For companies that are contemplating preparing a new or renewal advance pricing agreement (APA) request to address transfer pricing matters, it is important to consider recent guidance and public statements from the IRS and recent experience with that guidance. The guidance and public comments indicate that the IRS will now apply more defined review procedures to companies requesting APAs with the goal of improving the APA process through earlier identification of potential obstacles and alternative tools for certainty, while at the same time not limiting the number of APA submissions that the IRS’s Advance Pricing and Mutual Agreement Program (APMA) accepts. IRS officials have publicly stated that the IRS is “refocusing and emphasizing [its] recent experience with different treaty partners at the intake point.”

Overview of IRS Guidance

More specifically, the IRS’s Large Business and International (LB&I) division released a memorandum (LB&I-04-0423-0006), dated April 25, 2023, that provides guidance to its Treaty and Transfer Pricing Operations (TTPO) employees on the IRS’s review of APA prefiling memoranda and APA requests from taxpayers (TTPO Memorandum). LB&I indicated that it issued this memorandum to ensure that taxpayer and IRS resources are used as effectively as possible.

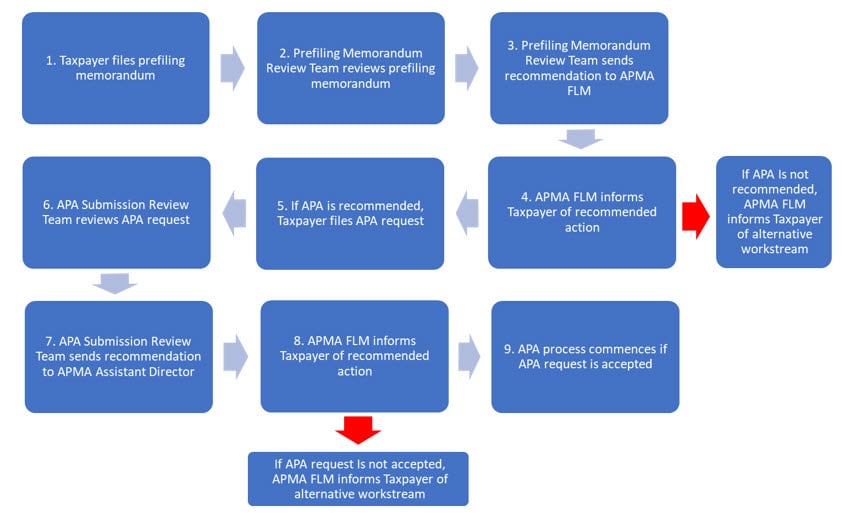

This flow chart depicts, at a high level, the various steps in the TTPO Memorandum:

Prefiling Memorandum Review

If a company submits a prefiling memorandum, APMA will review it to advise whether the APA “workstream” is well-suited or whether an alternative workstream is recommended. The prefiling memorandum review is intended to be a “rapid and high-level process” through which APMA provides information about the likely acceptance of an APA request, or other workstreams, to achieve transfer pricing certainty. Our experience confirms that APMA is conducting its review promptly. The Prefiling Memorandum Review Team (composed of the APMA team leader and a member of the Transfer Pricing Risk Assessment (TPRA) Team) will recommend to the APMA frontline manager (FLM) one of the following taxpayer actions:

- Submit an APA request

- Consider a different workstream (e.g., International Compliance Assurance Program (ICAP))

- Provide additional information to APMA

This review should take no more than four weeks from submission of the memorandum or requested additional information. The Prefiling Memorandum Review Team will consider approximately two dozen different categories of facts and circumstances of the proposed APA case, including:

- The significance of the proposed covered transactions.

- The proposed APA term and remaining statutes of limitations periods.

- For bilateral or multilateral APAs, the probability of improved transfer pricing compliance.

- For multilateral APAs, the extent to which (1) treaties and international exchange agreements allow for information exchange; and (2) disclosure restrictions may hamper communications among the parties.

- The potential for the proposed APA to impact prior year or period compliance.

- The appropriateness of resolving the proposed transactions through ICAP.

- For a Compliance Assurance Process taxpayer, whether the IRS has indicated that an APA might be appropriate.

- Whether resolution of the proposed covered transactions through an IRS Transfer Pricing Practice (TPP) examination or joint audit may be appropriate.

