This advisory reminds qualified retirement plan sponsors of upcoming deadlines for amending qualified retirement plans and highlights other action items for plan sponsors to consider.

Qualified Plan Amendments

Amendments for changes in law

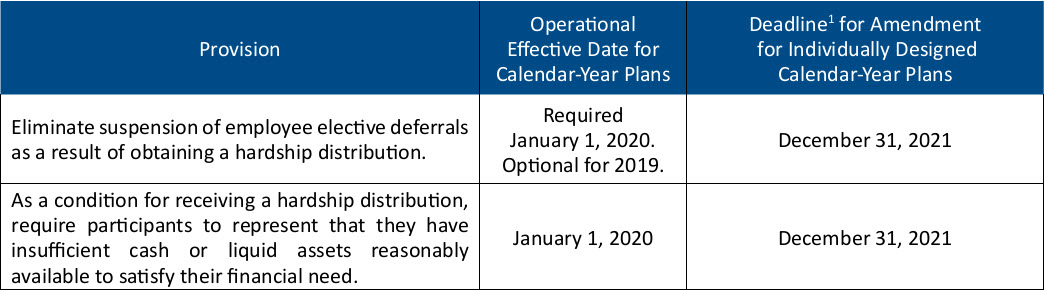

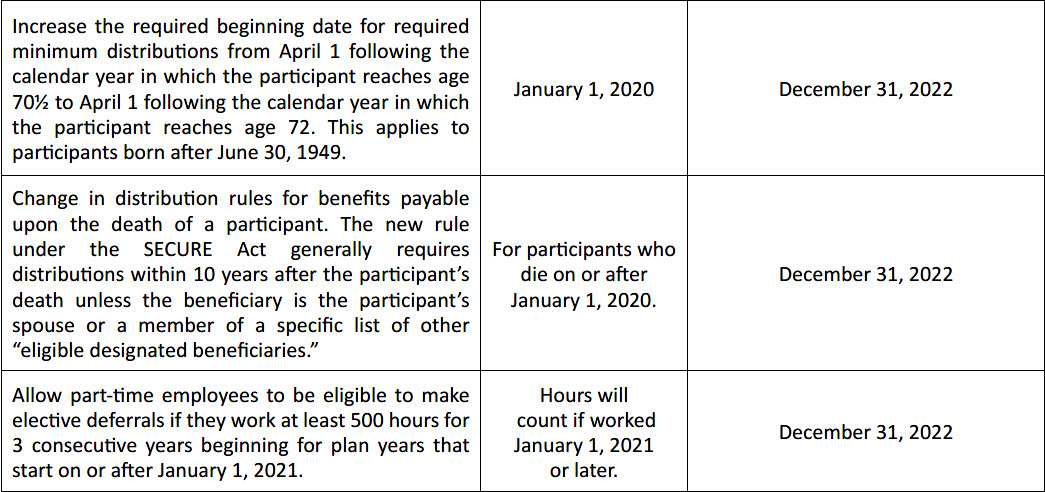

While most qualified retirement plan documents will need to be amended in the future and incorporate provisions of the SECURE Act, CARES Act, and final regulations issued under the Bipartisan Budget Act of 2019, the deadline for doing so will generally not occur until a future year (see the table below). Although amendments for these changes are generally not required by the end of 2020, these legal changes contained several provisions that were required to be implemented operationally effective January 1, 2020. Retirement plan sponsors should consider adding these changes to retirement plan documents even before the specific deadlines so that the retirement plan documents reflect the required operational changes.

Mandatory changes under the SECURE Act and hardship regulations

The following table outlines several of the mandatory provisions of the SECURE Act and the hardship regulations published by the IRS implementing changes under the Bipartisan Budget Act of 2019. This is not a complete summary, so we recommend that you consult your legal advisor to determine if your qualified retirement plans need other amendments.

