On December 15, 2021, the Securities and Exchange Commission (SEC) proposed amendments to its rules governing issuers’ disclosure of repurchases or buybacks of their equity securities registered under Section 12 of the Securities Exchange Act of 1934. The proposed amendments would heighten issuers’ disclosure requirements through more timely disclosure on new Form SR and enhance issuers’ periodic disclosure requirements on Form 10-K, Form 10-Q, Form 20-F, and Form N-CSR.

In its proposing release, the SEC noted that issuer share repurchase plans have grown in recent years, sparking debate on the nature and objectives of these transactions. The SEC acknowledged that issuers may repurchase shares for a variety of reasons that may be beneficial to investors and aligned with shareholder value maximization, such as to offset share dilution after issuance of new stock, to facilitate stock- and stock-option-based employee compensation programs, to signal the issuer’s view that the stock is undervalued, or to prudently use the issuer’s excess cash. However, the SEC noted that observers caution about uses of repurchases that are more driven by managerial self-interest, including increasing the share price before an insider’s sale, meeting a threshold in an executive compensation arrangement, or meeting a consensus earnings forecast.

According to the SEC, the proposed amendments would provide investors increased transparency into the impact of repurchases by improving the quality, relevance, and timeliness of the disclosures. Specifically, the SEC believes that the heightened disclosures would offer investors better insight into the extent of an issuer’s activity in the market and the potential impacts on the issuer’s share price, the issuer’s motivation for share repurchases, and the relationship between share repurchases, executive compensation, and stock sales.

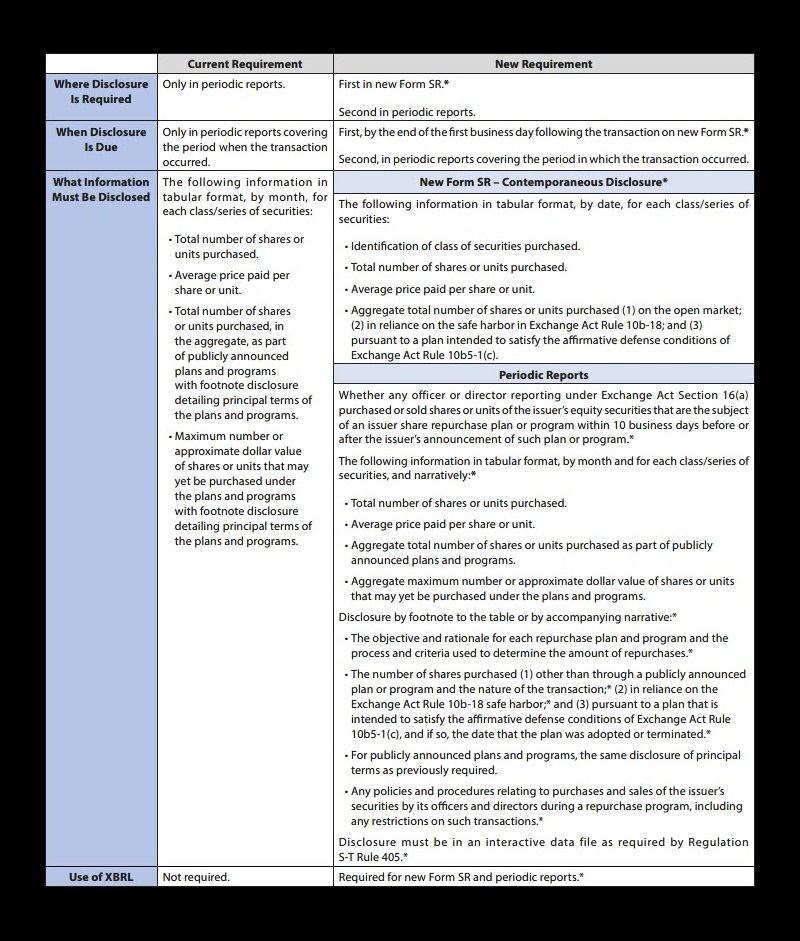

For a visual comparison of the current and proposed new requirements, please see the table following the “Going Forward” section of this advisory.

