An abridged version of this advisory appeared in the December 2014 edition of The Self-Insurer.

2014 has been another busy year of regulations and guidance affecting health and welfare benefit plans. We have the Affordable Care Act (ACA) to thank for much of the seemingly endless flow of regulations and guidance in 2014; however, the ACA cannot take full credit. Code Section 125, HIPAA privacy, the Mental Health Parity and Addiction Equity Act and the Americans with Disabilities Act (ADA)—just to mention a few—are each worthy of an honorable mention in the “which laws generated the most late nights” award category for 2014.

Many of the rules and regulations went into effect in 2014, while others were issued in 2014 but will not be effective until 2015 or later. Needless to say, keeping track of the “what” and “when” is a challenge for even the most seasoned benefits professional. To help you ensure that nothing slips through the cracks, we provide the highlights for 2014.

Affordable Care Act

As in prior years, the ACA occupied the majority of time and compliance effort for health plan sponsors, administrators and benefit advisors. The Departments of Labor, Treasury and Health and Human Services (collectively, the “agencies”) issued regulations and guidance—either independently or jointly— on a wide array of ACA topics. The Supreme Court even joined in with its controversial ruling on a religion-based corporation’s obligation to cover contraceptives.

The 2014 ACA related highlights include:

- Employer Shared Responsibility Requirements (aka 4980H or “Pay or Play” Rules): In February 2014, Treasury issued final regulations on 4980H that generally go into effect in January 2015. The much anticipated regulations were lengthy and complex and provide material clarification as well as critical transition relief. The IRS also issued Notice 201449, which clarified the application of the 4980H rules to employees who transfer to another controlled group member that uses different methods for identifying employees. Highlights of the 2014 guidance related to the 4980H rules include:

- A one-year delay (to 2016) for excise taxes for applicable large employers (ALEs) that had fewer than 100 full-time equivalents in 2014 and that also satisfied certain additional requirements—i.e., the delay is not applicable solely because the employer had between 50 and 99 full-time equivalents. Caution: Although ALEs subject to the delay avoid excise taxes in 2015, they must still satisfy the reporting requirements associated with the 4980H rules for 2015 (see discussion below regarding Section 6056 reporting requirements);

- Clarification that the look-back measurement period method for identifying full-time employees applies to all employees of the ALE member who are within the same distinguishable class, as defined by the regulations (e.g., salaried or hourly). In other words, an ALE member cannot simply apply the look-back measurement period method to “variable employees.”

- Transition relief for certain ALEs that maintain plans that have a non-calendar plan year (“fiscal plan year”). According to the regulations, ALE members can avoid excise taxes on a full-time employee to whom coverage was not offered in the months preceding the start of the fiscal plan year in 2015 (or 2016 if subject to the one-year delay for certain smaller ALEs) if certain conditions are satisfied. Caution: The transition relief isn’t automatically available to employers that sponsor plans with a fiscal plan year. It is available only to the extent certain requirements are satisfied (e.g., related to the number of employees or full-time employees offered coverage or actually covered), and even then, the relief may only be available for certain employees.

- Transition relief for 2015 that decreases the “substantially all” test threshold from 95 percent to 70 percent. In order to avoid the 4980H(a) (or “sledgehammer”) tax for a month, ALE members must satisfy the substantially all test by offering coverage through an eligible employer-sponsored plan (as defined in Code Section 5000A) to the applicable percentage of their full-time employees (and their dependent children) for that month.

- Transition relief for 2015 that increases the full-time employee reduction available for employers (the “throw away” rule) subject to the 4980H(a) tax from 30 to 80. If an ALE does not satisfy the substantially all test for a month, the total number of full-time employees on which the excise tax is based is reduced by the ALE member’s allocable share of the controlled group’s full-time employees, not to exceed the applicable full-time employee reduction number. Caution: This increase in the full-time employee reduction from 30 to 80 does not apply to ALEs with fewer than 100 full-time equivalents (i.e., employers that are not subject to the one-year delay).

