The restructuring plan proposed by a UK short-term property lender, Amicus Finance Plc, and sanctioned by the UK High Court on 19 August 2021 is significant because it is the first plan:

- Promoted by insolvency office holders (to exit a company from administration).

- Proposed by a small/medium-sized company.

- Involving a senior creditor cram up as a result of the application of cross-class cram-down provisions by the court. The court has effectively allowed the dissenting votes of certain secured creditors to be overridden.

Written reasons for the court’s decision to sanction the plan will follow.

Background

The company has been in administration since December 2018. The administrators proposed the plan because they considered that there was insufficient cash available to continue to fund the administration. The plan was intended to return Amicus to solvency and rescue the company as a going concern. The administrators argued that the plan would provide Amicus’s creditors with a better return than in a liquidation, which they considered to be the relevant alternative.

Key Elements of the Plan

- The injection of approximately £3.7 million in new funds.

- The making of certain lump-sum payments to Amicus’s expense creditors and preferential creditors in full satisfaction of their debts and to Amicus’s secured and unsecured creditors in part satisfaction of their debts.

- A waterfall of payments from the proceeds of the legacy loans to which the company is entitled from sanction of the plan until 31 December 2022.

Creditors Were Split into Five Classes

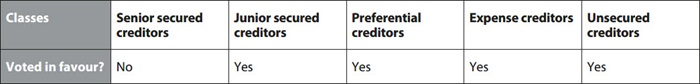

The plan was approved by four of the five creditor classes listed in the table below.

The class of senior secured creditors included Crowdstacker Corporate Services Limited and HGTL Securitisation Company Limited to the extent that their claims ranked equally (up to approximately £4.7 million each). The administrators had initially proposed one class of secured creditors only; however, following a challenge by Crowdstacker at the convening hearing, the court ordered the division of this class.

The class of junior secured creditors was composed of only one creditor, HGTL Securitisation, for the remainder of its secured claims, not covered by the senior secured creditor class.

Senior Creditor Cram Up

The new cross-class cram-down provisions do not preclude the possibility of a senior creditor cram up, which occurs when a dissenting senior creditor class is crammed down by a junior class of consenting creditors. Achieving a senior creditor cram up may be challenging for a plan and needs to be carefully planned and fact-specific. Absent a moratorium preventing enforcement of security (for example, when the company is in administration, as was the case with Amicus), the plan company would need to have support of senior secured creditors (at least the majority able to control enforcement process). Otherwise, such creditors would be able to enforce security and derail the plan. That said, there may be circumstances where secured creditors are unwilling to enforce or where junior creditors control enforcement (e.g., certain super senior RCF structures or unitranche facilities).

To sanction a plan involving a senior creditor cram up, the court needs to be persuaded that the treatment of creditors under the plan is just and equitable. It will be necessary to demonstrate that senior secured creditors are no worse off under the plan than they would be in the relevant alternative. If the relevant alternative is security enforcement and repayment in full, then it would be interesting to see how the courts would react to a plan where senior secured debt is termed out and reinstated in a restructured borrower (arguably with a more-robust capital structure) in exchange for increased pricing (higher coupon to compensate for continued credit exposure). It is not yet clear from the existing case law how the court will compare the position of a termed-out senior secured creditor under the plan and in the relevant alternative. It is possible that the court would consider similar factors that have been relevant in U.S. Chapter 11 cram-up cases, including the state of the market for refinancing (efficient or not efficient) and more complex issues such as cost of capital applicable to such senior secured lenders.

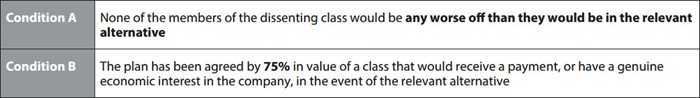

An important safeguard is that the class of creditors that approve the plan against the wishes of the senior class must be a class that would receive a payment or have a genuine economic interest in the company in the relevant alternative. This prevents senior secured lenders or bondholders being crammed up by an out-of-the-money unsecured creditors or equity class.

In the Amicus case, at the creditors’ meetings, Crowdstacker (holding 49.98% of the debt in the senior secured creditors class) voted against the plan, which meant that the plan had failed to gain the support of the required 75% in value of the senior secured creditor class (the most-senior class).

The remainder of the creditor classes voted overwhelmingly in favour of the plan. The focus of the sanction hearing was therefore Amicus’s request that the court utilize “cross-class cram-down” (which in this case is a senior creditor cram up) and sanction the plan despite the failure to secure the requisite support of the senior secured creditor class.

Crowdstacker’s Application for Disclosure

Crowdstacker made an application for disclosure of certain documents regarding a potential deal with Cabot Square Capital which fell away – a request which if granted would amount to the provision of hundreds of thousands of documents.

The court declined to grant the disclosure order sought on the basis that the scope for disclosure was too wide and that the requested disclosure order would have been disproportionally onerous for the administrators to comply with.

Dispute over the Relevant Alternative

Legislation regarding restructuring plans prescribes that the court may use cross-class cram-down provisions if Conditions A and B are met:

Crowdstacker disputed that Condition A was met, on the basis that the company’s estimated outcome statement (EOS) was fundamentally flawed and therefore unreliable to determine the estimated return in a liquidation. In Crowdstacker’s view, the EOS undervalued the estimated realisations of the company’s loan book and did not provide a value for the sale of goodwill, IP, and assets of the business in liquidation. In addition, Crowdstacker alleged that the EOS failed to apportion any value to potential claims which may be brought by a liquidator or creditors in a liquidation (e.g., transactions at an undervalue).

Even if both conditions to cross-class cram down are satisfied, the court still needs to be satisfied that it should exercise its discretion to approve the plan. On the evidence in this case, the court was satisfied that it was appropriate to exercise its discretion to approve the plan.

Costs

The court had been asked to make an order for costs for Crowdstacker and determined to award Crowdstacker £75,000 plus VAT, being a portion of their costs, as an expense of the administration on the basis that (1) Crowdstacker’s class-composition challenges did succeed; and (2) there was significant contribution by Crowdstacker’s counsel to the debates in court, which gave rise to amendments to the explanatory statement.

The key point here is that companies proposing restructuring plans will need to consider making provision for potential cost awards associated with challenges brought by dissenting creditors.

Key Takeaways

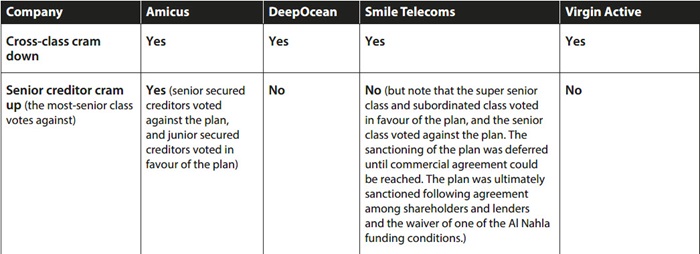

The Amicus restructuring plan is the first restructuring plan that facilitates exit from administration and is thought to be the first restructuring plan proposed by a small/medium-sized company. So far, the court has sanctioned three other restructuring plans applying the new cross-class cram-down provisions (DeepOcean, Smile Telecoms, and Virgin Active) and there is an expectation that the court will continue using its new powers.