On January 28, 2020, the Federal Trade Commission (FTC) announced an annual adjustment of the jurisdictional thresholds for pre-merger notification filings under the Hart–Scott–Rodino Antitrust Improvements Act of 1976 (HSR Act). The revisions account for changes in the level of the U.S. gross national product and constitute an increase of approximately 4.4 percent. They were announced one week after the FTC indexed thresholds related to interlocking directorates under Section 8 of the Clayton Act and two weeks after the FTC announced that it adjusted the maximum civil monetary penalties for violations of 16 statutory provisions the FTC enforces.

HSR Act Pre-Merger Notification Thresholds

The HSR Act requires companies contemplating mergers or acquisitions of voting securities or assets that meet or exceed certain monetary thresholds to file notification forms with the FTC and U.S. Department of Justice and to wait a designated period of time before consummating the contemplated transaction. The new thresholds will go into effect for transactions closing on or after February 27, 2020. For transactions closing on or after this date, companies generally will need to comply with the HSR Act pre-merger notification and waiting period requirements if either of the following is true:

- The size of the transaction (as defined by the HSR Act and applicable regulations) is more than $376 million; or

- The size of the transaction is more than $94 million, the total assets or annual net sales of one party to the transaction (as defined by the HSR Act and applicable regulations) equal $188 million or more, and the total assets or annual net sales of the other party to the transaction equal $18.8 million or more.

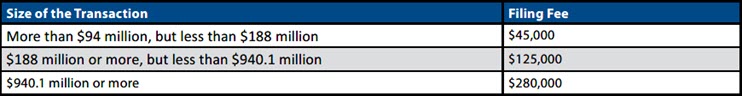

Although the HSR Act filing fees will not increase, these adjustments do affect the filing fee schedule as follows:

These adjustments constitute the primary changes to the HSR Act regulations adopted by the FTC on January 28, 2020. Additional regulations governing the methodology for calculating the size of party and size of transaction tests, as well as exemptions from the HSR Act, remain unchanged.

Interlocking Directorates Thresholds

Section 8 of the Clayton Act prohibits, with certain exceptions, one person from serving as a director or officer of two competing corporations. Under the FTC’s revised Section 8 thresholds, which became effective upon publication in the Federal Register on January 21, 2020, a person may not serve as a director or officer of two competing corporations if each corporation has capital, surplus, and undivided profits aggregating more than $38,204,000, unless one or more of the corporations has competitive sales under $3,820,400 or other exceptions apply.

Inflation-Adjusted Civil Penalty Amounts

On January 13, 2020, the FTC also announced adjustments to various maximum civil penalty levels for certain laws it enforces. The action was required by the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015, which significantly increased penalty levels in 2016 and required annual indexing of those levels for inflation.

Of most interest, the maximum civil monetary penalty for violations of the HSR Act and Section 5 of the FTC Act (concerning unfair methods of competition and unfair or deceptive acts or practices) increased by approximately 1.7 percent to $43,280 per day. The new maximum civil penalties became effective upon publication in the Federal Register on January 14, 2020.