- Clarifications regarding application of the 4980H rules in certain situations in which an ALE’s employees receive coverage from an unrelated third party, such as:

- Multi-employer plans

- Staffing agencies

- Clarifications regarding the application of the 4980H rules to certain types of employees, such as:

- Students and interns

- Bona fide volunteers

- Employees performing services outside the United States (e.g., Puerto Rico)

- Clarification regarding the calculations of hours of service for certain types of employees, such as:

- Adjunct faculty

- On-call employees

- Clarification that an ALE member is not considered to have made an offer of coverage to a full-time employee unless the employee had the opportunity to elect coverage for his/her dependent children (if any) AND that coverage, if elected, would extend through the end of the month in which the child turns age 26 (or the date coverage ends for the employee, if earlier).

- Transition relief for plans that did not offer coverage for dependent children on February 9, 2014.

- Section 6056 Reporting: The ACA added new Code Section 6056, which requires ALE members to file a form with the IRS that identifies each of the employer’s employees who were full time (as defined in Code Section 4980H) for at least one month during the calendar year and what, if any, coverage was offered to those full-time employees. Employers must also furnish that form to the full-time employees. The purpose of the reporting requirement is to assist the IRS with administration of both the 4980H rules and the Code Section 36B premium tax credit rules. In 2014, the IRS issued final regulations on the Code Section 6056 reporting requirements along with draft forms (Forms 1094 and 1095-C) and instructions. The forms have yet to be finalized, but they shed significant light on what will be reported and how, such as:

- Each ALE member is responsible for satisfying the reporting requirements for its full-time employees (although a third party may file on their behalf), even if another member of the controlled group of employers sponsors the health plan in which the applicable large employer member’s full-time employees participate.

- Most of the relevant information about the employer’s full-time employees, including the scope of coverage offered to full-time employees (if any), will be provided through various codes. The codes are described in the instructions for Forms 1094 and 1095-C.

- Employers must generally provide information for all 12 months of the year if an employee is full time at least one month during the year—even if the employee is not employed by the employer for all 12 months. For example, if an employee is hired in August 2015 (and is subsequently full time for at least one month so that there is a Code Section 6056 reporting obligation), the applicable large employer member will indicate on Form 1095-C—using the applicable codes—that the employee was not employed by the employer January through July.

- Section 6055 Reporting: The ACA also added new Code Section 6055, which requires providers of minimum essential coverage to file a form with the IRS that identifies for the IRS each individual who enrolled in minimum essential coverage at least one day during the year. Whereas the Code Section 6056 requirement applies only to ALEs, and then only to full-time employees, this requirement would apply to any employer that sponsors a self-insured plan and any individuals (including retirees and dependents) covered under a plan. Coverage providers must also furnish this form to the covered individuals. The purpose of the Code Section 6055 reporting requirements is to help the IRS administer the individual mandate. Employers that sponsor self-insured plans that provide minimum essential coverage (an “eligible employer sponsored plan” as defined in Code Section 5000A) are obligated to satisfy the Code Section 6055 requirements for all individuals enrolled in the self-insured plan. If the plan is fully insured, the insurance carrier that issues the policy will satisfy the Code Section 6055 obligation for individuals covered under the insurance policy. As they did with the Code Section 6056 requirements, the IRS issued final Code Section 6055 regulations in 2014 along with draft forms (Forms 1094 and 1095-B) and instructions. Highlights of the Code Section 6055 reporting requirements, as they relate to employers with self-insured plans, include:

- Each employer whose employees participate in a self-insured plan—even if the plan is sponsored by another employer—is independently responsible for filing the forms; however, a third party may file on behalf of the employer. NOTE: Employers that contribute to multi-employer plans are not obligated to satisfy the Code Section 6055 requirements for employees covered by the multi-employer plan; the administrator of the multi-employer plan is obligated to satisfy the Code Section 6055 requirements for employees of employers covered by the multi-employer plan. Caution: Don’t confuse a multi-employer plan with a multiple employer welfare arrangement (MEWA). In the latter situation, each employer that participates in a self-insured MEWA retains the Code Section 6055 reporting obligation.

