This is an updated advisory discussing new guidance on the transitional reinsurance fee. Please note that guidance is frequently issued in this area. This advisory is up-to-date as of the date of publication, but follow-up guidance from CMS may supersede the information below.

| The deadline for submitting the required information and scheduling the required payment, which must be done through Pay.gov, is November 15, 2014. |

Transitional Reinsurance Program: An Overview

The Affordable Care Act (ACA) provides for a transitional reinsurance program to help stabilize premiums for coverage in the individual health insurance market during the first three years of operation of the Health Insurance Marketplaces (2014–2016). The program is designed primarily to transfer funds from the group market to the individual market, where high risk individuals are more likely to be covered.

Payments to individual market insurers under the reinsurance program are funded by “contributions” (referred to in this advisory as “fees”) payable by health insurance issuers and third-party administrators on behalf of self-insured group health plans. However, under the regulations, self-insured group health plans are ultimately responsible for the payment. Under the statute, a total of $25 billion will be collected for the three-year period from 2014–2016, $20 billion of which will be used to fund the reinsurance program and $5 billion of which will be paid into the general funds of the U.S. Treasury. In addition to these statutory amounts, states may impose additional contribution requirements to fund administrative expenses associated with the reinsurance program and/or to provide for additional reinsurance payments. Each state decides whether to establish a reinsurance program or whether to have the Centers for Medicare and Medicaid Services (CMS) administer the reinsurance program for the state.

See our previous advisory[1] for more background about the transitional reinsurance program.

Guidance Background

Final regulations regarding the reinsurance program were initially published by CMS on March 16, 2012.[2] These initial regulations have since been supplemented and modified on numerous occasions.[3] Current regulations may be found at 45 C.F.R. § 153.400, et seq.

Application of the Fee to Group Health Plans

Amount of the Fee

The transitional reinsurance fee requirement applies on a per capita basis with respect to each individual covered by a plan subject to the fee (referred to here as “covered lives”). The total amount for 2014 is $63 per covered life, and decreases to $44 per covered life in 2015. The amount of the fee for 2016 has not yet been set by CMS, but it will be lower than the 2015 amount, reflecting the lower aggregate amount required to be collected.

Group Health Plans Subject to the Requirement

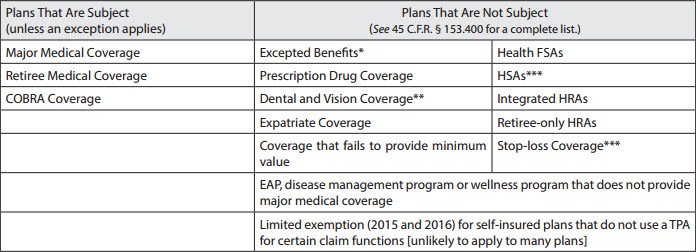

The fee applies to major medical coverage, which with respect to group health plans means (1) small group health plans subject to the metal tier actuarial value requirements (generally, non-grandfathered, fully-insured plans other than excepted benefit plans), and (2) any health coverage for a broad range of services and treatments provided in various settings that provides minimum value (MV) as defined under the ACA (e.g., self-funded plans that provide MV). Below is a chart illustrating some common plans and/or arrangements and whether they are subject to the fee.

* As defined by the Public Health Service Act § 2791(c). Excepted benefits include, for example, accident and disability coverage, specified disease coverage and stand-alone dental and vision coverage.

** These plans are excluded even if they constitute essential health benefits (i.e., pediatric dental coverage).

*** Note, these arrangements are not considered group health plans.

Who is Responsible for the Fee?

The transitional reinsurance fee is imposed on the “contributing entity,” defined as an insurer for fully-insured coverage or the group health plan for self-insured coverage. Third-party administrators (TPAs), administrative service only entities (ASO) and others may submit on behalf of contributing entities, though CMS has specified that the TPA or ASO is not required by law to do so.

| Practice Pointer. Because the fee is imposed on the self-insured plan, not the plan sponsor, plan assets may be used to pay the assessment. The Internal Revenue Service has also noted that plan sponsors can treat the fee as an ordinary and necessary business expense for tax purposes (i.e., deductibility ).[4] |

Many plans allow employees to choose a single benefit option from an array of benefit options, some of which are self-funded and some of which are fully insured (e.g., several self-funded options with a fully-insured HMO). In that situation, if each option separately provides major medical coverage, then the insurer would be responsible for the fee with respect to covered lives under the insured benefit options, and the plan would be responsible for the fee with respect to covered lives under the self-insured benefit options.

There also may be situations where a plan is partially self-funded and partially fully insured and where different plans of the same sponsor together provide major medical coverage. The regulations contain rules to address these situations, including determining what entity is responsible for the fee and the counting rules that are available. Special rules also apply if a plan changes from self-funded to fully insured (or vice versa) in the middle of a calendar year.

Finally, plans are not required to count individuals primarily residing in a U.S. territory not subject to the transitional reinsurance program and may exclude Medicare-eligible individuals if Medicare pays primary to the plan with respect to such individuals.

