Plan sponsors of defined contribution qualified plans may need to issue one or more annual notices to participants before the end of each plan year. Failure to issue a required annual notice can have significant consequences. For example, if a plan sponsor forgets to issue the annual 401(k) safe harbor notice, the plan could lose its safe harbor status and be forced to limit (or refund) contributions by highly compensated employees.

This advisory serves as a reminder of the multiple year-end notices that defined contribution plans must issue to participants. These notices must be distributed within a reasonable period of time, typically 30 days, before the start of the plan year.

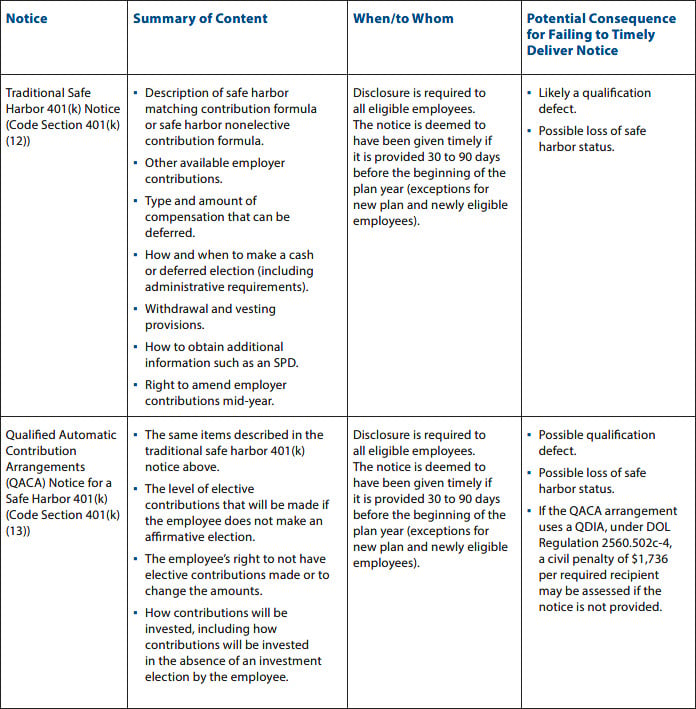

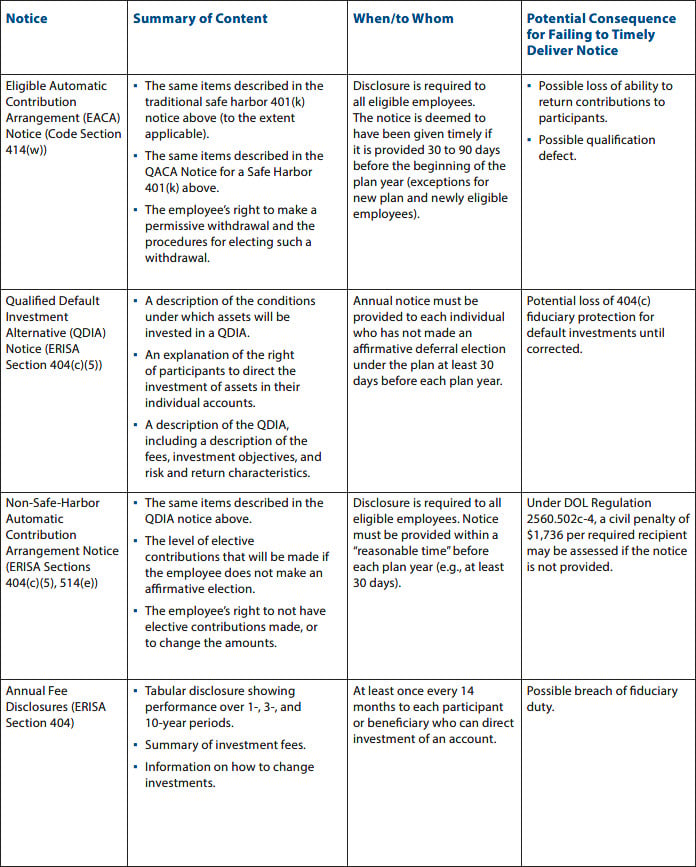

The following table provides a list of the content and deadlines for the most common notices that plan sponsors may need to distribute. It includes:

- Traditional Safe Harbor 401(k) Notice

- Qualified Automatic Contribution Arrangements (QACA) Notice for a Safe Harbor 401(k)

- Eligible Automatic Contribution Arrangement (EACA) Notice

- Qualified Default Investment Alternative (QDIA) Notice

- Non-Safe-Harbor Automatic Contribution Arrangement Notice

- Annual participant fee disclosures

|

Important News…

|

Practice Pointers

- In addition to the year-end notices described above, there are several additional notices that must be provided from time to time. These include Summaries of Material Modifications (SMMs), Summary Annual Reports (SARs), and notices regarding changes to investment funds and certain other information in the Annual Fee Disclosure.

- Plan sponsors can generally combine multiple notices in a single notice. However, since different notices have different distribution requirements, generally a combined notice should be distributed to the broadest applicable recipient group.

- These and other notices may also require distribution during the plan year to newly eligible participants or rehired participants.

- Sponsors of defined contribution plans may also have other notices they must provide participants, such as diversification notices (ERISA Section 101(m), IRC Section 401(a)(35)) and quarterly or annual participant statements (ERISA Section 105(a)).

- Recent IRS guidance changes several rules concerning hardship withdrawals. These are discussed in greater detail in our advisory, “Final Hardship Distribution Rules Are Here: Does Your 401(k) or 403(b) Plan Comply?” To the extent plan notices reference hardship rules, ensure that the appropriate language is updated to reflect any changes adopted by the plan.

- Plans that issue a safe harbor notice should include language in the notice clearly reserving the employer’s right to reduce or eliminate employer safe harbor contributions.

Please do not hesitate to contact your Alston & Bird attorney if you have any questions about notice obligations or if we can assist you in providing proper notices for your qualified retirement plan.

* This deadline applies to calendar-year plans. Non-calendar-year plans have similar requirements, though their deadlines may be different.