- All individuals covered under the plan for at least one day during the year must be identified, including current employees, former employees and dependents. Unlike the Code Section 6056 requirements, the Code Section 6055 requirements extend beyond employees who qualify as full time; it applies to any individual covered under the plan. Caution: Employers are generally required to provide the dependent’s social security number; however, there is a specific process whereby the employer is able to use the dependent’s date of birth if the employer that follows the process is unable to obtain the social security number.

- Employers that sponsor self-insured plans and are also ALEs will satisfy their Code Sections 6055 and 6056 obligations on the same form—Form 1095-C. Caution: The IRS has informally indicated that the employer may have to report coverage elected by a former employee (and his/her family members) and any independent contractors on Form 1095-B as opposed to Form 1095-C.

- One additional late November change that has garnered a great deal of attention is regulations that address how employer credits should be considered for purposes of determining affordability for purposes of determining eligibility for the individual premium subsidy. For purposes of affordability determinations under the ACA’s individual shared responsibility provisions, the employee’s required contribution is reduced by any contributions made by an employer under a cafeteria plan that the employee:

- may not opt to receive as a taxable benefit;

- may use to pay for minimum essential coverage; and

- may use only to pay for medical care within the meaning of Code Section 213.

While IRS regulations do not specifically address how employer contributions that an employee may elect to use for health coverage are treated under the employer responsibility provisions, we do not see any reason why a different interpretation would apply. In addition, this has caused some employers to consider whether cashable credits provided by an employer would increase the employee’s required contribution for affordability purposes. More guidance on this issue would be helpful.