How Do I Count Covered Lives?

The term “covered lives” includes everyone covered under the plan or policy, e.g., spouses, dependents and retirees. Because the fee is based on the number of covered lives under the plan, it is important to pay careful attention to the permissible counting methods.

Overview

CMS has enumerated several options for counting covered lives, depending on whether the plan is insured or self-funded. The methods of counting covered lives for the reinsurance fee are similar to, but not exactly the same as, the Patient-Centered Outcomes Research Institute (PCORI) count methods; thus, plans should not rely on the PCORI methods for purposes of the reinsurance fee.[5] Plans may choose any applicable method, but the same method must be used for a benefit year (and across all plans). Note that the counting method does not need to be the same one the plan used for the PCORI fee. The counting period is generally the first nine months of the calendar year (except for the Form 5500 method), regardless of the plan year.

A brief description of the counting methods is below, and helpful guidance on the methods for counting can be found here.[6]

| Practice Pointer. The enrollee counting rules are technical and can be very complicated. While TPAs can pull enrollment counts for the fee submission, employers should consult counsel if they have any questions about the application of the rules to their specific plan(s). |

Options Available to Insured Plans

- Actual method: Add the total number of covered lives for each day of the first nine months of the benefit year, then divide that total by the number of days in those nine months.

- Snapshot count method: Add the total number of covered lives on any date (or more dates, if an equal number of dates are used for each quarter) during the same corresponding month in each of the first three quarters of the year (for example, January, April and July), then divide that by the number of dates on which a count was made. Note that the date used for the second and third quarters must fall within the same week of the quarter as the corresponding date used for the first quarter.

- Member months/state form method: Multiply the average number of policies in effect for the first nine months of the benefit year by the ratio of covered lives per policy in effect, calculated using the prior NAIC exhibit or a form with the issuer’s state of domicile.

Options Available to Self-Insured Plans

- Actual method: Add the total number of covered lives for each day of the first nine months of the benefit year, then divide that total by the number of days in those nine months.

- Snapshot count and snapshot factor method:

- Count: Add the total number of covered lives on any date (or more dates, if an equal number of dates are used for each quarter) during the same corresponding month in each of the first three quarters of the year (for example, January, April and July), then divide that by the number of dates on which a count was made. Note that the date used for the second and third quarters must fall within the same week of the quarter as the corresponding date used for the first quarter.

- Factor: Add the total number of covered lives on any date (or more dates, if an equal number of dates are used for each quarter) during the same corresponding month in each of the first three quarters of the benefit year (for example, January, April and July), divided by the number of dates on which a count was made (note that the date used for the second and third quarters must fall within the same week of the quarter as the corresponding date used for the first quarter). Then, add the number of participants with self-only coverage and the product of the number of participants with coverage other than self-only coverage and a factor of 2.35.

- Form 5500 method: For a plan offering more than self-only coverage (i.e., dependent or spousal coverage), add the number of participants at the beginning and end of the plan year from the most current Form 5500 (lines 5 and 6a–6c). For a plan offering self-only coverage, perform the same calculation, but divide this number by two.

| Practice Pointer. The choice of counting method may have a significant impact on the number of covered lives and the fee owed. For example, if a plan uses a wrap plan document and files a single Form 5500 for a plan that includes multiple health and welfare benefits, using the Form 5500 method to estimate the number of covered lives may significantly increase the number of covered lives (and thus, the fee). For example, if all employees receive employer-provided basic life coverage, the number of participants would include all employees, not just those enrolled in medical coverage. Please contact us if you would like assistance in choosing a method that minimizes the fee. |

Necessary Documentation

Regardless of the method chosen, plans must maintain documentation of the count, including all materials provided by TPAs in arriving at this figure, for at least 10 years. CMS may audit a plan to assess its compliance with the program requirements, and it will be crucial to be able to produce this information.

Submitting the Fee

Form Submission Process

The entire reinsurance fee process takes place on Pay.gov. This process is separate from the Health Insurance Oversight System (HIOS) which is used, for example, to obtain a Health Plan Identifier (HPID). The applicable form became available on October 24, 2014. While this leaves somewhat limited time for plan sponsors to submit the applicable form and schedule the fee by the November 15, 2014, deadline, CMS has issued no guidance indicating that the submission date will be delayed. Thus, plan sponsors should act quickly to ensure compliance by the deadline.

In order to successfully complete the reinsurance fee submission, plan sponsors (or their representatives) need to:

- Register on Pay.gov;

- Fill out the Transitional Reinsurance Form;

- Attach a supporting documentation file; and

- Schedule a reinsurance payment.

More information about these steps is discussed in detail below. A helpful guide for the submission process is available here.[7]

Form

After registering on Pay.gov, the submitter will select the Transitional Reinsurance Program Annual Enrollment and Contributions Submission Form. The form requires basic company and contact information, payment type, benefit year and the annual enrollment count (calculated using one of the methods above).

