Plan sponsors of defined contribution qualified plans may need to issue one or more annual notices to participants before the end of each plan year. Failure to issue a required annual notice can have significant consequences. For example, if a plan sponsor forgets to issue the annual 401(k) safe harbor notice, the plan could lose its safe harbor status and be forced to limit (or refund) contributions made by highly compensated employees.

This advisory serves as a reminder of the multiple year-end notices that defined contribution plans must issue to participants. These notices must be distributed within a reasonable period of time, typically 30 days, prior to the start of the plan year.

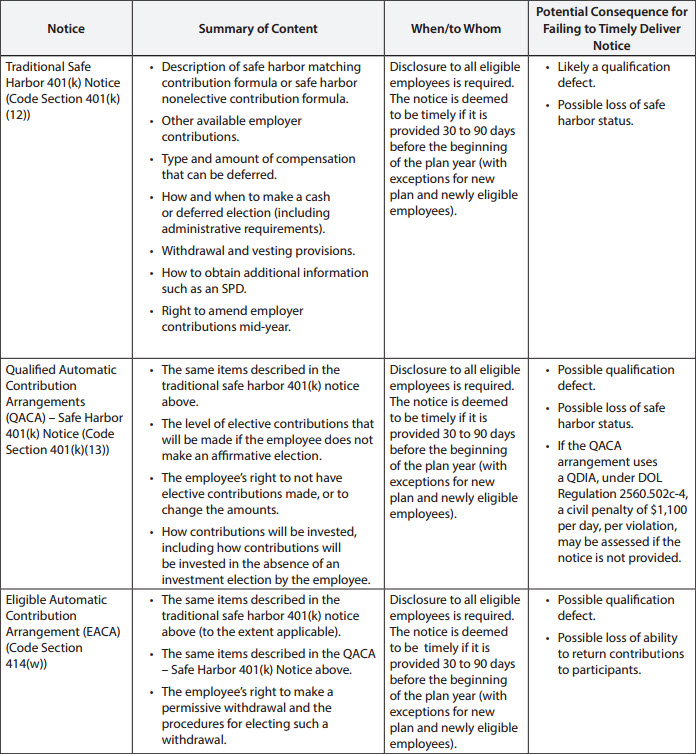

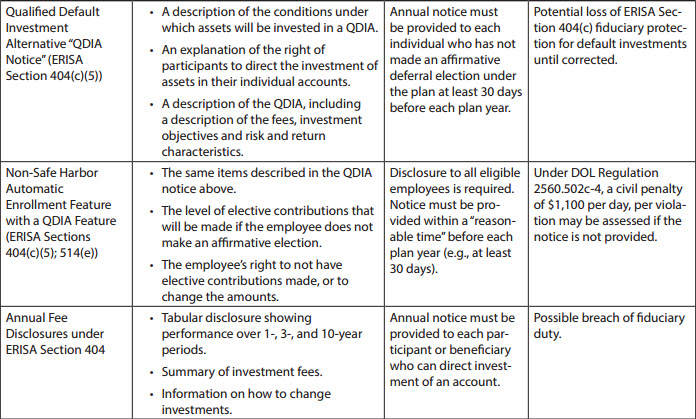

The following table provides a list of the content and deadlines for the most common notices that plan sponsors may need to distribute. It includes:

- Traditional Safe Harbor 401(k) Notice

- Qualified Automatic Contribution Arrangements for a Safe Harbor 401(k) Notice

- Eligible Automatic Contribution Arrangement Notice

- Qualified Default Investment Alternative Notice (QDIA)

- Non-Safe-Harbor Automatic Contribution Arrangement Notice

*This deadline applies to calendar-year plans. Non-calendar-year plans have similar requirements, though their deadlines may be different.

|

Important News… The IRS recently announced changes in the dollar limits for qualified retirement plans (and generally for 403(b) and 457(b) plans) for 2015. The following is a list of some important retirement plan limits for 2015:

Please contact your Alston & Bird attorney if you have any questions about the 2015 plan limits. |

Suggested Change to Safe Harbor Notice

The IRS has generally taken the position that mid-year changes to any plan feature described in a plan’s annual safe harbor notice may cause the plan to violate the 401(k) safe harbor requirements. The IRS has provided specific exceptions for certain purposes (e.g. the addition of a Roth 401(k) feature). Plan sponsors may not be able to make any other changes to plan features that were previously described in the annual safe harbor notice (e.g., changes to the plan’s vesting schedule). The IRS’s reasoning is that the notice may cause the participants to rely on the information contained in the notice, and thus, mid-year changes would harm the participants.

The IRS does provide an exception for mid-year changes to employer contributions, but only if the notice clearly reserves the employer’s right to change these contributions. We suggest adding this language to your safe harbor notice to preserve this option.

More on Fee Disclosure

ERISA Section 404 requires that participants receive an annual fee disclosure notice at least once every 12 months. For 2014, there are two options to accomplish this:

- Furnish the fee disclosure notice no later than 12 months after the 2013 fee disclosure notice was issued.

- Furnish the 2014 fee disclosure notice no later than February 2015.[1] For employers that wish to align their fee disclosure notice with other year-end notices, the 2014 fee disclosure notice would be issued no later than December 1, 2014.

No matter when your fee disclosure cycle occurs, we suggest making a note of the timing to help you and your service providers remember when the next fee disclosure is due.

|

Practice Pointers.

|

Please do not hesitate to contact your Alston & Bird attorney if you have any questions about notice obligations or if we can assist you in providing proper notices for your qualified retirement plan.

[1] The actual date is 18 months from when the 2013 fee disclosure notice was issued, as long as it was issued before the end of August 2013. For most plans, the latest possible date to issue the 2014 fee disclosure will be the end of February 2015. Note that this option is available only if the employer did not take advantage of the one-time option to delay fee disclosures in 2013. See DOL Field Assistance Bulletin 2013-02.

This advisory is published by Alston & Bird LLP’s Employee Benefits & Executive Compensation practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.