The first month of 2022 brought multiple significant developments impacting how the U.S. antitrust enforcement agencies review proposed transactions. These include not only the annual adjustments to the filing thresholds under the Hart–Scott–Rodino Antitrust Improvements Act of 1976 (HSR Act) but also proposed revisions to the government’s merger review guidelines and news that the U.S. Supreme Court will review a case involving the administrative structure of the Federal Trade Commission (FTC).

HSR Act Pre-Merger Notification Thresholds

On January 24, 2022, the FTC published the annual adjustment of the jurisdictional thresholds for pre-merger notification filings under the HSR Act. Existing thresholds will increase by approximately 9.8 percent to account for an increase in the U.S. gross national product. This increase is a dramatic turn from last year, when the HSR Act filing thresholds decreased for the first time in over a decade. The new thresholds will go into effect for transactions closing on or after February 23, 2022.

The HSR Act requires companies contemplating mergers or acquisitions of voting securities or assets that meet or exceed certain monetary thresholds to file notification forms with the FTC and U.S. Department of Justice Antitrust Division (DOJ) and to wait a designated period of time before consummating the contemplated transaction. For transactions closing on or after February 23, 2022, companies will generally need to comply with the HSR Act pre-merger notification and waiting period requirements if either of the following is true:

- The size of the transaction (as defined by the HSR Act and applicable regulations) is more than $403.9 million; or

- The size of the transaction is more than $101 million, the total assets or annual net sales of one party to the transaction (as defined by the HSR Act and applicable regulations) equal $202 million or more, and the total assets or annual net sales of the other party to the transaction equal $20.2 million or more.

The HSR Act implementing regulations are complex, and it is important to consult with experienced antitrust counsel to determine whether a filing is required.

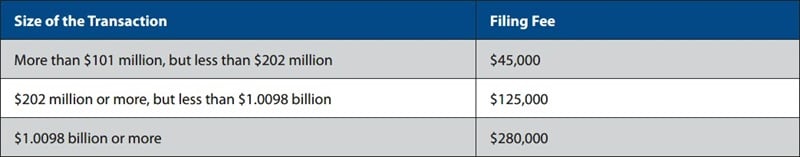

The FTC has also announced changes to the various thresholds that determine the amount of the required filing fees submitted with an HSR filing. The new schedule is:

Although the amount of the fees remains unchanged for now, FTC Chair Lina Khan and Commissioner Rebecca Kelly Slaughter concurrently issued a statement reiterating their support of recent legislation in Congress that would substantially increase the HSR Act filing fees and urging the lengthening of the current 30-day statutory waiting period.

The FTC and DOJ have yet to reinstate the process for granting “early termination” of the HSR Act waiting period, which was suspended a year ago. Also, as noted in another advisory of ours last year, the FTC is considering other more significant revisions to the reporting rules promulgated under the HSR Act that could significantly impact certain industries, including private equity and hedge funds.

Recent Enforcement Actions for Failure to Comply with the HSR Act

The FTC also provided strong reminders at the end of 2021 that failure to comply with the HSR Act can result in hefty penalties.

On December 22, 2021, the FTC settled charges it levied against Clarence L. Werner, the founder and executive of publicly traded truckload carrier Werner Enterprises Inc., following allegations that he violated the HSR Act by failing to report his recent purchases of shares of Werner Enterprises. He agreed to pay a $486,900 civil penalty.

That same day, the FTC also announced that Biglari Holdings Inc., a publicly traded holding company, agreed to pay $1,374,190 in civil penalties to resolve allegations that it violated the HSR Act for approximately three months by failing to report its purchases of additional Cracker Barrel stock that surpassed the filing thresholds.

Significantly, although both parties claimed that their violations were inadvertent, the FTC nonetheless sought penalties because each had been involved in alleged HSR Act violations in previous years.

These enforcement actions underscore the importance of maintaining strict compliance with the HSR Act and demonstrate the substantial penalties that the government may seek from both individuals and companies that fail to comply.

FTC/DOJ Request for Information on Merger Guidelines

On January 18, 2022, the FTC and DOJ held a joint press conference soliciting public input to inform changes they say are needed to strengthen and modernize the guidelines under which the antitrust agencies review transactions.

