On February 2, 2021, the Federal Trade Commission (FTC) published an annual adjustment of the jurisdictional thresholds for pre-merger notification filings under the Hart–Scott–Rodino Antitrust Improvements Act of 1976 (HSR Act). The revisions account for changes in the level of the U.S. gross national product and constitute a decrease of approximately 2.1 percent. This is the first decrease to the HSR Act filing thresholds since 2010. They were announced shortly after the FTC reduced similarly indexed thresholds related to interlocking directorates under Section 8 of the Clayton Act and three weeks after the FTC announced that it was increasing the maximum civil monetary penalties for violations of 16 statutory provisions the FTC enforces. These changes occur as the FTC also continues to evaluate proposed changes to the HSR Act rules.

HSR Act Pre-Merger Notification Thresholds

The HSR Act requires companies contemplating mergers or acquisitions of voting securities or assets that meet or exceed certain monetary thresholds to file notification forms with the FTC and U.S. Department of Justice and to wait a designated period of time before consummating the contemplated transaction. The new thresholds will go into effect for transactions closing on or after March 4, 2021. For transactions closing on or after this date, companies generally will need to comply with the HSR Act pre-merger notification and waiting period requirements if either of the following is true:

- The size of the transaction (as defined by the HSR Act and applicable regulations) is more than $368 million; or

- The size of the transaction is more than $92 million, the total assets or annual net sales of one party to the transaction (as defined by the HSR Act and applicable regulations) equal $184 million or more, and the total assets or annual net sales of the other party to the transaction equal $18.4 million or more.

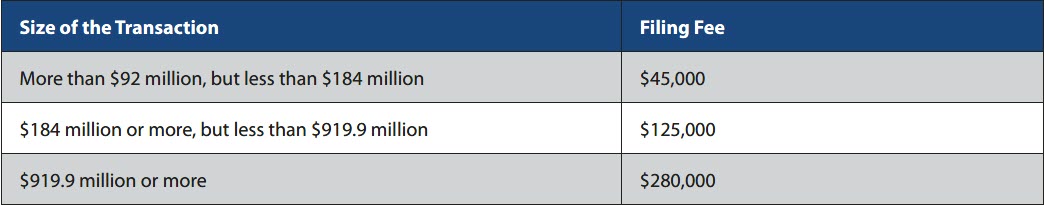

Although the HSR Act filing fees will not increase, these adjustments do affect the filing fee schedule as follows:

These adjustments constitute the primary changes to the HSR Act regulations published by the FTC on February 2, 2021. Additional regulations governing the methodology for calculating the size of party and size of transaction tests, as well as exemptions from the HSR Act, remain unchanged.

Interlocking Directorates Thresholds

Section 8 of the Clayton Act prohibits, with certain exceptions, one person from serving as a director or officer of two competing corporations. Under the FTC’s revised Section 8 thresholds, which became effective upon publication in the Federal Register on January 21, 2021, and also were reduced due to GNP indexing, a person may not serve as a director or officer of two competing corporations if each corporation has capital, surplus, and undivided profits aggregating more than $37,382,000, unless one or more of the corporations has competitive sales under $3,738,200 or other exceptions apply.

Inflation-Adjusted Civil Penalty Amounts

On January 11, 2021, the FTC also announced adjustments to various maximum civil penalty levels for certain laws it enforces. The action was required by the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015, which significantly increased penalty levels in 2016 and required annual indexing of those levels for inflation.

Of most interest, the maximum civil monetary penalty for violations of the HSR Act and Section 5 of the FTC Act (concerning unfair methods of competition and unfair or deceptive acts or practices) increased by approximately 1.2 percent to $43,792 per day. The new maximum civil penalties became effective upon publication in the Federal Register on January 13, 2021.

FTC HSR Act Rulemaking Initiative

In September 2020, the Commission announced that it was seeking comments on proposed rule changes under the HSR Act that could have a significant impact on certain industries.

Specifically, the Commission issued a Notice of Proposed Rulemaking that, among other things, would require filers to disclose additional information about their “associate” entities under common management (but not majority ownership) and to aggregate acquisitions in the same issuer across those entities. This would lead to more filings for investment entities such as private equity and hedge funds. The proposed rules also would exempt the acquisition of 10 percent or less of an issuer’s voting securities unless the acquiring person already has a competitively significant relationship with the issuer. These proposals have been controversial.

Commentators have raised concerns about the compliance burdens of the expanded aggregation rule. And, while one Republican commissioner believes the 10 percent exemption will spur competition by removing restrictions on investor activities under current HSR Act rules, two Democratic commissioners voted against the new rules because they wanted more filings and information to be required.

In addition, the Commission issued an Advance Notice of Public Rulemaking that seeks to gather information on seven topics that will help determine potential future amendments to the HSR Act rules and their interpretation, including the potential narrowing of some current exemptions. These topics related to the HSR Act’s use or treatment of: the size of transaction test; real estate investment trusts; non-corporate entities; acquisitions of small amounts of voting securities; influence of entities outside the scope of voting securities; transactions or devices for avoiding the HSR Act requirements; and issues pertaining to the HSR filing process.

The comment period closed on both of these rulemaking initiatives on February 1, 2021, and further action on both is under consideration.