If So, You May Need to Do So by December 1, 2017*

Plan sponsors of defined contribution qualified plans may need to issue one or more annual notices to participants before the end of each plan year. Failure to issue a required annual notice can have significant consequences. For example, if a plan sponsor forgets to issue the annual 401(k) safe harbor notice, the plan could lose its safe harbor status and be forced to limit (or refund) contributions by highly compensated employees.

This advisory serves as a reminder of the multiple year-end notices that defined contribution plans must issue to participants. These notices must be distributed within a reasonable period of time, typically 30 days, before the start of the plan year.

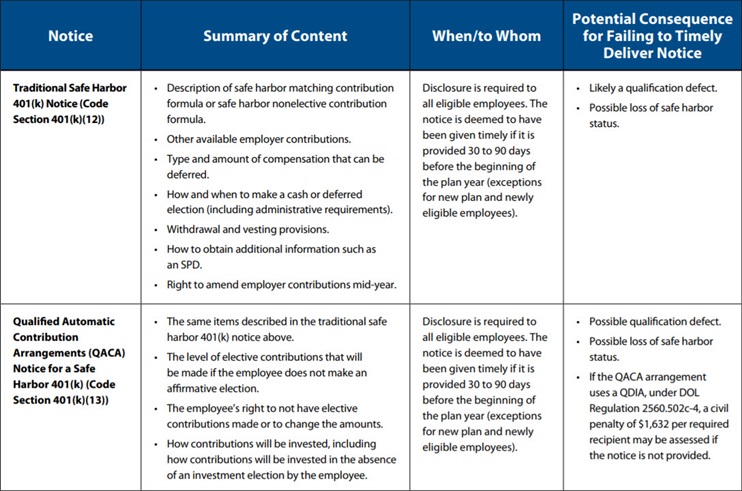

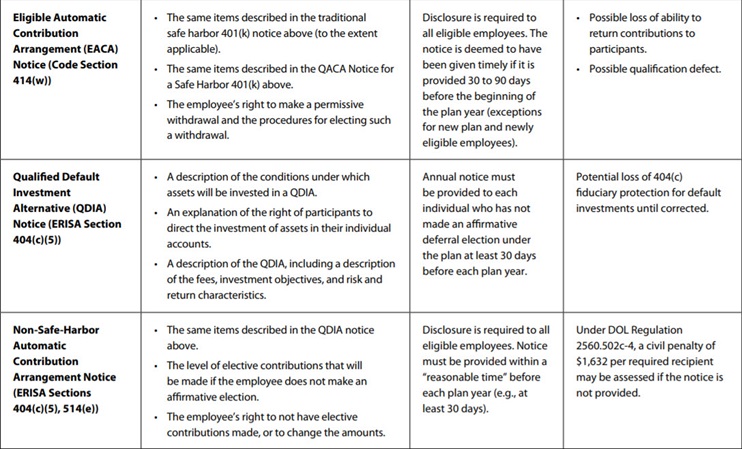

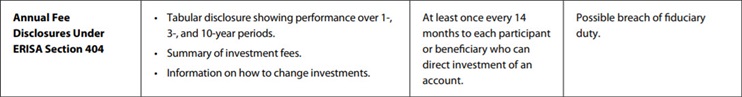

The following table provides a list of the content and deadlines for the most common notices that plan sponsors may need to distribute. It includes:

- Traditional Safe Harbor 401(k) Notice

- Qualified Automatic Contribution Arrangements (QACA) Notice for a Safe Harbor 401(k)

- Eligible Automatic Contribution Arrangement (EACA) Notice

- Qualified Default Investment Alternative (QDIA) Notice

- Non-Safe-Harbor Automatic Contribution Arrangement Notice

- Annual participant fee disclosures

|

Important News…

|

Special Consideration for Safe Harbor Plans

In 2016, the IRS issued guidance (Notice 2016-16) relaxing its position on mid-year changes to safe harbor plans. Many mid-year changes are now permissible to safe harbor plans, though a change affecting the plan terms described in the plan’s safe harbor notice will typically require that participants be provided with a new safe harbor notice 30 to 90 days before the change.

Not all changes are permitted, and the IRS has listed several amendments that are impermissible, including (among others) changing the type of safe harbor used, narrowing the group of employees eligible to receive a safe harbor contribution, and increasing vesting conditions for nonelective contributions under a nonelective contribution safe harbor plan. Also, existing plans cannot be amended to become a safe harbor plan after the start of the plan year.

Prior IRS guidance also permits the reduction or elimination of employer safe harbor contributions as long as the safe harbor notice clearly reserves the employer’s right to change these contributions. We suggest adding this language to your safe harbor notice to preserve this option.

Regardless of the increased flexibility regarding changes to safe harbor plan provisions, amendments can often have unintended consequences. We recommend consulting the plan’s legal adviser before modifying any safe harbor plan provisions, particularly if those provisions are described in the plan’s safe harbor notice.

Practice Pointers

- In addition to the year-end notices described above, there are several additional notices that must be provided from time to time. These include Summaries of Material Modifications (SMMs), Summary Annual Reports (SARs), and notices regarding changes to investment funds.

- Plan sponsors can generally combine multiple notices in a single notice. However, since different notices have different distribution requirements, generally a combined notice should be distributed to the broadest applicable recipient group.

- These and other notices may also require distribution during the plan year to newly eligible participants or rehired participants.

- Sponsors of defined contribution plans may also have other notices they must provide participants, such as diversification notices (ERISA Section 101(m), IRC Section 401(a)(35)) and quarterly or annual participant statements (ERISA Section 105(a)).

Please do not hesitate to contact your Alston & Bird attorney if you have any questions about notice obligations or if we can assist you in providing proper notices for your qualified retirement plan.

*This deadline applies to calendar-year plans. Non-calendar-year plans have similar requirements, though their deadlines may be different.