners’ Loan Act of 1933 (HOLA), subjecting that company (and its affiliates) to activity restrictions, source of strength requirements, capital and liquidity requirements, regulatory reporting, transactions with affiliates rules, and ongoing supervision by the Board. A control determination can also determine the regulatory framework for a banking entity investing in a nonbank firm and can affect the ability of a company to unwind an existing control relationship. While control determinations made under the controlling influence standard are subject to notice and an opportunity for a hearing, these rights are rarely, if ever, used.

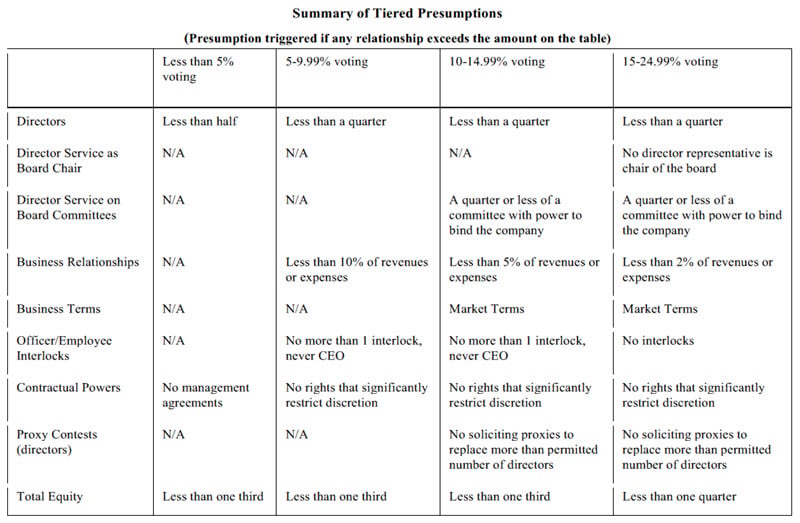

The proposed rules largely consolidate standards found variously in existing regulations, policy statements, orders, interpretive letters, and unpublished “lore” that the Board has followed in making control determinations over the past few decades.1 However, in some cases the proposal also articulates entirely new standards for control determinations. The Board also released a helpful chart (included below) that shows how different combinations of influencing factors may or may not result in a control determination under the proposed rules. Further, the Board has posed numerous questions for public comment, indicating that it may be willing to further refine or expand the scope of the proposed rules.

In our view, numerous benefits can be achieved by the proposed rules, including:

- Providing private equity and other investors in banks and bank holding companies2 with significantly greater deal certainty about when an investment is noncontrolling, avoiding or mitigating regulatory burdens.

- Easing friction in capital-raising transactions.

- Reducing “gray areas” when banking institutions wish to make noncontrolling equity investments in nonbanking companies, particularly those they have business relationships with.

- Mitigating the “Hotel California” problem for investors that desire to exit a regulated control relationship.

While there are aspects of the proposal that clarify and in some cases liberalize the Board’s control framework, there remain open questions and areas of concern that will emerge through the comment process.

Background on the Control Framework

Under the BHC Act, a company has control over a second company if:

(A) the [first] company directly or indirectly or acting through one or more other persons owns, controls, or has power to vote 25 per centum or more of any class of voting securities of the [second] company;

(B) the [first] company controls in any manner the election of a majority of the directors or trustees of the [second] company; or

(C) the Board determines, after notice and opportunity for hearing, that the [first] company directly or indirectly exercises a controlling influence over the management or policies of the [second] company.3

While the first two tests are generally bright-line rules, the controlling influence test in particular has been left to interpretation by the Board, taking into account a range of factors, or “levers” of control, that has been subject to sometimes changing and unpublished guidelines, often assessed case by case.

Tiered Presumptions of Control Framework

The central theme of the proposed rules is establishing a tiered framework of presumptions of control. In general, the tiers are structured to provide for an inverse relationship between the percentage of voting control in another company and the other indicia of control.

The Board has historically used certain indicia of control to determine whether a company exercises a controlling influence over another. Each factor could stand on its own for purposes of making a control determination, or be viewed in combination with other factors. These indicia of control have included: (1) a company’s voting and nonvoting equity investment in a second company; (2) a company’s rights to director and committee representation in a second company; (3) a company’s use of proxy solicitations to shareholders of a second company; (4) management, employee, or director interlocks between the companies; (5) covenants or other agreements that allow a company to influence or restrict management or operational decisions of a second company; and (6) the scope of the business relationships between the companies.

