The year 2020 has been like no other. Congress and regulatory agencies entered a high gear of sorts to respond to the COVID-19 pandemic. Congressional and agency efforts have provided some welcome relief, as well as several new requirements for health plans and a variety of non-pandemic-related developments.

COVID-19 DEVELOPMENTS

Congress and the agencies reacted quickly in 2020 to adopt legislation, regulations, and other guidance to address a number of COVID-19-related issues, including the Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief, and Economic Security (CARES) Act. COVID-19 provisions generally have an uncertain end date tied to the end of the COVID-19 public health emergency (PHE) or the national emergency. The COVID-19 PHE is determined by the Secretary of Health and Human Services (HHS) under the Public Health Service Act and is set to expire on January 20, 2021, but is expected to be extended. The national emergency was established pursuant to a declaration by the President under the National Emergencies Act.

Required Coverage of COVID-19 Vaccines

Under the Affordable Care Act (ACA), non-grandfathered group health plans (GHPs) are required to cover certain preventive care services without cost-sharing. The general deadline for implementation of new preventive recommendations and guidelines is the plan year beginning one year after the new recommendation or guideline is issued. Prior ACA regulations provide for coverage only for vaccines listed for “routine use” and generally allowed plans to apply cost-sharing if the preventive service is delivered by an out-of-network (OON) provider.

The CARES Act accelerates the time by which a COVID-19 vaccine is required to be offered as a no-cost preventive service to 15 business days after a recommendation for a COVID-19 vaccine is made. Unlike many aspects of COVID-19 relief, this CARES Act provision does not sunset (end) at a future date.

On October 28, 2020 the “tri-agencies” (the Departments of Treasury, Labor, and Health and Human Services) issued an Interim Final Regulation (IFR) under the CARES Act that also requires, for the duration of the COVID-19 PHE, that a COVID-19 vaccine be covered as a preventive service even if not listed for “routine use” and also that cost-sharing cannot be imposed regardless of whether the vaccine is provided in- or out-of-network. Plans are required to pay an OON provider a “reasonable” amount (e.g., the amount Medicare would pay). Note that the cost of the administration of the vaccine is subject to the mandate even if the cost of the vaccine itself is paid for by a third party (e.g., by the federal or a state government). This mandate does not apply to plans that are not subject to the ACA preventive care coverage mandate. Thus, this mandate does not apply to retiree-only plans, plans providing only “excepted benefits” (e.g., hospital indemnity and other fixed indemnity plans, cancer or specific disease only policies, stand-alone dental and vision plans, certain employee assistance programs, and health flexible spending accounts), or grandfathered plans.

On December 13, 2020, the Advisory Committee on Immunization Practices for the Centers for Disease Control and Prevention issued its recommendation for the Pfizer-BioNTech COVID-19 vaccine. Accordingly, coverage for the vaccine without cost-sharing should be made available on or about January 1, 2021.

Required Coverage of COVID-19 Testing

Generally effective March 18, 2020 through the COVID-19 PHE, the FFCRA, as amended by the CARES Act, requires most GHPs to cover COVID-19 testing, including certain related items and services, without cost-sharing and prior authorization or the use of medical management techniques. This mandate generally does not apply to plans that are not subject to the ACA health coverage mandates, such as retiree-only plans and plans providing only excepted benefits. The mandate does, however, apply to grandfathered plans. If testing is performed by an OON provider, plans are required to pay the provider’s posted cash rate, unless another rate is agreed upon. Federal regulators issued two sets of FAQs providing more detail on the testing coverage requirement, which may be found here and here.

Reimbursement of Over-the-Counter Medicines and Drugs

The ACA prohibited health flexible spending arrangements (health FSAs), health reimbursement arrangements (HRAs), and health savings accounts (HSAs) from reimbursing expenses for medicines and drugs (other than insulin) without a prescription. Effective for expenses incurred on or after January 1, 2020, the CARES Act eliminated that ACA restriction and also provides that menstrual care products qualify as a reimbursable expense. Prospective plan amendments will likely be required to take advantage of these permissive changes for health FSAs and HRAs.