In order to be prepared for implementation of the new requirements for long-term part-time employees beginning in 2024 (i.e., the earliest date a long-term part-time employee could have earned 500 hours of service for three consecutive years), plan sponsors may need to take steps now to ensure hours and eligibility are tracked correctly. Also, for plans that have historically used elapsed time for calculating service, the part-time employee rules may require coordination with recordkeepers to ensure that systems are in place starting January 1, 2021 to track hours for part-time employees. Note that although the new requirements do not require that service for years before January 1, 2021 be tracked for purpose of eligibility to make elective deferrals for long-term part-time employees, any service such employees completed before January 1, 2021 may still need to be counted for vesting purposes.

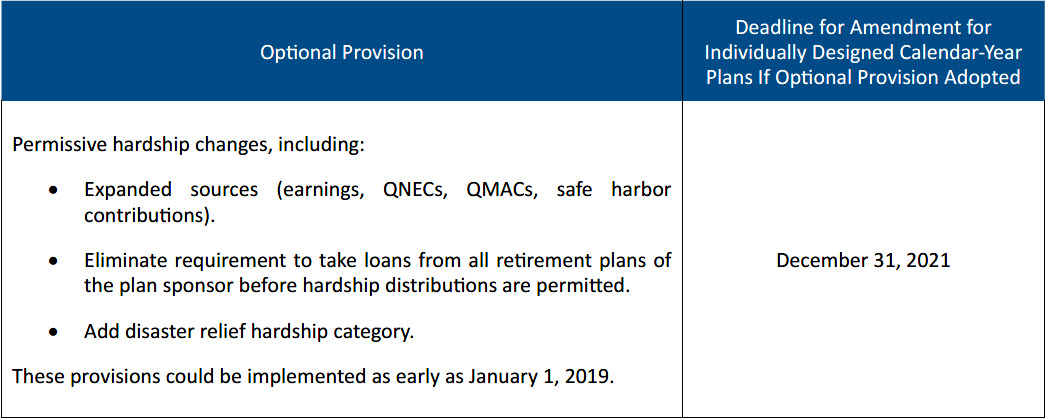

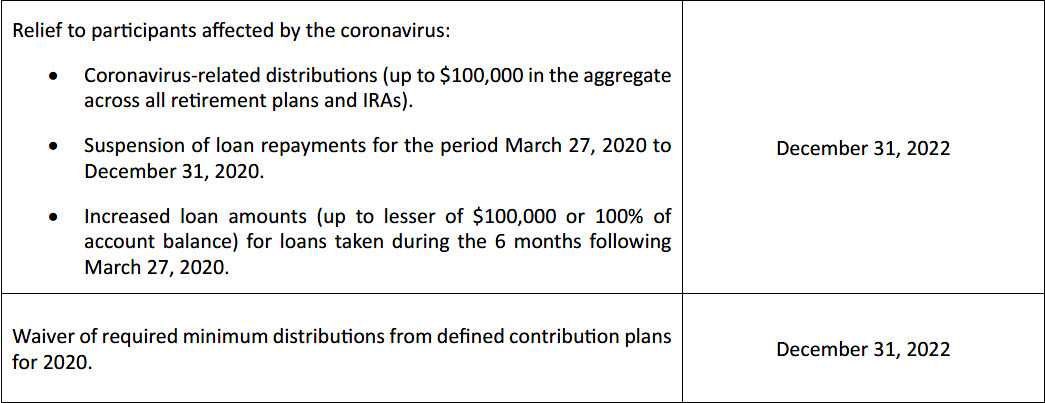

Optional changes under the SECURE Act, CARES Act, and hardship regulations

The following are some of the optional changes under recent legislation and guidance. Plan amendments are only required if these changes were implemented (or are implemented in the future).

Your qualified retirement plan may have implemented other provisions as well, such as special adoption or childbirth distributions or provisions allowing in-service distributions from a pension plan as early as age 59½. Consult your legal advisor to determine when you need to amend your qualified retirement plan to reflect these changes.

