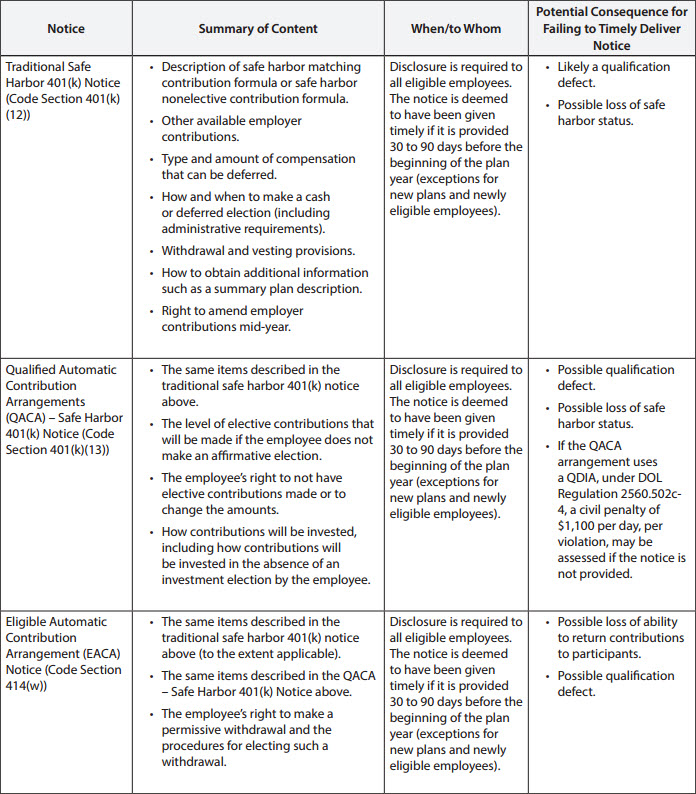

Plan sponsors of defined contribution qualified plans may need to issue one or more annual notices to participants before the end of each plan year. Failure to issue a required annual notice can have significant consequences. For example, if a plan sponsor forgets to issue the annual 401(k) safe harbor notice, the plan could lose its safe harbor status and be forced to limit (or refund) contributions by highly compensated employees.

This advisory serves as a reminder of the multiple year-end notices that defined contribution plans must issue to participants. These notices must be distributed within a reasonable period of time, typically 30 days, prior to the start of the plan year.

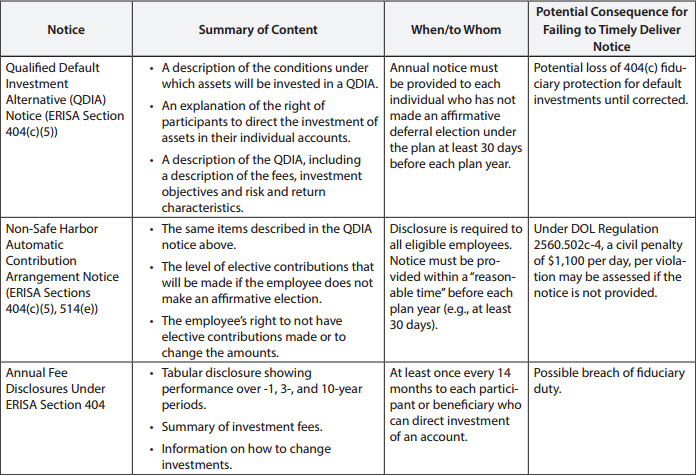

The following table provides a list of the content and deadlines for the most common notices that plan sponsors may need to distribute. It includes:

- Traditional Safe Harbor 401(k) Notice

- Qualified Automatic Contribution Arrangements (QACA) for a Safe Harbor 401(k) Notice

- Eligible Automatic Contribution Arrangement Notice

- Qualified Default Investment Alternative Notice (QDIA)

- Non-Safe-Harbor Automatic Contribution Arrangement Notice

- Annual participant fee disclosures