Employee Assistance Programs Permitted to Cover COVID-19 Testing and Diagnosis

Qualifying employee assistance programs (EAPs) that do not provide significant benefits in the form of medical care and meet certain other requirements are “excepted benefits” and therefore exempt from ACA health coverage requirements. The tri-agencies issued guidance providing that, for the duration of the COVID-19 PHE or national emergency, diagnosis and testing for COVID-19 will not be treated as significant benefits in the form of medical care and therefore may be provided through an EAP. See Q&A 11 in these agency FAQs.

Telehealth and Other HSA/HDHP Flexibility

The CARES Act permits telehealth and other remote care services (including services unrelated to COVID-19) to be provided below the minimum required deductible for a high deductible health plan (HDHP) without adversely impacting HSA eligibility. The provision is effective for services provided on or after January 1, 2020 and for plan years beginning before December 31, 2021. See IRS Notice 2020-29. In other words, this provision only applies to services during the 2020 and 2021 plan years for a calendar-year plan. There is some hope that this provision may be extended.

Additionally, IRS Notice 2020-15 provides that HDHPs may provide benefits for testing and treatment of COVID-19 below the HDHP deductible without adversely impacting HSA eligibility. The CARES Act now requires first-dollar coverage of COVID-19 testing. The flexibility under Notice 2020-15 also does not sunset.

Nothing in the CARES Act or FFCRA required coverage for COVID-19 treatments without cost-sharing. Some states did have mandates for first-dollar coverage of treatment applicable to fully insured plans. Also, some insurers extended this coverage even without a state mandate while giving their self-funded clients an option to provide treatment without cost-sharing. For many plans and insurers, any voluntary coverage of COVID-19 treatment without cost-sharing was of a limited duration that varies by insurer and plan.

Extension of Certain COBRA and ERISA Deadlines

The Department of Labor (DOL) and IRS issued a notice extending certain timeframes for participants, beneficiaries, and plan administrators. When applying these time frames, the period between March 1, 2020 through 60 days after the end of the national emergency is disregarded, but it is unclear when the national emergency will end. The extension of these timeframes, statutorily, can be no more than one year (ending at the latest on February 28, 2021). The following time frames were extended:

- The 30/60-day HIPAA special enrollment periods.

- The 60-day COBRA election period for COBRA qualified beneficiaries.

- The 45-day (initial) and 30-day (subsequent) COBRA premium payment deadlines.

- The 60-day period in which COBRA qualified beneficiaries must notify the plan administrator of certain qualifying events, second qualifying events, or determination of disability.

- A plan administrator’s 14-day period for sending COBRA election notices (or the 44-day period if the employer is the plan administrator).

- The period for filing claims and appeals under an ERISA-covered plan.

- The period to request external review of an adverse benefit determination under the ACA.

Additional Flexibility for Cafeteria Plans and FSAs

IRS Notice 2020-29 provides employers flexibility to allow additional mid-year cafeteria plan elections for group health plans, health FSAs, and dependent care assistance plans (DCAPs) during calendar year 2020. This notice also provides increased flexibility for the grace periods that apply unused amounts in health FSAs to medical expenses incurred through December 31, 2020 and to similarly apply unused amounts in DCAPs incurred through December 31, 2020.NON-COVID-19 DEVELOPMENTS

Legislative Developments: ACA Taxes and Fees

Calendar year 2020 is the last year that the ACA health insurance tax (HIT) applies. The HIT has an on-again-off-again history, and legislation was enacted at the end of 2019 that finally repealed the tax starting 2021. HIT is, however, applicable for 2020. The same legislation also repealed the so-called “Cadillac tax” that would have gone into effect starting in 2022.

