On March 27, 2023, the IRS issued its Announcement and Report Concerning Advance Pricing Agreements (APA Report), which presents the key results of the IRS’s Advance Pricing and Mutual Agreement Program (APMA). The APA Report provides general information about the operation of the program, including staffing, and statistical information about the numbers of APA applications received and resolved during the year, including countries involved, demographics of companies involved, industries covered, and transfer pricing methods (TPMs) employed.

Much of the data in the APA Report represents a snapshot in time, and similar to prior years, the APA Report does not provide data for categories involving fewer than three APAs. Despite these caveats, we can identify important trends based on such data and our experience advising companies pursuing and executing APAs.

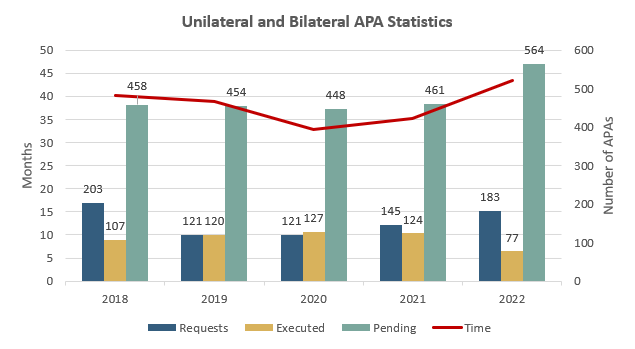

First, APMA faced historic demand for APAs, with a 26% increase in APA requests compared with 2021. Second, the number of APAs executed during 2022 fell by 38% from 2021 – a sign of how the COVID-19 pandemic ravaged treaty partner negotiations. Third, juxtaposed with the increased demand is APMA’s further resource constraints, including a 17% decrease in staffing.

Although these are all snapshots in time, some of the trendlines may raise concerns when viewed in a vacuum. It is important, however, to evaluate the datapoints in the context of the COVID-19 pandemic and the severe impact it had on the ability of the IRS and other tax authorities to negotiate cases. One takeaway is that additional resources are needed to ensure that APMA has the personnel to execute its mission pursuant to Revenue Procedure 2015-41, Sec. 2.02(1):

In accordance with its mission, APMA endeavors to administer the programs within its jurisdiction in a manner that is consistent with U.S. tax treaty obligations and that secures the appropriate tax bases of the United States and its treaty partners, prevents fiscal evasion, promotes consistency and reasonableness in outcomes, and provides taxpayers access to competent authority assistance and to the APA process in accordance with considerations of principled, effective, and efficient tax administration.

APMA’s workload continues to grow at a pace that is outstripping resources and APMA’s ability to resolve APAs, as shown by the delta between APA requests filed and APAs executed and by the elevated number of pending APAs. In addition, while the overall time to obtain renewal APAs (unilateral and bilateral) decreased in 2022 from 2021, new bilateral APA processing times increased.

As companies navigate negotiating APAs with terms covering years impacted by COVID-19, supply chain issues, sanctions, and other unexpected events, as well as post-COVID-19 years, our experience indicates that companies with robust proposed TPMs that effectively address arm’s-length returns for nonroutine intangibles and COVID-19 should see their APAs progress more efficiently than APAs with proposed TPMs that arguably require significant modifications.

APMA has indicated in public comments that addressing the impact of COVID-19 and supply chain issues on a company is not a one-size-fits-all approach, but rather, it requires careful analysis of each company’s situation. According to APMA, companies have to do more than cite general economic trends to justify results that deviate from the terms of the relevant APAs. In public comments, APMA has stated that it has generally succeeded in finding mutually agreeable solutions to COVID-related issues in APAs when the circumstances of a particular taxpayer warrant relief.

Although APMA experienced challenges during 2022, in our experience such challenges are due, in part, to factors outside APMA’s control, such as the impact of the COVID-19 pandemic on the ability to have face-to-face negotiations with treaty partners. Also, certain treaty partners were severely limited in their ability to work on APAs during the pandemic. Finally, actions and positions taken by treaty partners can affect case processing times. Reaching a mutually acceptable agreement requires that all tax authorities take meaningful steps to reach agreement.

Finally, the data clearly shows that APMA requires additional resources to address increased demands, but throughout our guidance and advocacy for companies during the APA process, APMA has been available to discuss and has been dedicated to addressing various questions and issues and advancing cases toward completion.

APMA Operations and Staffing

Demand for APAs continued to grow in 2022 while APMA’s headcount shrank, which raises concerns about how APMA will keep up with increased demand. APMA’s staffing resources decreased 17% in 2022. The total number of APMA employees decreased from 117 professionals at the end of 2021 to 97 professionals at the end of 2022. At the end of 2022, APMA had 59 team leaders (significantly decreased from 80 at the end of 2021), 26 economists (increased from 25 at the end of 2021), 9 managers (unchanged from 2021), and 3 assistant directors (unchanged from 2021). Each assistant director oversees three managers who lead teams composed of both team leaders and economists. Finally, APMA experienced a change in leadership in 2022, and those changes can temporarily divert resources.