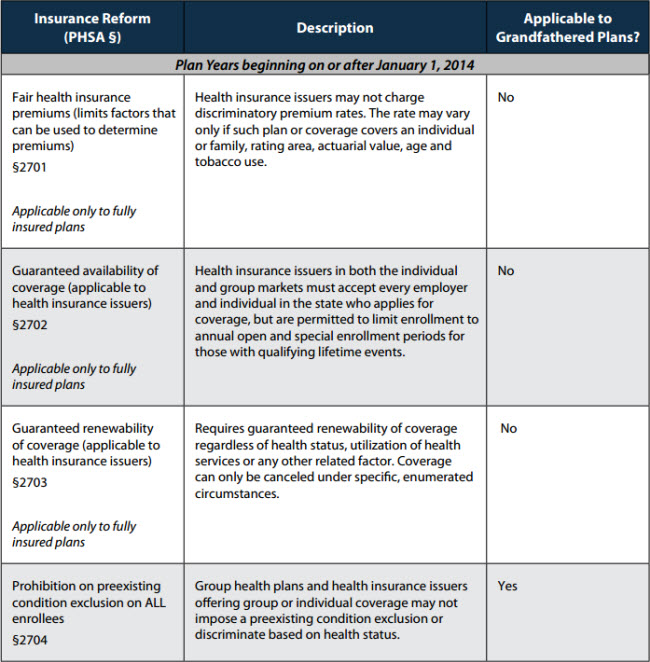

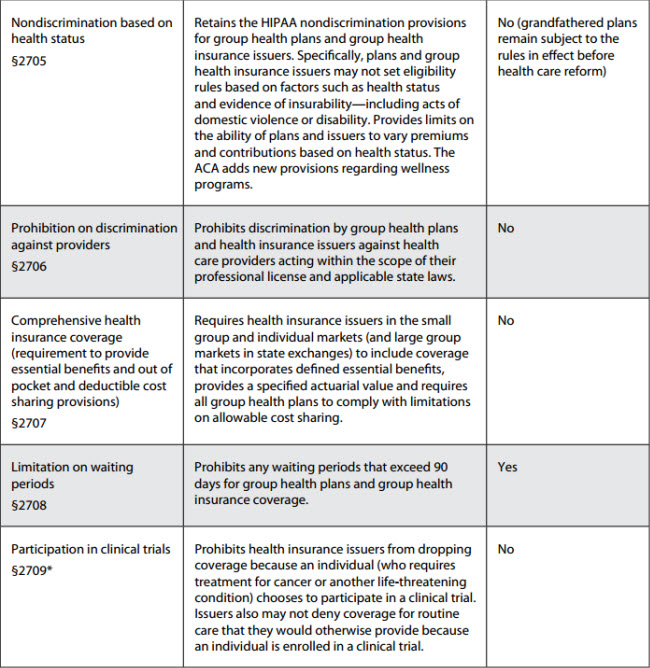

- 2014 Health Insurance Reforms. Various health insurance reforms were added by the ACA to Section 27 of the Public Health Service Act (PHSA) (and also ERISA Section 715 and Code Section 9815). The reforms apply to all group health plans other than plans that provide only “excepted benefits” or plans that have fewer than two active employees participating in the plan on the first day of the plan year (“stand alone retiree plan”). Although some of the reforms went into effect for plan years beginning on or after September 23, 2010, some went into effect for plan years beginning on or after January 1, 2014. See Appendix A for a recap of the 2014 health insurance reforms.

- Two of the 2014 reforms received the bulk of attention from the agencies during the year: the waiting period limitation and out of pocket maximum requirements.

- The agencies issued final regulations under PHSA Section 2708, which generally limits waiting periods for otherwise eligible individuals to 90 calendar days. The regulations clarify that terms of eligibility generally cannot be based solely on the passage of time (e.g., continuous days of employment) but that eligibility based on accumulated hours (not to exceed 1,200) or a “measurement period” are permissible. Additional regulations issued by the agencies in 2014 further clarify that employers may implement a 30-day “orientation” period for an employee who otherwise satisfies the eligibility requirement after which the waiting period can begin.

- The agencies also issued a series of FAQs (FAQs XIX and XXI) addressing the application of the out of pocket requirements for “reference based pricing arrangements.” Generally, the out of pocket maximum imposed by the ACA applies to all cost sharing for services or treatments provided by network providers; cost sharing for out of network providers do not have to be applied to the out of pocket maximum. The agencies attempted to clarify the application of the out of pocket rules to reference based pricing arrangements. Generally, reference based pricing arrangements identify an amount that will be paid or allowed by the plan for a particular service or treatment. According to the FAQs, plans may treat providers who accept the plan’s reference based pricing as the only network providers as long as certain conditions are satisfied. If the conditions are satisfied, then all services or treatments provided by providers who do not accept the plan’s reference based pricing—including “network providers”—can be treated as out of network, and the cost sharing for such services falls outside the out of pocket maximum limitation. Finally, regulations issued in late November request comments on whether plans should be limited to the self-only out of pocket maximum for individual family members (i.e., an embedded out of pocket maximum).

- Employer’s Payment or Reimbursement of Individual Market Coverage: Following on the heels of guidance issued in 2013 (e.g., Notice 2013-54), the agencies issued FAQs in 2014 (Part XXII) that confirm what many already knew: it is a violation of PHSA Section 2711’s prohibition against annual dollar limits on essential health benefits for an employer to pay or reimburse an employee’s premiums for major medical coverage purchased in the individual market, including the Marketplace. This is true whether the reimbursement is tax free under Code Section 106 or taxable. Caution: Employers that condition the taxable payment on receiving coverage would run afoul of the rules. In order to avoid running afoul of the DOL safe harbor, employers could only give employees taxable dollars and hope that they enroll in coverage. The agencies further clarified that plans would violate HIPAA’s nondiscrimination provisions if they attempt to offer unhealthy individuals a choice between coverage under the plan or additional taxable cash.