Companies that anticipate submitting a prefiling memorandum should carefully evaluate the facts and circumstances in the TTPO Memorandum, which may influence the likelihood of APMA recommending an APA as the most appropriate workstream, and plan for this additional IRS review period of approximately four weeks.

APA Submission Review and Acceptance

Whether or not a company submitted a prefiling memorandum, the APA Submission Review Team (composed of an APMA FLM, an APMA team leader, a Treaty Assistance and Interpretation Team analyst, a TPRA manager, and a TPP reviewer) will review an APA request submission to decide whether the APA workstream is most appropriate to achieve certainty for the proposed covered transactions. Within eight weeks of the submission of the APA request, APMA will either accept the APA request or reject the APA request and recommend an alternative workstream. Forgoing a prefiling memorandum submission will not allow a company to avoid certain review criteria.

Below are some of the criteria that the APA Submission Review Team will use to recommend an APA request for assignment of APMA resources instead of an alternative workstream:

- If APMA did not conduct a prefiling memorandum review, it will apply the prefiling memorandum review criteria to the APA request.

- Whether there is an actual or potential transfer pricing dispute that would be most efficiently resolved through an APA, taking into account factors including the company’s proposed transfer pricing method and examination history in the United States or applicable foreign jurisdiction.

- Whether the APA process likely will lead to prospective APA years based on APMA’s experience with the treaty partner, the type of covered transaction, and the industry at issue.

- Whether there is arbitration with the treaty partner and other strategic considerations that are country-specific.

- Whether APMA is best situated within TTPO to effectively assess the proposed covered transactions, including developing facts and reliable financial data.

- Whether, in the TPRA Submission Review Team member’s opinion, the proposed transactions are appropriate for ICAP.

- Whether the IRS has an interest in examining the covered transactions per TPP’s workload selection process.

- The extent to which the transfer pricing issues posed by the covered transactions are secondary to the application of other U.S. tax law provisions.

- If there is a request for a bilateral or multilateral APA, the views of the treaty partners, which the TPRA Submission Review Team may solicit in its discretion.

If APMA believes that a joint audit might be a better option, the APMA assistant director will consult with the TPP territory manager on resource allocation and coordinate with the relevant geographic practice area. If LB&I chooses to propose a joint audit, APMA will inform the company that it will not accept the APA request. TPP will then contact the company to discuss any timing and administrative issues relating to the joint audit process. The IRS has indicated that it will not force a company to pursue one of the alternative workstreams (e.g., joint audit, ICAP).

Initial Observations

As described in detail in our April International Tax advisory, 2022 was difficult for APMA, with historically high demand, a reduction in resources, a drop in executed APAs, and leadership changes. It is likely that LB&I hopes the TTPO Memorandum will improve APMA’s efficiency, and the statistics in the APA Report, in the years ahead.

While it is helpful to have more insight into APMA’s review and decision-making procedures for prefiling memorandum and APA requests, and our initial experience is positive, there are certain aspects of the TTPO Memorandum that raise questions about the IRS’s objectives. For example, the IRS’s intention to be more selective about the APA requests that it accepts appears to be in conflict, at least in part, with the IRS’s statement that the guidance should not limit the number of accepted APA requests:

This guidance also is not intended to limit or decrease the number of APA requests accepted by APMA. Rather, its goal is to improve the quality and timeliness of APMA’s APA program by providing an early mechanism for identifying potential roadblocks to successfully concluding a proposed APA and opportunities for other paths to certainty.

In our experience, and as recognized by tax authorities, companies, and the Organisation for Economic Co-operation and Development (OECD), the APA program has been a successful alternative dispute program that provides tax certainty and conserves resources. It would be unfortunate if guidance in the TTPO Memorandum were applied to preclude parties that would otherwise be appropriate candidates from accessing the APA program.

Finally, with increased demands on the APA program, numerous OECD best practices and performance benchmarking, and additional needs for future transfer pricing dispute resolution in light of OECD BEPS actions, more resources should be allocated to APMA to improve the efficiency and effectiveness of the APA program.

For more information, please contact Richard Slowinski at 202.239.3231 or Stefanie Kavanagh at 202.239.3914.