On February 23, 2015, the IRS issued Notice 2015-16 (the “Notice”),[1] which provides important insight (and requests public comment) on positions the IRS may take on Code § 4980I (often referred to as the “Cadillac Plan tax”). Interested parties may submit comments to the IRS by May 15, 2015. Employers, insurers and third-party administrators should begin now to plan their compliance strategies for this confiscatory excise tax.

Code § 4980I, which was added by the Affordable Care Act (ACA), imposes a 40 percent excise tax on any “excess” health benefit provided to an employee (including former employees and retirees). The tax is not deductible for federal income tax purposes. “Excess benefit” is defined as the excess (if any) of the “aggregate cost of the applicable coverage” over the “applicable dollar limit” for an employee for the month. The Notice primarily addresses the definition of applicable coverage, how to determine the cost of applicable coverage and the application of the annual dollar limit to the cost of applicable coverage.

The Notice is the first step in the formal process that will ultimately lead to regulations. The Notice is not guidance, i.e., cannot be relied upon, but does provide valuable insights on the IRS thinking on the tax. The IRS intends to issue another, similar request for comments on other issues, including procedural issues on calculation and assessment of the tax. After comments on the two notices are reviewed, proposed regulations will then be issued (which will also be open for comment).

What Is Applicable Coverage?

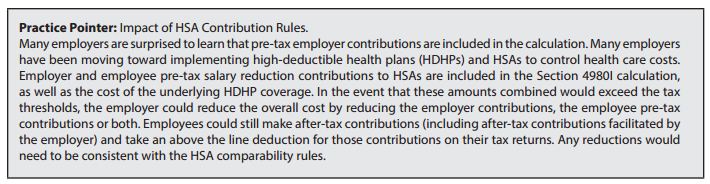

The tax applies to “applicable employer sponsored coverage.” Applicable employer-sponsored coverage (“applicable coverage”) includes group health plans (as defined in Code § 5000) sponsored by all employers, including private, governmental, nonprofit and church-based employers, and applies to both self-funded and fully insured coverage. Further, with a limited exception for fixed indemnity coverage and specified disease coverage provided on an after-tax basis, the full actuarial value of the cost of coverage, determined in a manner similar to COBRA premiums, is considered, whether paid for by the employer or by the employee on a pre- or post-tax basis. The Notice details, and to some extent clarifies, which health-related benefits are “applicable coverage” for purposes of the statute.[2] While most employers recognize that their primary health coverage is considered, other types of coverage also are taken into account. We have included below a high-level overview of the types of health benefits that the Notice indicates will be included in the definition of applicable coverage.

How Is the Cost of Applicable Coverage Determined?