In the proposed rules, applying these factors, the Board provided the chart below to further detail a newly proposed tiered framework of presumptions of control:

It should be noted that, in line with current Board practice, the thresholds set forth under the proposed rules create presumptions only and will not determine whether control exists; however, the Board has noted in the proposed rule that it would not expect to find a controlling influence unless a presumption was triggered. This is a notable change from current practice, under which the Board may find “controlling influence” even in the absence of exceeding a stated presumption of control.

Historically, investors taking voting stakes of 10 percent or more (and in some cases 5 percent or more) in a bank or bank holding company may be permitted by the Board to avoid a determination of control if they accept certain “passivity commitments.” These commitments form a binding, enforceable obligation under law and include certain restrictions on further investment, board representation, management interlocks, proxy solicitations, and business relationships, among other factors.

Oddly, the Board does not explicitly address whether passivity commitments would be eliminated in favor of the tiered framework of presumptions. However, it is arguably the case that the Board would not utilize passivity commitments given its stance that it would not expect to find a controlling influence in the absence of a presumption. It is our expectation that clarification of this issue will draw significant attention in the comment process.

Other Notable Aspects of the Proposed Rule

While not an exhaustive list, we note that the proposed rule also:

- Provides several examples of contractual arrangements that will not give rise to a presumption of control, including rights of first refusal on “market” terms, restrictions that are incidental to loan transactions (such as liens), and limited voting arrangements requiring a current shareholder to vote in favor of a proposed acquisition of the company.

- Clarifies that certain types of contractual investor rights granted by a company that are limited in nature will not result in a control determination, including reporting requirements, restrictions on issuances of new securities, and market-standard “most-favored nation” requirements.

- Codifies the Board’s method for calculating the number of shares held by an investor, which would count all shares that an investor would hold upon the exercise of options and warrants, but provides an important exception for antidilutive preemptive rights and similarly designed options or warrants that simply allow an investor to acquire additional voting securities to maintain the investor’s percentage of the company’s voting securities.

- Sets a standard for determining an investor’s total equity ownership in a stock corporation that prepares financial statements under generally accepted accounting principles (GAAP) by implementing a three-step process: (1) calculate the total percentage of each class of voting and nonvoting common or preferred stock in the second company that the investor owns (generally including options, warrants, and other rights to acquire shares); (2) multiply the amount by the value of shareholders’ equity allocated to the class of stock under GAAP; and (3) divide the amount calculated under the second step by the total shareholders’ equity of the second company under GAAP.

- Significantly revises the current “tear-down” rule (often requiring a reduction in voting control to 5 percent or less) to allow investors seeking to divest control of a second company by either: (1) reducing its voting percentage in any class of securities in the second company below 15 percent (resulting in an immediate divesture of control); or (2) reducing its ownership percentage to less than 25 percent and maintaining that level of ownership for a period longer than two years (at which time the divesting company will no longer be presumed to control the second company).

- Codifies a presumption of control when a first company serves as an investment adviser to a second company that is an investment fund when the first company controls 5 percent or more of any class of voting securities of the second company or 25 percent or more of the total equity capital of the second company, provided that the presumption of control would not apply if the first company organized and sponsored the investment fund within the preceding 12 months (which is meant to allow the first company to avoid triggering the presumption of control over the investment fund during the initial seeding period of the fund).

- Makes an exception from all presumptions of control if the second company is a registered investment company and the relationship between the companies are limited such that: (1) the only business relationships between the company and investment company are investment advisory, custodian, transfer agent, registrar, administrative, distributor, and securities brokerage services provided by the first company to the investment company; (2) representatives of the first company compose 25 percent or less of the board of directors or trustees of the investment company; and (3) the first company controls less than 5 percent of each class of voting securities of the investment company and less than 25 percent of the total equity of the investment company.

Conclusion

We believe that the Board’s proposal is a significant and welcome step in removing uncertainty in what can be a critical question for those investing in or accepting investments from banking institutions.

1 The last formal guidance issued by the Board on control issues was its 2008 policy statement on equity investments in banks and bank holding companies.

2 When we refer to banks or bank holding companies, you can assume that the same standard will generally apply to thrift institutions and savings and loan holding companies.

3 The BHC Act also provides a presumption of noncontrol for a company that owns, controls, or has the power to vote less than 5 percent of any class of voting securities.