- New Preventive Care Requirements: The agencies issued an FAQ in 2014 regarding the scope of smoking cessation coverage that the agencies believe a non-grandfathered plan must provide to satisfy the preventive care requirements in PHSA Section 2713. See FAQs XX and XXI. In addition, a number of new or modified preventive care requirements go into effect for plan years beginning in 2014 and 2015. For example, an additional change to the preventive care guidelines will require certain cancer drugs to be covered as preventive care beginning January 1, 2015, for calendar year plans. See FAQs XVIII. NOTE: A new or revised recommended preventive service or treatment goes into effect with the plan year that begins at least one year after the date the recommendation is issued. Moreover, recommendations issued in a month are considered issued on the last day of that month. Thus, a recommendation issued in June 2013 would apply to plans for plan years beginning on or after July 1, 2014.[1]

- Hobby Lobby Contraception Case: In 2014, the Supreme Court ruled that the ACA’s requirement for non-grandfathered plans to cover certain contraceptives violated the First Amendment rights of for-profit corporations established and maintained based on religious beliefs that are inconsistent with such requirements. The agencies subsequently established processes whereby such corporations would be exempt from the contraceptive coverage requirements.

- Transitional Reinsurance Fee Registration and Payment: The ACA added the transitional reinsurance fee to assist insurers offering coverage in the Marketplace with absorbing the additional costs associated with high risk claimants. Self-insured health group plans and insurance carriers that provide coverage for fully insured plans are responsible for paying this annual fee for 2014, 2015 and 2016. Registration for payment was initially required by November 17 (first weekday after November 15), 2014; however, on November 14 the Centers for Medicare and Medicaid Services (CMS) announced a delay until December 5 for reinsurance fee registration (See http://www.cms.gov/CCIIO/Programs-and-Initiatives/Premium-Stabilization-Programs/The-Transitional-Reinsurance-Program/Reinsurance-Contributions.html). The total payment for 2014 is $63.00 multiplied by the average number of covered lives during the first three quarters of the year; however, the payment consists of two components: a component for reinsurance and another for the general Treasury fund. Each component is due on separate dates. The reinsurance component of the fee is $52.50 multiplied by the average number of covered lives and is due no later than January 15, 2015. The Treasury component is $10.50 multiplied by the average number of covered lives and is due by November 15, 2015. Although plans and carriers may choose to pay the fee in two installments, they may also choose to pay the entire fee by the January 15 deadline if desired. NOTE: HHS has already indicated that the total fee due for 2015 is $44.00 and the total fee for 2016 is $27.00.

In addition, HHS issued regulations this year that clarified critical aspects of the requirements, such as:- Plans and insurers need only count individuals covered by major medical plans that provide minimum value.

- Individuals covered by plans that are secondary to other primary plans also do not have to be counted (e.g., a spouse who is also covered by the spouse’s employer’s plan).

- Health Plan Identifier Number: The ACA also required health plans with annual receipts of more than $5 million to obtain a health plan identifier number (HPID). Regulations originally issued by HHS required plans with at least $5 million in gross receipts to obtain the HPID by November 5, 2014, and all other health plans to obtain the HPID by November 5, 2015. However, on October 31, 2014, CMS announced that it is suspending enforcement of the HIPAA HPID requirement until further notice. The statement is on the CMS website at http://www.cms.gov/Regulations-and-Guidance/HIPAA-Administrative-Simplification/Affordable-Care-Act/Health-Plan-Identifier.html. Caution: The impact of this delay on HIPAA’s electronic data interchange (EDI) certification requirements (late in 2015) is currently not clear.

- Revised PCORI Fee: Another fee added by the ACA was the Patient-Centered Outcomes and Research Institute (PCORI) fee. The fee is imposed on health insurance issuers that insure group health coverage and sponsors of self-insured group health plans. The fee was first payable for plan years ending on or after October 1, 2013, and will be payable for each plan year thereafter that ends on or before October 1, 2019. The IRS issued guidance in 2014 indicating that the PCORI fee due for plan years ending on or after October 1, 2014, and prior to October 1, 2015, is $2.08 (up from $2.00). NOTE: Don’t forget that the PCORI fee is due by July 31 following the plan year for which the payment is due.