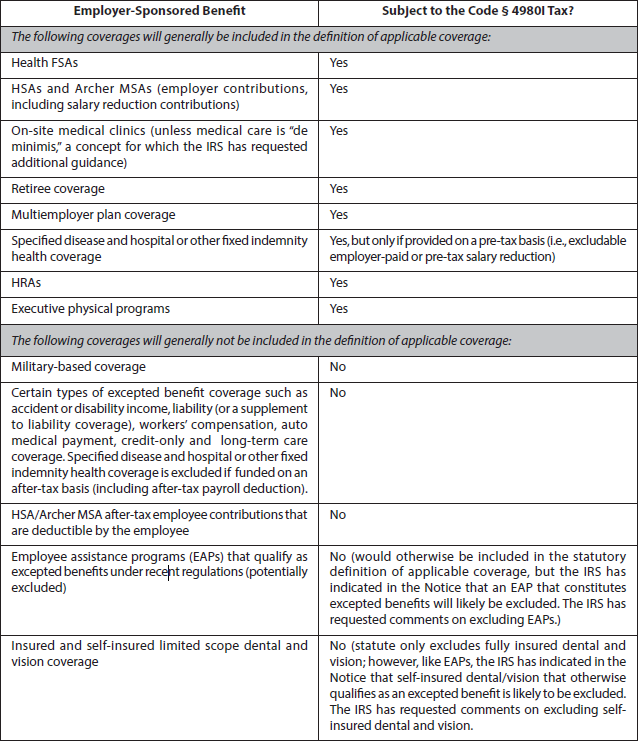

The cost is calculated on a monthly basis, based on the coverage in which the employee is actually enrolled, and is determined separately for self-only and other-than-self-only coverage. The IRS intends this process to be similar to the COBRA premium determination process (particularly the concept of “similarly situated individuals”). There are special rules for self-insured plans and various types of account-based plans (e.g., health FSAs, HRAs, HSAs and Archer MSAs).

The Notice outlines a number of possible approaches to determining cost, some of which the IRS indicates may apply for COBRA purposes, and some of which may be limited to the 4980I tax. For example, the cost of self-only and other-than-self-only coverage must be determined separately for purposes of the 4980I tax.

How Is the Annual Dollar Limit Applied to the Cost of Coverage?

The annual dollar limit differs for self-only and other-than-self-only coverage. The statutory dollar limits are set at $10,200 and $27,500, respectively; however, these limits will be adjusted before they go into effect in 2018 by a specified health cost factor. After 2018, the limits will be adjusted for cost-of-living adjustments. In addition, adjustments are permitted based on the employee population’s age and gender mix, the high-risk status of the employee population (categories of which are listed in the statute) and retiree status. Note that the other-than-self-only limit applies to multiemployer plan coverage.

Calculation and Payment of the Tax

If triggered, the tax is paid by:

- The insurer, for fully insured coverage;

- The employer, for employer or salary reduction contributions to an HSA or Archer MSA; and

- The “person who administers the plan benefits” for other coverage (e.g., self-insured coverage, including FSA

and HRA coverage).

Regardless of the entity responsible for paying the tax, the employer is responsible for calculating any excess benefit

subject to the tax and notifying the entity (or entities) responsible for paying the tax. The employer can be subject to

penalties for incorrectly calculating the excess benefit. In the case of multiemployer plan coverage, the plan sponsor

(generally, the joint board of trustees) is responsible for calculating the excess benefit.

Issues relating to calculation and payment of the tax are expected to be addressed by the IRS in another notice.

What Should Plan Sponsors Do Now?

The 2018 effective date for the so-called “Cadillac Plan tax” may seem far away and, given current legislative proposals

surrounding the ACA and tax reform, it is always possible that the tax may be amended, repealed or replaced before

it goes into effect. However, such possible future developments are speculative at this point. Given the thresholds

for the tax, the term “Cadillac” and the luxury it implies is a misnomer. Many plans may be caught. Triggering the tax

may also have implications for financial statements.

It’s not too early for plan sponsors to be thinking about plan design over the long term and, particularly, to be aware

of benefits that will, or won’t, be captured by the so-called Cadillac Plan tax.

2015 Benefits Checkup

With constant regulatory changes in health and welfare benefits, it’s important for plan sponsors to evaluate whether

their benefits compliance is on track and make any necessary changes. Pressing issues for 2015 include making the

necessary offers of coverage to full-time employees to avoid penalties under Code § 4980H, preparing for Code §§

6055 and 6056 reporting in early 2015 for offers of coverage and the provision of minimum essential coverage, and

deciding whether to incorporate the cafeteria plan changes set forth in IRS Notice 2014-55. If you missed our 2014

year-end checklist, you can find it here.[3] Contact your Alston & Bird attorney if you have any questions about ACA or

general employee benefits compliance.

[1] The Notice can be found here: http://www.irs.gov/pub/irs-drop/n-15-16.pdf.

[2] “Applicable coverage” is defined as coverage under an employer-sponsored group health plan that is excludable from an employee’s gross income under Code § 106 (or would be excludable if it were employer-sponsored coverage).

[3] http://www.alston.com/advisories/welfare-plan-year-end/.

This advisory is published by Alston & Bird LLP’s Employee Benefits & Executive Compensation practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.