On September 12, 2014, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) announced it added seven new entities to the Sectoral Sanctions Identifications (SSI) List pursuant to OFAC’s authority under Executive Order (EO) 13662. Also included in the September 12 announcement were significant changes to the SSI program, including modification of the previous two directives and the issuance of two new directives. The impact of OFAC’s amended and new directives is to create a more complex sanctions regime, requiring additional due diligence for firms dealing with SSI listed entities. This client advisory highlights the substantive changes of OFAC’s new directives.

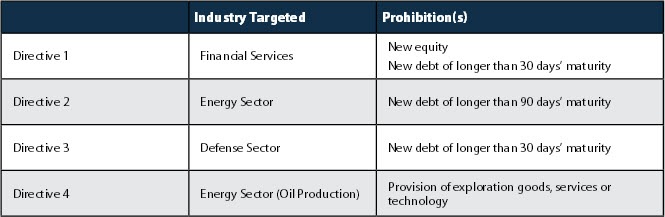

Originally the SSI sanctions were implemented under two directives issued on July 16, 2014. Under the previous Directive 1, U.S. persons were prohibited from financing or otherwise dealing in new equity or new debt of longer than 90 days’ maturity for SSI listed financial institutions. Similarly, the previous Directive 2 prohibited new debt of longer than 90 days’ maturity for SSI listed energy companies. Directive 1, as amended, now prohibits new debt of longer than 30 days’ maturity, while Directive 2, as amended, maintains its previous prohibition (including the 90-day standard). The new Directive 3 prohibits new debt of longer than 30 days’ maturity in SSI listed entities in the defense and related material sectors. OFAC also expanded the SSI program beyond capital restrictions with Directive 4, which prohibits U.S. persons from providing goods, services (but not financial services) or technology to support exploration and production of oil projects involving deepwater, Artic offshore or shale. In addition, all four directives prohibit transactions that evade, avoid or otherwise attempt to violate any of the applicable restrictions.

Overview of OFAC's SSI Directives

OFAC also issued a number of new Frequently Asked Questions (FAQs) describing these directives. A few notable clarifications presented in the FAQs:

- FAQ 394: If a U.S. person entered into a long-term credit facility or loan agreement prior to the sanctions’ effective date, drawdowns and disbursements with repayment terms of 30 days or less (for persons subject to Directives 1 and 3) or 90 days or less (for persons subject to Directive 2) are permitted. Drawdowns and disbursements whose repayment terms exceed the applicable authorized tenor are not prohibited if the terms of such drawdowns and disbursements (including the length of the repayment period, the interest rate applied to the drawdown and the maximum drawdown amount) were contractually agreed to prior to the sanctions’ effective date and are not modified on or after the sanctions’ effective date. U.S. persons may not deal in a drawdown or disbursement initiated after the sanctions’ effective date with a repayment term of longer than 30 days (for persons subject to Directives 1 and 3) or 90 days (for persons subject to Directive 2) if the terms of the drawdown or disbursement were negotiated on or after the sanctions’ effective date. Such a newly negotiated drawdown or disbursement would constitute a prohibited extension of credit.

- FAQ 395: U.S. persons may advise or confirm a letter of credit issued on behalf of a non-sanctioned entity in which an entity subject to Directive 1, 2 or 3 is the beneficiary (i.e., the exporter or seller of the underlying goods) because the subject letter of credit does not represent an extension of credit to the SSI entity.

U.S. persons may not advise or confirm a letter of credit if these three conditions are met: (i) the letter of credit was issued on or after the sanctions’ effective date, (ii) the letter of credit carries a term of longer than 30 days’ maturity (for persons subject to Directives 1 and 3) or 90 days’ maturity (for persons subject to Directive 2), and (iii) an SSI entity is the applicant of the letter of credit (i.e., the importer or buyer of the underlying goods or services). This would constitute prohibited activity because the subject letter of credit would represent an extension of credit to the SSI entity.

FAQ 415 makes it clear that each directive is independent of each other. Therefore, an SSI listed entity could be subject to more than one directive or only subject to a single directive. For example, one of the SSI listed entities is Lukoil, which is subject to Directive 4 (see here). Directive 4 prohibits the provision of exploration goods, services or technology, but it does not contain, unlike the other directives, any restrictions on debt dealings. Thus, Lukoil is not subject to debt restrictions, although other SSI entities listed under Directives 1, 2 and 3 are subject to such restrictions.

The issuance of the amended and new directives clearly indicates that OFAC’s SSI program is still evolving in its response to the activities of the Russian Federation. When evaluating potential transactions, firms should not only determine if they are dealing with an SSI listed entity by examining the SSI List (available on OFAC’s website), but they also must understand which specific directive (or directives) is in force for that entity, as shown on that SSI List under the name of that entity. OFAC has decided to pursue a nuanced sanctions approach and, as a consequence, the compliance burden has increased as firms will have to analyze transactions with SSI entities on a case-by-case basis to identify prohibited and permissible dealings.

In addition to OFAC’s SSI program changes, the Commerce Department’s Bureau of Industry and Security published a final rule on September 17, 2014, which added five Russian energy companies to the Entity List. These energy companies are now subject to a license requirement for the export, reexport or foreign transfer of items subject to the Export Administration Regulations when the exporter, reexporter or transferor knows those items will be used directly or indirectly in exploration for, or production from, deepwater, Arctic offshore or shale projects in Russia that have the potential to produce oil. License applications for such transactions will be reviewed with a presumption of denial.

Please direct any questions concerning this matter to Thomas E. Crocker (thomas.crocker@alston.com, 202-239-3318), Kenneth G. Weigel (ken.weigel@alston.com, 212-239-3431) or Guillermo E. Cuevas (guillermo.cuevas@alston.com, 202-239-3205) of the firm’s International Trade & Regulatory Group.

This advisory is published by Alston & Bird LLP’s International Trade & Regulatory practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.