FTC Chair Lina Khan and DOJ Assistant Attorney General Jonathan Kanter took the virtual stage to stress their shared concern that industries across the nation were becoming more concentrated and less competitive. In response, they announced the issuance of a Request for Information (RFI) to understand how developments in the modern economy and new evidence of mergers’ effects on competition might inform potential revisions to guidelines about both horizontal and vertical mergers. The 15 topics covered in the RFI are wide-ranging, including the types and sources of evidence, innovation and intellectual property, potential and nascent competition, and monopsony power and labor markets. The current joint Horizontal Merger Guidelines and the DOJ Vertical Merger Guidelines have not been updated since 2010 and 2020, respectively.

Khan’s comments emphasized her desire to investigate the incentives and strategies that drive mergers, like “moat-building” and data acquisition strategies by tech firms and roll-up strategies by private equity firms. She also said she would consider whether the agencies should broaden the evidence of anticompetitive effects to include other indicia of market power and non-price effects.

Kanter highlighted the broad-ranging effects of the digital transformation of the economy and noted an interest in better understanding the unique characteristics of digital markets. He also suggested that the RFI could be used to re-evaluate how to assess transactions involving firms that already have market power and to move away from the “static formalism” of traditional market definition analysis to what he called a multidimensional analytic approach. Both agency leaders also expressed some skepticism of efficiency defenses, especially when those efficiencies come at the expense of labor.

FTC Commissioners Noah Phillips and Christine Wilson, both Republican appointees, issued a statement in support of the RFI but raised concerns about some of the assumptions they said underlie the RFI questions. In particular, the statement lamented that the RFI questions seem to assume that “difficulty for rivals equates to harm to competition” and that “agencies should discount or ignore efficiencies when analyzing mergers.” The commissioners also expressed a hope that any new guidelines would continue to adhere to the legal precedents reflected in current antitrust jurisprudence.

The comment period for the RFI remains open until March 21, 2022. The agencies then plan to issue draft revised merger guidelines and open another comment period for the public to weigh in. The agencies intend to have the new guidelines finalized by the end of 2022.

Supreme Court Accepts Case Involving Constitutionality of the Structure of the FTC

In another potentially significant development, on January 24, 2022, the U.S. Supreme Court agreed to hear arguments involving a challenge to the FTC’s structure. In Axon Enterprise Inc. v. Federal Trade Commission, the FTC challenged Axon Enterprise’s consummated acquisition of VieVu LLC through its administrative process. Axon filed a case in district court arguing that the FTC’s role in bringing and reviewing such a case violated its due process rights and that the administrative law judge (ALJ) appointment process violated separation of power principles in the Constitution because the President cannot fire an ALJ (or the commissioners who appoint an ALJ) at will. The district court and Ninth Circuit dismissed the case, saying Axon should first raise the issues in the administrative proceeding. The Supreme Court accepted Axon’s cert petition solely on the question of whether the district court can review the constitutional challenge rather than having it raised in the administrative proceeding (but declined to accept a direct challenge to the FTC’s structure). The Supreme Court will hear the case in the new term beginning in October 2022. This case is worth following—any challenge to the structure of the FTC could impact its role and processes in merger reviews.

Other Antitrust Updates

On January 10, 2022, the FTC announced adjustments to various maximum civil penalty levels for certain laws it enforces. The action was required by the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015, which significantly increased penalty levels in 2016 and required annual indexing of those levels for inflation.

Of most interest, the maximum civil monetary penalty for violations of the HSR Act and Section 5 of the FTC Act (concerning unfair methods of competition and unfair or deceptive acts or practices) increased by approximately 6.2 percent to $46,517 per day. The new maximum civil penalties became effective upon publication in the Federal Register on January 10, 2022.

On the same day as the updated HSR Act thresholds were announced, the FTC also announced the new indexed levels for interlocking directorates. Section 8 of the Clayton Act prohibits, with certain exceptions, one person from serving as a director or officer of two competing corporations. Under the FTC’s revised Section 8 thresholds, which became effective upon publication in the Federal Register on January 24, 2022, and were increased due to GNP indexing, a person may not serve as a director or officer of two competing corporations if each corporation has capital, surplus, and undivided profits aggregating more than $41,034,000 unless one or more of the corporations has competitive sales under $4,103,400 or other exceptions apply.