Over the last six years, employers and insurers have been working diligently to adapt to the ever-changing landscape under the Affordable Care Act. Meanwhile, the agencies have also issued comprehensive regulations under the Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (MHPAEA) that have gone largely unnoticed. But the lack of notice may quickly be changing. Recently, we have seen a significant increase in Department of Labor (DOL) investigations and enforcement of the MHPAEA. Employers and insurers would be wise to redouble their compliance efforts in this area.

Background

The MHPAEA amended Section 712 of ERISA, Section 2705 of the Public Health Services Act and Section 9812 of the Internal Revenue Code, and is designed to require true benefit parity (and then some) between medical and surgical benefits and mental health and substance abuse benefits. The MHPAEA applies to mental health and substance abuse benefits offered in connection with group health plans. If a plan provides medical/surgical benefits and mental health or substance abuse benefits, the plan must provide parity with respect to (1) financial requirements (e.g., deductibles, copayments, coinsurance and out-of-pocket maximums); (2) quantitative treatment limitations (e.g., number of visits or treatments or days of coverage); and (3) nonquantitative treatment limitations (NQTLs)(e.g., medical management standards).

The MHPAEA generally became effective for plan years beginning on or after October 3, 2009 (January 1, 2010, for calendar year plans). The effective date was delayed for some union plans until the collective bargaining agreement in place at that time terminated. For years before 2010, the Mental Health Parity Act (MHPA), the precursor to the MHPAEA, applied. The MHPA’s more limited equality provisions required parity between annual and lifetime dollar limits applicable to medical benefits and mental health/substance abuse benefits.

What’s Required Under the MHPAEA?

The MHPAEA established complicated testing requirements to determine whether financial requirements and quantitative treatment limitations on mental health and substance abuse benefits are applied in a manner consistent with corresponding medical benefits. A full discussion of those requirements is beyond the scope of this advisory, but such testing requires a full analysis of claims treatment under the plan in each of six separate classifications:

- Inpatient, in-network;

- Inpatient, out-of-network;

- Outpatient, in-network;

- Outpatient, out-of-network;

- Emergency care; and

- Prescription drugs.

If a “type” of financial requirement or treatment limitation (such as a copayment) applies to at least two-thirds of the medical/surgical benefits in a “classification” (or subclassification) of benefits, the application of that financial requirement or treatment limitation to mental health or substance abuse benefits in that same classification (or subclassification) cannot be more restrictive than the “predominant” financial requirements or treatment limitations that apply to the plan’s medical/surgical benefits.

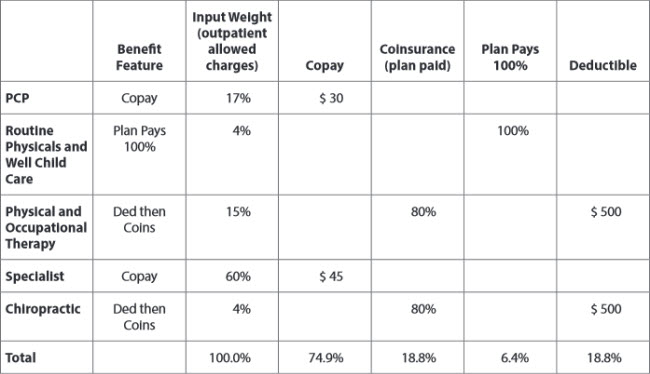

Let’s look at an example to demonstrate how this works. Suppose a plan covers the following outpatient, in-network medical benefits with total claims as shown:

The copay “type” of financial requirement applies to more than two-thirds of the claims in this classification. And within the copay type, the $45 copay level is the predominant level, since at least 50% of the claims fall within that level.

In our example, outpatient, in-network mental health/substance abuse benefits must be subject to a copay of $45 or less. Coinsurance may not apply to mental health/substance abuse benefits in this classification.

For most plans, insurers and third-party administrators (TPAs) have performed this test to determine the necessary design for compliance. We further understand that many insurers/TPAs performed this testing in prior years across their book of business, rather than on a plan-by-plan basis. This last point is the important point for purposes of the recent audit scrutiny.

DOL Guidance and Investigation Activity

Many plans relied on data across their insurer/TPA’s book of business to determine compliance. However, there was some indication that plan-specific testing was required based on the final MHPAEA regulations. On April 20, 2016, the DOL, IRS and HHS (the “Agencies”) issued FAQ guidance that addressed this issue. In Q8 of the FAQ, the agencies stated that a plan or issuer cannot base its analysis on an insurer’s entire overall book of business for the year. To the extent plan-specific data is available, each self-funded and fully insured plan must use such data in making their compliance projections. Insured small group and individual market plans are subject to slightly different rules for conducting plan-level tests.

We have recently become aware of several plan investigations in which the DOL has alleged compliance violations with this plan-specific testing requirement. This suggests that the DOL will attempt to enforce the plan-specific testing requirements for prior years, notwithstanding the recent nature of its FAQ guidance.

Take the Opportunity to Review Your Plan for Other Aspects for MHPAEA Compliance

Financial requirements and quantitative treatment limitations are not the only plan design issues that should be reviewed. Plan sponsors may also want to review their plans’ nonquantitative treatment limitations (NQTLs) to ensure they are also compliant. The Agencies recently issued guidance to assist plans with identifying NQTLs that could run afoul of the MHPAEA.

Federal MHPAEA regulations contain an illustrative, nonexhaustive list of NQTLs, which include:

- Medical management standards limiting or excluding benefits based on medical necessity or medical appropriateness or based on whether the treatment is experimental or investigative (including standards for concurrent review).

- Formulary design for prescription drugs.

- Network tier design.

- Standards for provider admission to participate in a network, including reimbursement rates.

- Plan methods for determining usual, customary and reasonable charges.

- Fail-first policies or step therapy protocols.

- Exclusions based on failure to complete a course of treatment.

- Restrictions based on geographic location, facility type, provider specialty and other criteria that limit the scope or duration of benefits for services provided under the plan or coverage.

The agencies’ outline of potential problem practices should be carefully reviewed.

Penalties

Potential enforcement actions should be cause for concern for employers and insurers, as significant excise taxes can arise under Code Section 4980D. Under Section 4980D, a plan sponsor, including a plan sponsor of a fully insured plan if the employer has 50 or more employees, may be liable for up to a $100 per day, per affected beneficiary excise tax if the plan fails to comply with the MHPAEA. Thus, plan sponsors who may have relied on an insurer/ASO provider’s book of business calculation to set its financial requirements and quantitative treatment limitations may be at risk for significant excise taxes if later testing reveals that the financial requirements and quantitative limitations would not satisfy the requirements when only plan-specific claims are used. Plans may also be at risk of excise taxes if the plan is unable to provide evidence that the plan’s nonquantitative treatment limitations comply with the MHPAEA. In addition to the IRS taxes, participant claims may be asserted and the DOL might choose to sue employers for breach of fiduciary duty based on their failure to comply with the MHPAEA.

Summary

The DOL is actively investigating plans for compliance with the MHPAEA; this is not a theoretical problem. Employers and insurers should take heed and begin reviewing their plan designs for prior years to determine whether they have any potential liability.

This advisory is published by Alston & Bird LLP’s Employee Benefits & Executive Compensation practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.