Supporting Documentation

After the information is entered into the form, plan sponsors will need to upload a Supporting Documentation CSV file. This file must contain certain company information, the annual enrollment count and the benefit year; in addition, certain technical requirements (such as file size and a prohibition on special characters) apply. CMS’s Job Aid allows companies to create and error-test the file in advance.[8]

Payment

After the enrollment and supporting documentation information is submitted, the form will auto-calculate the amount owed by multiplying the required amount by the number of covered lives. Plans then need to schedule payment(s) for this amount; the form cannot be submitted without payment information. Plans can choose to remit payment for the entire benefit year at once (the full $63 per covered life), or plans can submit two separate payments for the year. If the separate payment method is used, the first payment ($52.50 per covered life) is due by January 15, 2015, and the second payment ($10.50 per covered life) is due by November 15, 2015. Plans may choose to schedule earlier payments. CMS suggests leaving 30 days between the form submission and payment date—i.e., an early December 2014 payment date for plans wishing to pay earlier than January 15, 2015. Regardless of the option chosen, the payments MUST be scheduled by November 15, 2014. Note that if a plan chooses to submit two payments, the plan must submit the same form and supporting documentation (with the same information) twice.

An automated clearinghouse (ACH) payment is currently the only accepted payment method, although CMS may send an invoice if there are problems with payment. Plans need to add a particular ALC+2 value (according to CMS guidance, “7505008015”) with the applicable bank to ensure the payment is processed correctly; the company name for ACH purposes is “USDEPTHHSCMS.”

Finally, plans can only include one bank account per form, so make sure to choose an account with a large enough balance for the fee.

What Should Plans Do to Prepare Before Submitting the Form and Supporting Documentation?

The actual submission process will be smoother if plan sponsors are prepared with the necessary information. To prepare for this process, plan sponsors should:

- Collect relevant information;

- Count covered lives (remember, the method chosen can affect the amount of the fee);

- Prepare a CSV file; and

- Notify the bank of the applicable ALC+2 value.

Enforcement

In response to questions about how the fee will be enforced, CMS issued an FAQ stating that reinsurance contributions are considered federal funds and are thus subject to the False Claims Act. The FAQ also referred to regulations stating that, with respect to health insurance issuers, the fee is a determination of debt subject to federal debt collection. Although the regulations refer only to insurers and not self-funded plans, it is expected that CMS will pursue enforcement with respect to both types of plans.

[1] “Health Care Reform Update: Final Regulations Impose Reinsurance ‘Contribution’ on Fully Insured and Self-Insured Plans Starting in 2014,” March 28, 2012, available at http://www.alston.com/files/publication/3809b9de-2da1-4904-9e80-4fd034fc9a62/presentation/publicationattachment/a6c2cd4d-3e55-4642-b740-50081175b13f/12-196%20reinsurance%20fee.pdf.

[2] The final regulations were published in 77 Fed. Reg. 17219 (Mar. 23, 2012) and may be found at https://federalregister.gov/a/2012-6594.

[3] HHS Notice of Benefit and Payment Parameters for 2014, 45 C.F.R. Parts 153, 155, 156, 157, and 158, 78 Fed. Reg. 15409 (Mar. 11, 2013) (https://federalregister.gov/a/2013-04902); HHS Notice of Benefit and Payment Parameters for 2015, 45 C.F.R. Parts 144, 147, 153, 155, 156, and 158, 79 Fed. Reg. 13743 (Mar. 11, 2014) (https://federalregister.gov/a/2014-05052); Program Integrity: Exchange, Premium Stabilization Programs, and Market Standards; Amendments to the HHS Notice of Benefit and Payment Parameters for 2014, 45 C.F.R. Parts 144, 146, 147, 153, 155, and 156, 78 Fed. Reg. 65045 (Oct. 30, 2013) (https://federalregister.gov/a/2013-25326).

[4] http://www.irs.gov/uac/Newsroom/ACA-Section-1341-Transitional-Reinsurance-Program-FAQs.

[5] See 45 C.F.R. 153.405(d)– 45 CFR 153.405(g).

[6] Centers for Medicare and Medicaid Services, The Transitional Reinsurance Program Operational Guidance: Counting Method Examples for Contributing Entities (July 17, 2014), available at http://www.cms.gov/CCIIO/Programs-and-Initiatives/Premium-Stabilization-Programs/The-Transitional-Reinsurance-Program/Downloads/Examples-of-Counting-Methods-for-Contributing-Entities.pdf.

[7] Centers for Medicare and Medicaid Services, ACA Transitional Reinsurance Program Annual Enrollment and Contributions Submission Form Manual (Oct. 20, 2014), available at http://www.cms.gov/CCIIO/Programs-and-Initiatives/Premium-Stabilization-Programs/The-Transitional-Reinsurance-Program/Downloads/RIC_FormManual_102014_v1.pdf

[8] The file, and associated manual, are available on Regtap and at this link: http://www.cms.gov/CCIIO/Programs-and-Initiatives/Premium-Stabilization-Programs/The-Transitional-Reinsurance-Program/Reinsurance-Contributions.html.

This advisory is published by Alston & Bird LLP’s Employee Benefits & Executive Compensation practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.