- Minimum value rules for plans that don’t provide hospital coverage: The IRS issued Notice 2014-69, which closed the loophole that allowed group health plans that do not provide substantial inpatient and/or physician care to qualify as minimum value coverage. If there was a binding written commitment prior to November 4, 2014, to offer the plan, or enrollment had already started, and the plan year began on or before March 1, 2015, the plan would continue to be treated as providing minimum value (according to the MV calculator or an actuary) for 4980H purposes (and only 4980H purposes) until the end of the plan year in which the final regulations are issued (expected to be in early 2015). Otherwise, such a plan would qualify as providing minimum value only until the final regulations are issued. Notwithstanding the treatment of such plans for 4980H purposes, such plans will not be treated as providing minimum value for purposes of an individual’s eligibility for a premium subsidy or tax credit in the Marketplace. Caution: If communications have already been provided that such plans will disqualify an individual from receiving a subsidy, additional communications are required to clarify the treatment of such coverage for purposes of premium tax/subsidy eligibility.

- Excepted Benefits: Certain benefits are exempt from many of the ACA’s requirements, including the health insurance reforms. On October 1, the agencies issued regulations that clarified the excepted benefit status of certain benefits such as dental and vision plans. The regulations also prescribe the rules for employee assistance plans to qualify as an excepted benefit. More specifically:

- Dental and vision plans qualify as excepted benefits if participants in an employer’s primary health care plan are allowed to decline the benefits; or

- The claims for the benefits are administered under a separate contract from claims administration for any other benefits (presumably health) under the plan.

- Employee Assistance Plans: EAPs qualify as excepted benefits if:

The EAP doesn’t provide significant benefits in the nature of medical care;

The benefits can’t be coordinated with the benefits under another group health plan;

No employee contributions are required as a condition of participation; and

The EAP imposes no cost sharing requirements.

- Two of the 2014 reforms received the bulk of attention from the agencies during the year: the waiting period limitation and out of pocket maximum requirements.

Cafeteria Plans

The IRS issued guidance in 2014 regarding several aspects of cafeteria plan administration (some of which is ACA driven), including:

- Two New Permissible Election Changes: The IRS issued Notice 2014-55, which creates two new permissible election changes. According to Notice 2014-55, cafeteria plans are allowed, but not required, to permit plan participants to revoke their group health plan coverage and elect other minimum essential coverage in the following situations:

- An employee who was expected to average 30 hours of service or more per month experiences an employment status change such that the employee is no longer expected to average 30 hours or more each month but does not otherwise lose eligibility under a group health plan that provides minimum essential coverage.

- An employee is eligible to enroll in a qualified health plan offered in the Marketplace during the Marketplace’s special or annual election period.

Plans that wish to permit these election changes must amend their plan by December 31, 2015, or if later, the end of the plan year in which the changes are allowed. Employers that permit these election changes must notify participants of the new election change provision in order for the amendment to be effective. - Pay and Chase Procedures: A Chief Counsel’s Memorandum (CCM) issued in 2014 clarified the procedures required to chase overpayments of health flexible spending accounts (FSAs). The CCM also clarified that failure to recover the overpayment results in income to the participant that must be reported on a W-2.

- Impact of Carryover on HSA eligibility: A second CCM issued in 2014 clarifies the impact Health FSA carryovers have on health savings account (HSA) eligibility. The CCM also provides options for plans that are designed to facilitate HSA eligibility despite the existence of a carryover (e.g., the employee may choose to opt out or can convert to a limited purpose carryover if the employer otherwise has a limited purpose Health FSA).

- Deadline to Amend Plans to Add Carryover: Employers that added a carryover provision to their Health FSA for 2014 have until the end of 2014 to officially amend their plans to add the carryover.