Rev. Proc. 2015-41 continued to serve as the main source of IRS guidance on the APA process during 2022. APMA is actively updating Rev. Proc. 2015-41 and is soliciting comments from taxpayers, practitioners, and other stakeholders. This is one of the items on the 2022-2023 Priority Guidance Plan, and it appears reasonable to anticipate updated APA procedures this calendar year. Although not discussed in the APA Report, based on public comments it appears that updated APA procedures may address pre-APA submission conferences, various tools available to companies to address transfer pricing risks (e.g., International Compliance Assurance Program (ICAP)), APA submission requirements, APA case processing, and other issues.

APA Demand and Output

A continued and marked increase in processing times and number of pending APAs

The median time required to complete an APA increased to approximately 43 months in 2022 (up from approximately 35 months in 2021 and 33 months in 2020). This increase is interesting given that the median processing time for renewal unilateral and bilateral APAs decreased by approximately 8 months and 4 months, respectively. The median processing time for new bilateral APAs, which appear to have made up a large portion of the executed APAs, increased to 53 months (an increase of approximately four months compared with 2021).

As indicated, the data reflects a snapshot in time for cases resolved during 2022, and the increase in median processing times for new bilateral APAs may be due to the resolution of older cases. Nevertheless, combined with the increased pending APA inventory and the reduction in staffing, APMA continues to have challenges to address, and the trendlines for certain types of APAs are concerning. Given these circumstances, careful legal and economic analysis, preparation, management, and responsiveness throughout the APA process are critical.

The number of pending APAs also significantly increased from 2021 to 2022. At the end of 2022, there were 564 APA requests pending (54 unilateral, 480 bilateral, and 30 multilateral), up from 461 at the end of 2021 (39 unilateral, 395 bilateral, and 27 multilateral). As in past years, the number of pending bilateral APAs continues to trend upward to historic highs. APMA would need approximately seven years to work through its existing inventory at its current processing rate, but it is anticipated that its processing rate will increase as APMA and other tax authorities bounce back from the impact of the COVID-19 pandemic. Japan (24%), India (22%), and Canada (11%) constituted the majority of the pending bilateral APAs, consistent with past years.

Increased number of new applications

In 2022, 183 APA applications were filed, an increase of 26% from 2021. This was the highest number of APA applications filed since at least 2010 in any year in which impending filing fee increases did not influence demand (impending fee increases influenced filings in 2010, 2015, and 2018). Natural demand for APAs continues to grow.

The country-by-country breakdown of bilateral filings remained fairly consistent. In line with previous years, the number of bilateral filings involving Japan, India, and Canada represented 54% of all bilateral filings in 2022. Bilateral filings involving Korea represented 10% of all bilateral filings in 2022, which was a 6% increase from 2021.

Decreased number of APAs executed

The IRS executed far fewer APAs in 2022 than in 2021 (77 compared with 124). This was the lowest number of APAs executed in over 10 years. The percentage of executed APAs that were renewals decreased slightly (55% in 2022 and 63% in 2021). There was also an increase in the percentage of executed APAs that were bilateral (86% in 2022 and 79% in 2021). Only one multilateral APA was executed in 2022, which is consistent with past years (between 0 and 3 multilateral APAs have been executed annually in the last 10 years).

The APA Report indicates that U.S.-Japan bilateral APAs continued to constitute the largest percentage of bilateral APAs that the program processed (39%), followed by Canada (14%), India (8%), Switzerland (8%), Korea (5%), Germany (4%), Italy (4%), China (3%), the United Kingdom (3%), Belgium (3%), and Finland (3%). The large number of bilateral APAs executed involving Japan can be attributed to the long history of the APA programs in the United States and Japan. The number of bilateral APAs executed involving Germany fell dramatically from 2021, when bilateral U.S.-Germany APAs represented 20% of the bilateral APAs executed.

In terms of geographic diversity, APMA’s execution of a reportable number of APAs with tax authorities from a larger number of countries signals that APMA continues to develop more substantial and regular APA discussions and negotiations with a broader range of countries, which is a positive development for the overall APA process and companies desiring to resolve transfer pricing issues through APAs. It is our understanding that the increased use of videoconferencing technology by APMA and other tax authorities has been helpful in facilitating more frequent formal and informal negotiations, although in-person negotiations are necessary to make progress on more complex issues.

Withdrawn APA requests

Six APA applications were withdrawn in 2022, which was consistent with the number withdrawn in 2021. For the eleventh consecutive year, no APAs were revoked or canceled in 2022.

