Plan sponsors of defined contribution qualified plans may need to issue one or more annual notices to participants before the end of each plan year. Failure to issue a required annual notice can have significant consequences. For example, if a plan sponsor forgets to issue the annual 401(k) safe harbor notice, the plan could lose its safe harbor status and be forced to limit (or refund) contributions by highly compensated employees.

This advisory serves as a reminder of the multiple year-end notices that defined contribution plans must issue to participants. These notices must be distributed within a reasonable period of time, typically 30 days, prior to the start of the plan year. Note that plan sponsors can generally use a single notice to satisfy many of these requirements.

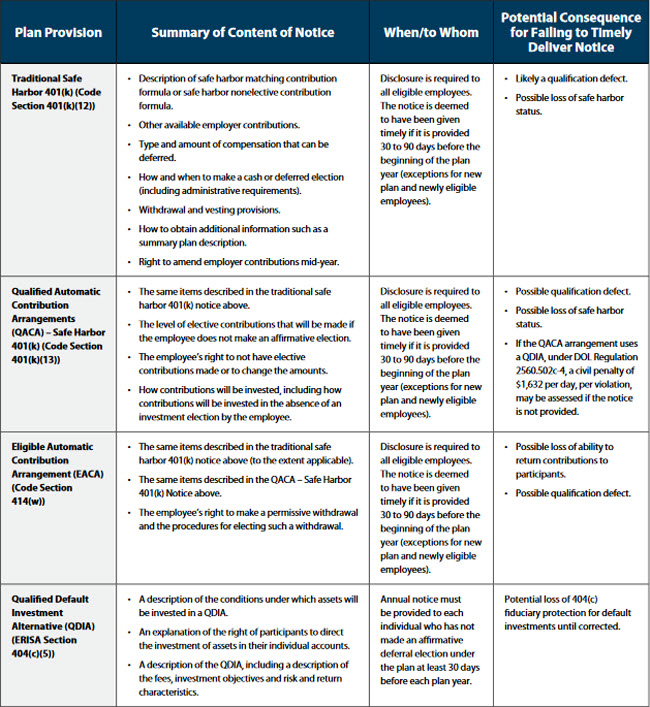

The following table provides a list of the content and deadlines for the most common notices that plan sponsors may need to distribute. It includes:

- Traditional Safe Harbor 401(k) Notice

- Qualified Automatic Contribution Arrangements for a Safe Harbor 401(k) Notice

- Eligible Automatic Contribution Arrangement Notice

- Qualified Default Investment Alternative Notice (QDIA)

- Non-Safe-Harbor Automatic Contribution Arrangement Notice

- Annual participant fee disclosures (each plan will have a different deadline for this notice, and the deadline is different each year)

|

Important News…IRS Announces 2017 Retirement Plan Limits

Please contact your Alston & Bird attorney if you have any questions about the 2017 plan limits. |

.jpg)

Special Consideration for Safe Harbor Plans

Prior to 2016, the IRS took a position that most mid-year changes to safe harbor plans were impermissible. However, this year the IRS issued new guidance (Notice 2016-16) significantly relaxing this position.

Under the new guidance, many changes to safe harbor plan terms after the start of the plan year will be permitted (and will not result in a loss of safe harbor treatment). However, if the mid-year change affects something described in the plan’s safe harbor notice, participants must be provided with a new safe harbor notice, generally 30 to 90 days in advance of the change.

While this significantly expands a plan sponsor’s ability to amend a safe harbor plan, the new guidance lists a few amendments that will not be permitted. For example, plans cannot be amended to change the type of safe harbor used, to narrow the group of employees eligible to receive a safe harbor contribution, or to increase vesting conditions for nonelective contributions under a nonelective contribution safe harbor plan. Also, existing plans cannot be amended to become a safe harbor plan after the start of the plan year. Additionally, safe harbor plans can be amended to add or increase matching contributions only during the first nine months of the plan year and only if the change is retroactive to the start of the plan year.

The new IRS guidance does not provide for the reduction or elimination of employer safe harbor contributions; however, prior guidance does permit this type of change mid-year as long as the safe harbor notice clearly reserves the employer’s right to change these contributions. We suggest adding this language to your safe harbor notice to preserve this option.

Even with the revised IRS position, changes to safe harbor plan provisions can have unintended consequences. We recommend consulting the plan’s legal advisor before modifying any safe harbor plan provisions, particularly if those provisions are described in the plan’s safe harbor notice.

Practice Pointers

- In addition to the year-end notices described above, there are several additional notices that must be provided from time to time. These include Summaries of Material Modifications (SMMs), Summary Annual Reports (SARs) and notices regarding changes to investment funds.

- Plan sponsors can generally combine multiple notices in a single notice.

- These and other notices may also require distribution during the plan year to newly eligible participants or rehired participants.

- Sponsors of defined contribution plans may also have other notices they must provide participants, such as diversification notices (ERISA Section 101(m), IRC Section 401(a)(35)) and quarterly or annual participant statements (ERISA Section 105(a)).

Please do not hesitate to contact your Alston & Bird attorney if you have any questions about notice obligations or if we can assist you in providing proper notices for your qualified retirement plan.

* This deadline applies to calendar-year plans. Non-calendar-year plans have similar requirements, though their deadlines may be different.

This advisory is published by Alston & Bird LLP’s Employee Benefits & Executive Compensation practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.