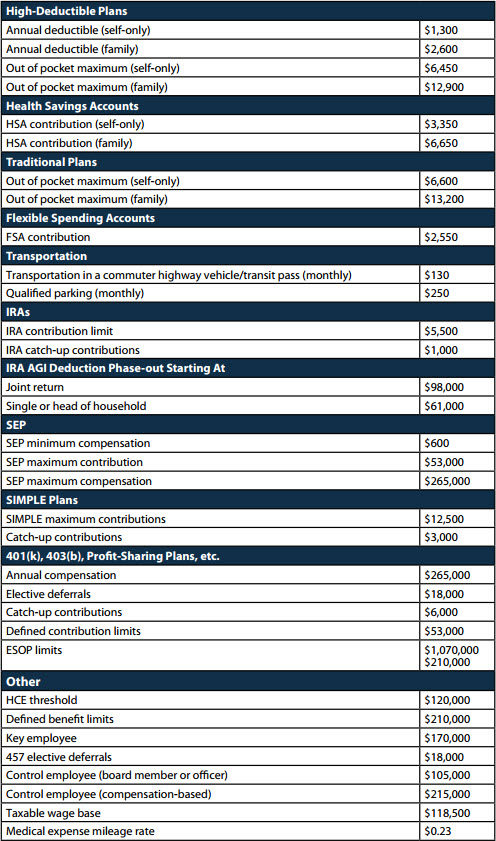

- Deadline to Amend Health FSA Plans for $2,500 Salary Reduction Cap and Increase in $2,500 Limit to $2,550. Plan sponsors that have not yet formally amended their plans for the ACA’s $2,500 salary reduction cap for Health FSAs must amend their plans by the end of 2014. Also, the $2,500 amount has been increased to $2,550 for 2015 (See the COLA Appendix attached to this article).

Mental Health Parity and Addiction Equity Act

The final regulations under the Mental Health Parity and Addiction Equity Act (MHPAEA) became effective for plan years beginning on or after July 1, 2014. The final regulations made a number of clarifications regarding the application of the MHPAEA, including the application of the rules to non-quantitative treatment limitations.

The agencies also issued several FAQs (FAQs XVII and XVIII) and an overhauled self-compliance tool in 2014.

ADA and GINA

In 2014, the Equal Employment Opportunity Commission (EEOC) made news when it sued Honeywell over its wellness program. The EEOC claims that Honeywell’s wellness program violates both the ADA and Genetic Information Nondiscrimination Act (GINA). Honeywell’s wellness program imposes premium surcharges for employees and spouses who fail to complete the biometric screen and/or use tobacco. The EEOC claims that imposing a penalty on employees for failing to complete the screening violates the ADA’s prohibition against “involuntary” post-hire medical inquiries. The EEOC further claims that imposing penalties for failure to provide a spouse’s information is a violation of GINA’s prohibition against requesting a family member’s medical history. The EEOC requested a temporary restraining order from the district court, which was denied. It remains to be seen how this case will come out.

Transit Guidance

The IRS issued Rev. Rul. 2014-32, which addresses the use of smart cards and other electronic media as “fare media” for transit passes. The rule creates doubt about the permissibility of cash reimbursement of transit passes in some areas where smart cards and certain types of terminal restricted cards are otherwise “readily” available.

Cost of Living Adjustments

Attached as Appendix B is a list of the cost of living adjustments issued this year for next year.

Appendix A

2014 Health Insurance Reforms

* Due to drafting errors, there are two Sections 2709 of the PHSA after ACA. The section referred to in the table is a new section. The other Section 2709 (relating to disclosure of information) is renumbered from prior law PHSA Section 2713. Grandfathered plans remain subject to the pre-ACA requirements that are still in effect.

Appendix B

Cost-of-Living Adjustments for 2015

This advisory is published by Alston & Bird LLP’s Employee Benefits & Executive Compensation practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.