U.S. vs. non-U.S. parent companies

Similar to past years, the majority of APAs involved non-U.S. parent companies: 62% of the executed APAs for 2022 were for non-U.S. parent companies and their U.S. subsidiaries, while 31% involved U.S. parent companies and their non-U.S. subsidiaries and 7% involved sister companies. The ongoing appeal of the APMA program to non-U.S. parent companies, particularly Japanese parent companies, could be due to, among other things, the IRS’s continued focus on transfer pricing involving non-U.S. parent companies, non-U.S. parent companies’ desire for transfer pricing certainty, or an increase in audit activity in other countries for which resolution through a bilateral APA with the United States may be preferred.

Industries represented

Most of the APAs executed in 2022 involved the wholesale/retail trade (42%) and manufacturing (41%) industries. The other industries specifically identified in the APA Report were services (13%) and finance, insurance, and real estate (1%). Within the wholesale/trade industry, a majority of the APAs executed involved merchant wholesalers of durable goods (75%), while merchant wholesalers of nondurable goods and all other wholesalers each represented 13%. Within the manufacturing industry, the largest proportion of APAs executed involved chemical (42%), while the computer and electronic products (29%) and transportation equipment (19%) industries were also represented. To some extent, the year-over-year industry breakdown is random, providing a snapshot of a particular 12-month period, and many factors can impact the resolution timing for specific cases.

TPMs applied

For 2022, the comparable profits method/transactional net margin method (CPM/TNMM) continued to be the most commonly applied TPM for tangible and intangible property transactions (applied to 77% of such transactions). Of the profit level indicators (PLI) used when the CPM/TNMM is employed, the operating margin (defined as operating profit divided by net sales) was applied 73% of the time. Similar to past years, the CPM/TNMM was applied in 80% of the APAs with intercompany service transactions, and the most commonly selected PLI with the CPM/TNMM was the operating margin, used 53% of the time. Based on our experience, increased focus by APMA and other tax authorities on nonroutine intangibles, including marketing intangibles, may lead to a shift in the types of TPMs deployed going forward.

APA terms

Rev. Proc. 2015-41 instructs taxpayers to request a term of at least five prospective years, and taxpayers may also request that the APA be “rolled back” to cover one or more earlier taxable years. APA term lengths, including rollback years, averaged six years in 2022, unchanged from 2021. The largest number of APAs were executed with five-year terms (48%), and 94% had terms of five or more years. In 2022, the longest APA term was 11 years (only two APAs had an 11-year term), compared with 15 years in 2021. A substantial number of the APAs with terms of greater than five years were submitted as a request for a five-year term, and the additional years were agreed to between the taxpayer and the IRS (or between the IRS and the foreign government, upon the taxpayer’s request, in the case of a bilateral APA) to ensure, for example, a reasonable amount of prospectivity in the APA term. Of the APAs executed in 2022, 16% included rollback years (compared with 22% in 2021).

Companies with APA terms spanning years before and after the effective date of the Tax Cuts and Jobs Act of 2017 should take into account any implications from APMA’s announcement Implementation of Competent Authority Resolutions, which addresses “telescoping” and other related topics.

FX adjustments

APMA does not have a set policy for adjustments to company financials to account for currency fluctuations. As in past years, the APA Report notes that “[i]n appropriate cases, APAs may provide specific approaches for dealing with risks, including currency risk, such as adjustment mechanisms and/or critical assumptions.” Over the years of the APA program, FX-adjustment mechanisms have been proposed by companies and by governments, and when the fluctuations are extreme, or when a currency has weakened significantly, this can be taken into account when shaping a bilateral APA.

Observations and Conclusions

It should not be unexpected that 2022 was difficult for APMA, with historically high demand, a reduction in resources, a drop in executed APAs, and leadership changes. On the positive side, APMA decreased its processing times for renewal APAs.

Some of the unfavorable datapoints in the APA Report are attributable to factors outside APMA’s control, such as COVID-19 pandemic impacts, delays in processing APAs by other tax authorities, and reluctance by other tax authorities to negotiate in good faith to reach a mutually acceptable agreement. Based on our experience advising companies on APAs since the beginning of the IRS’s APA program, careful strategic planning, legal and economic analysis, management, and responsiveness are important steps to most efficiently obtain an APA.

APAs are a critical tool for companies and tax authorities to address and resolve transfer pricing and ancillary issues on a principled, effective, and efficient basis, and it will be important to evaluate future IRS investments in APMA and see how APMA responds to the challenges going forward, particularly given the additional complexities arising from BEPS Pillars One and Two and increasing transfer pricing adjustments being asserted by non-U.S. tax authorities.

For more information, please contact Richard Slowinski at +1 202 239 3231 or Stefanie Kavanagh at +1 202 239 3914.