Discretionary amendments

Plan sponsors that have made discretionary changes to their qualified retirement plans or may have added operationally optional features other than those discussed above during 2020 (e.g., a plan loan feature) must ensure that the associated “discretionary” amendments are signed no later than December 31, 2020 (for calendar-year plans). If you have made any discretionary amendments to your qualified retirement plan, you should take some time to make sure they have been formally adopted by the end of the year.

Other Action Items

Considerations for safe harbor plans

In response to the coronavirus pandemic, many companies sponsoring safe harbor plans elected to reduce or suspend employer contributions to their qualified retirement plans, including in some cases a reduction or suspension of safe harbor contributions. Retirement plans that may have previously satisfied safe harbor requirements may need to conduct nondiscrimination testing for the 2020 plan year due to the reduction or suspension of employer contributions. If your qualified retirement plan did reduce or suspend employer contributions, and if you are planning to resume making employer contributions including safe harbor contributions for the 2021 plan year, you may need to take action before the end of 2020. For qualified retirement plans intending to satisfy safe harbor requirements, the required steps may vary based on whether the plan uses matching contributions or nonelective contributions to satisfy the safe harbor requirements.

For qualified retirement plans that will use matching contributions to satisfy the safe harbor requirements for the 2021 plan year, the plan will need to be amended by December 31, 2020. Additionally, participants should be sent their annual safe harbor notice no later than December 1, 2020. We recommend that the safe harbor notice highlight the plan sponsor’s ability to reduce or suspend safe harbor contributions in the future in case adjustments need to be made in 2021.

For qualified retirement plans that will use nonelective contributions to satisfy the safe harbor requirements for 2021, the safe harbor notice is generally no longer required. Additionally, the plan may not need to be amended until as late as 30 days before the end of 2021 to reflect the retirement plan’s safe harbor status, or even later if the nonelective contribution is 4% of compensation or more. However, we recommend discussing the specific requirements with your legal advisor to determine whether communication to participants may be desired and to ensure compliance with the requirements necessary to qualify for safe harbor status.

Adjustment to the determination letter program

The IRS announced in Revenue Procedure 2019-20 that it is expanding its determination letter program in certain circumstances. If, in connection with a corporate merger, acquisition, or similar transaction, plan sponsors merge an acquired plan into an existing plan, the IRS has begun allowing merged plans to file for an updated determination letter, with some restrictions and requirements. To be eligible, the plan merger must be completed no later than the end of the plan year after the plan year that includes the date of the corporate transaction, and the determination letter application must be submitted by the last day of the first plan year beginning after the effective date of the plan merger. Note that, for eligible mergers of calendar-year plans that occurred in 2018 or 2019, the deadline to file may be as early as December 31, 2020.

Other items to consider

As you review your plan document, you may consider whether adding any of the following provisions to your retirement plan is appropriate:

- Internal limitations period for filing claims

- Forum selection clause

- Mandatory arbitration provision

We recommend all plan sponsors consider these features and discuss these with your legal advisor, but please be aware that these features are not legally required and might not be appropriate for every qualified retirement plan or for every plan sponsor.

Also, recall that IRS and DOL guidance from earlier this summer has suspended certain deadlines for participants to appeal claims until 60 days after the end of the national emergency based on the coronavirus outbreak. This national emergency period is still ongoing, so ensure your plan administrator is continuing to resolve claims and respond to appeals as required under your plan.

Conclusion

The end of the year presents an opportunity for plan sponsors to review their qualified retirement plans and consider whether their retirement plans have any legally required amendments and whether they want to add any of the features discussed above even before a legally required deadline. Please do not hesitate to contact your Alston & Bird attorney to discuss any of these plan amendments or other action items.

Alston & Bird has formed a multidisciplinary response and relief team to advise clients on the business and legal implications of the coronavirus (COVID-19). You can view all our work on the coronavirus across industries and subscribe to our future webinars and advisories.

1 This presents the earliest probable deadline. The IRS may extend deadlines in further guidance. Governmental plans may have extended deadlines as well.