The Patient-Centered Outcomes Research Institute (PCORI) fee proved resilient through its unexpected extension—so that it now applies for the next decade—to plan years ending before October 1, 2029. The PCORI fee is imposed on most self-funded and fully insured plans. Excepted benefit plans aren’t subject to this fee. For policy and plan years ending after September 30, 2019 and before October 1, 2020, the applicable dollar amount was $2.54. For policy and plan years ending after September 30, 2020 and before October 1, 2021, the applicable dollar amount is $2.66. Additional information is on the IRS PCORI fee website.

Regulatory Developments

Two new types of HRAs for 2020

Regulations that were finalized in 2019 created two new types of HRAs for plan years beginning on or after January 1, 2020: individual coverage HRAs (ICHRAs) and excepted benefit HRAs (EBHRAs). The details of the rules for each new type of HRA are detailed and complex.

ICHRAs allow employers to help pay premiums for qualifying individual market major medical coverage and out-of-pocket expenses not reimbursed by insurance. Among other requirements, ICHRAs cannot be offered to employees who are eligible for a traditional group health plan offered by the employer. There are intricate rules if an employer only wants to offer an ICHRA to a certain subset of employees. Applicable large employers (ALEs) offering ICHRAs need to consider how the ACA employer pay-or-play penalties apply and in particular when an ICHRA will be considered “affordable” under the ACA. Form 1095-C was revised to accommodate the mandatory ACA reporting of ICHRAs for ALEs.

EBHRAs are designed to reimburse certain medical expenses for employees who are eligible to participate in a traditional group health plan offered by the employer (even if they are not enrolled in the traditional group health plan). The maximum annual contribution to an EBHRA is currently set at $1,800.

The IRS issued final ICHRA and EBHRA regulations in June 2019 and has issued proposed rules on ICHRAs for ACA affordability and penalty issues, as well as nondiscrimination requirements. These rules have not been finalized.

DOL allows expanded use of electronic disclosure

The DOL finalized a revamped electronic disclosure rule under ERISA. Although not applicable to health and welfare plans (including health FSAs and HRAs), the new rule forwards the broader electronic communication initiative for retirement plans by adding two new safe harbor methods: a “notice and access” method and email delivery.

The notice and access method allows electronic delivery by posting information online. The email delivery method allows delivery directly by email. While currently only applicable to retirement plans, it is possible that similar changes will be made in the future for health plans. For now, the DOL indicates that additional time is necessary for coordination between the tri-agencies that all have jurisdiction over some aspects of GHPs.

New SBC template

Federal agencies introduced a new Summary of Benefits and Coverage (SBC) template to be used for plan years starting on or after January 1, 2021. The template eliminates the reference to the ACA individual mandate, makes changes to the coverage examples, and provides no further relief for HRAs subject to SBCs. More information is on the DOL SBC webpage.

2021 notice of benefit and payment parameters (drug coupons and the ACA out-of-pocket limit)

This annual HHS notice clarified that, to the extent consistent with state law, insurers and plans will be permitted, but not required, to count toward the ACA maximum out-of-pocket limits any form of direct support offered to participants and beneficiaries by drug manufacturers (e.g., coupons).

For fully insured plans, state law may require that coupons be counted for the OOP limit, which could make an HDHP nonconforming, resulting in the ineligibility to contribute to an HSA. This annual notice also set the 2021 ACA maximum OOP limit at $8,550 (self only) / $17,000 (family) and allowed midyear special enrollment for qualified small employer HRAs (QSEHRAs).

Transparency rules for group health plans

The tri-agencies finalized sweeping transparency regulations, creating two significant price and coverage disclosure requirements that require non-grandfathered GHPs and insurers of non-grandfathered health insurance coverage in the group and individual markets to:

- Individually disclose cost-sharing information to plan participants.

- Publicly disclose negotiated rates for in-network providers and allowed amounts for OON providers.