Current Requirements

The SEC adopted the current repurchase rules in 2003 to ensure that investors obtained important and useful information about an issuer’s securities. These rules currently require issuers to disclose all issuer repurchases of shares or other equity securities whether in private or open market transactions in the periodic report covering the period when the repurchase took place. The disclosure must be in tabular format and include:

- The total number of shares or units purchased by the issuer or any affiliated purchaser during the relevant period on a monthly basis and by class, as well as footnote disclosure of the number of shares purchased other than through a publicly announced plan or program and the nature of the transaction.

- The average price paid per share or unit.

- The total number of shares or units purchased as part of a publicly announced repurchase plan or program.

- The maximum number or approximate dollar value of shares or units that may yet be purchased under the plans or programs.

The current rules also require footnote disclosure in the aggregate of the principal terms of all publicly announced repurchase plans or programs, including the date each plan or program was announced, the dollar amount or share or unit amount approved, the expiration date (if any) of each plan or program, each plan or program that has expired during the period covered by the table, and each plan or program the issuer has determined to terminate before expiration or under which the issuer does not intend to make further purchases.

Importantly, the SEC’s proposed amendments would enhance the current disclosure requirements by mandating more detailed and frequent disclosure.

Proposed Amendments

New Form SR would require next-day reporting

The proposed rules would require an issuer to disclose any purchase made by or on behalf of the issuers or an affiliated purchaser of shares or units of any class of the issuer’s equity securities registered under Section 12 of the Exchange Act.

The issuer would be required to file a new Form SR by the end of the first business day following the day the issuer executes the share repurchase. The proposed new Form SR would require the following information in tabular format and structured data language using Inline XBRL:

- Date of the repurchase.

- Identification of the class of securities purchased.

- The total number of shares or units purchased (including all issuer repurchases whether made pursuant to publicly announced plans or programs).

- The average price paid per share or unit.

- The aggregate total number of shares or units purchased on the open market.

- The aggregate total number of shares or units purchased in reliance on the safe harbor in Exchange Act Rule 10b-18.

- The aggregate total number of shares purchased pursuant to a plan intended to satisfy the defense conditions of Exchange Act Rule 10b5-1(c).

Notably, the additional disclosure that would be required under the proposed new Form SR would result in more frequent, contemporaneous, and detailed disclosure.

New rules would require enhanced disclosure on Form 10-K, Form 10-Q, Form 20-F, and Form N-CSR

The proposed rules would also heighten the periodic disclosure of repurchases set forth on Form 10-K, Form 10-Q, Form 20-F, and Form N-CSR. The issuer would also be required to disclose the following information in periodic reports and use structured data language using Inline XBRL where applicable:

- The objective or rationale for its share repurchases and process or criteria used to determine the amount of repurchases.

- Any policies or procedures relating to purchases and sales of the issuer’s securities by its officers and directors during a repurchase program, including any restriction on such transactions.

- Whether repurchases were made pursuant to a plan that is intended to satisfy the affirmative defense conditions of Exchange Act Rule 10b5-1(c), and if so, the date the plan was adopted or terminated.

- Whether repurchases were made in reliance on the Exchange Act Rule 10b-18 non-exclusive safe harbor.

Additionally, the proposed rules would create a requirement that the issuer check a box indicating whether any of the issuer’s officers or directors subject to Exchange Act Section 16(a) reporting requirements purchased or sold shares or other units of the class of the issuer’s equity securities that are the subject of an issuer share repurchase plan or program within 10 business days before or after the announcement of such plan or program.

What Should Companies Do Now?

Although these are proposed rules, companies can still take some general steps to prepare for these potential new rules, including:

- Consider whether they want to submit a comment letter to the SEC.

- Review their disclosure controls and procedures to ensure that they would be able to timely comply with the new Form SR filing requirements and the enhanced periodic disclosures contemplated by the proposed rules.

- Review their controls and procedures regarding Exchange Act Rule 10b5-1 plans for the issuer, officers, and directors.

- Consider policies and procedures for officers and directors selling shares while the company is in the market repurchasing securities, whether they should have any restrictions on such sales, and the impact on both issuer repurchase programs and sales by officers and directors such a policy would have on the company.

Going Forward

The proposed amendments will be subject to a 45-day comment period, beginning on the publication of the proposal in the Federal Register. To submit comments, use the SEC’s internet submission form or send an email to rule-comments@sec.gov.

Summary Chart for Current and Proposed Requirements

Below is an abbreviated comparison of the current requirements against the proposed new requirements.