The public disclosure requirements are effective for plan years beginning on or after January 1, 2022 with the individual disclosure requirements following a year later (plan years beginning on or after January 1, 2023). The rule will impose significant disclosure requirements on employer plan sponsors and health plan insurers. The rule doesn’t apply to excepted benefit plans, and the rule contains several enforcement safe harbors that are only available if the plan is exercising good faith and reasonable diligence. Further, beginning with the 2020 medical loss ratio (MLR) reporting year, the rule allows insurers a credit for “shared savings” in calculating their MLR when a consumer selects a lower-cost provider.

Promptly planning ahead and taking prudent action can help ensure that new transparency rule responsibilities are upheld. A deeper-dive summary of the rule can be found in our upcoming advisory on the impact of 2020’s final transparency requirements on employer-sponsored health plans.

Proposed rule on direct primary care and health care sharing ministries

An IRS proposed rule provides that certain direct primary care arrangements and health care sharing ministries are “medical care” for federal tax purposes as either payment for medical care or medical insurance. As a consequence, fees, premiums, or contributions for participation in such arrangements qualify for the individual itemized deduction for medical expenses. Further, such payments and fees may be reimbursed by HRAs. The proposed rule also notes that health FSAs may not reimburse “premiums” for the these arrangements and that participating in either of these arrangements may, depending on the specifics of the arrangement, disqualify an individual from contributing to an HSA.

While the proposed rule would provide favorable federal tax treatment, there are a host of other issues under the ACA, ERISA, and COBRA if an employer desires to sponsor one of these arrangements for its employees.

Proposed rule on grandfathered plans

Another IRS proposed rule would amend the grandfather plan rules to provide relief for HDHPs that lose grandfather status merely due to the technical increase of IRS deductible amounts. The proposed rule would also provide an alternative means to determine whether increases to fixed-amount cost-sharing trigger a loss of grandfather status. On December 11, 2020, this proposed rule was finalized without substantial changes.

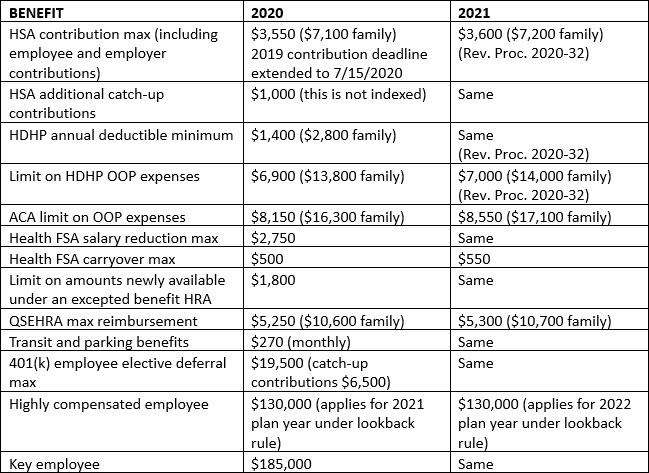

Benefit Plan Inflation Adjusted Amounts for 2021 for Popular Benefits

The following table provides a summary of key dollar limits for health and certain other employee benefits for 2020 and as adjusted for inflation for 2021.

Conclusion

The year isn’t quite done. Federal agencies and Congress are still at work. Also, 2021 looks to once again be an exciting year. Issues related to COVID-19 will likely dominate the beginning of 2021, and we will have a new Administration with new Secretaries of the tri-agencies. We are also awaiting important Supreme Court decisions that will come in the late spring or early summer of 2021. Key among these is the pending case challenging the constitutionality of the ACA. We are still awaiting an appellate court ruling on the fate of the association health plan regulations. While not yet public, the EEOC has submitted proposed regulations to the Office of Management and Budget on wellness programs under the Americans with Disabilities Act and the Genetic Information Nondiscrimination Act. There are sure to be many other developments in 2021, and we will continue to keep you informed.